Market Pulse: End of November 2025 Market Review

Market Pulse: End of November 2025 Market Review

Navigating uncertainty and mixed market signals, shifting yields and evolving policy developments...

Market Pulse: Mid of November 2025 Market Review

Market Pulse: Mid of November 2025 Market Review

Global equity markets shifted into a more defensive mode mid-November with...

Market Pulse: End of October 2025 Market Review

Market Pulse: End of October 2025 Market Review

October’s market landscape showed signs of renewed risk appetite and policy re-alignment...

Market Pulse: Mid of October 2025 Market Review

Market Pulse: Mid of October 2025 Market Review

Markets hold firm amid shifting policy signals and apparent global uncertainty...

Market Pulse: End of September 2025 Market Review

Market Pulse: End of September 2025 Market Review

In China, factory activity has now contracted for six straight months which is the longest such run since 2019...

Market Pulse: Mid of September 2025 Market Review

Market Pulse: Mid of September 2025 Market Review

Markets advance amid AI-driven corporate gains, central bank caution, and rising geopolitical tensions...

Market Pulse: End of August 2025 Market Review

Market Pulse: End of August 2025 Market Review

From trade tariffs to fed tensions as markets navigate a tumultuous August...

Market Pulse: Mid of August 2025 Market Review

Market Pulse: Mid of August 2025 Market Review

Resilient risk appetite balanced by inflation pressures and easing geopolitical tensions...

Market Pulse: End of July 2025 Market Review

Market Pulse: End of July 2025 Market Review

Resilient US equities shine amid persistent global trade tensions and policy uncertainty...

Market Pulse: Mid of July 2025 Market Review

Market Pulse: Mid of July 2025 Market Review

After a strong Q2 rally, global equity markets have entered a consolidation phase, weighed down by renewed macroeconomic caution and...

Market Pulse: End of June 2025 Market Review

Market Pulse: End of June 2025 Market Review

Global stock markets advanced to new highs in June, with notable strength in the United States where the S&P 500 breached the 6,170 mark...

Market Pulse: Mid of June 2025 Market Review

Market Pulse: Mid of June 2025 Market Review

Investor sentiment turned more cautious across international markets following a high-profile military operation...

Market Pulse: Mid of May 2025 Market Review

Market Pulse: Mid of May 2025 Market Review

Equity markets around the globe rebounded from the heightened uncertainty as the VIX index continued its gradual descent...

Market Pulse: END of April 2025 Market Review

Market Pulse: END of April 2025 Market Review

In early April, policy changes in the United States have impacted the global financial markets...

Market Pulse: MID of April 2025 Market Review

Market Pulse: MID of April 2025 Market Review

Over the past five years, equity markets have experienced two major events that have had a lasting impact on the global economy....

Market Pulse: END JANUARY 2025 Market Review

Market Pulse: END JANUARY 2025 Market Review

DeepSeek having a deep impact on the artificial intelligence play...

Market Pulse: MID JANUARY 2025 Market Review

Market Pulse: MID JANUARY 2025 Market Review

Trump’s expected economic policies take centre stage in markets....

Market Pulse: END - DECEMBER 2024 Market Review

Market Pulse: END - DECEMBER 2024 Market Review

Federal Reserve Spoils the Party on Rates as Market Retreat....

Market Pulse: MID - DECEMBER 2024 Market Review

Market Pulse: MID - DECEMBER 2024 Market Review

Fixed Income on the Backfoot as Reflationary Risks Resurface....

Market Pulse: End November 2024 Market Review

Market Pulse: End November 2024 Market Review

Trump wins convincingly the us election as countries prepare to a raft of tariffs and negotiation....

Market Pulse: Mid June 2024 Market Review

Market Pulse: Mid June 2024 Market Review

Markets rebound healthily in May, as the market chooses to interpret the Fed's overtures as dovish...

Market Pulse: May 2024 Market Review

Market Pulse: May 2024 Market Review

Stock indices have quickly recovered the ground lost in a turbulent April, as inflation data stabilised after a streak of hotter than expected readings...

Market Pulse: April 2024 Recap

Market Pulse: April 2024 Recap

April presented a stark contrast to the previous months, with major equity markets experiencing a broad-based sell-off, as data forced investors to reappraise their expectations for interest rates – in that they became a more distant prospect...

Market Pulse: Mid-April 2024 Recap

Market Pulse: Mid-April 2024 Recap

By mid-April 2024, the stock market began to show signs of unease, marking a shift from the positive start to the month. Several factors contributed to this growing volatility...

Market Pulse: End of March 2024 Roundup

Market Pulse: End of March 2024 Roundup

March proved to be a strong month for equity markets, extending the positive momentum witnessed in February....

Market Pulse 15th March 2024

Market Pulse 15th March 2024

Stock markets continued its positive trajectory from the beginning of the month. This positive trend was fuelled by several key factors...

Market Pulse: February 2024 Review

Market Pulse: February 2024 Review

February saw a continuation of the cautious optimism observed in January, with major indices posting solid gains across the board....

Market Pulse: 15th February 2024

Market Pulse: 15th February 2024

Month to date markets have witnessed a positive sentiment globally, led by Japan shares:...

Market Pulse: January 30, 2024

Market Pulse: January 30, 2024

Global stock markets finished January with mixed results, reflecting a month of cautious optimism and some profit-taking, giving back some of the gains posted mid-month...

Market Pulse: January 15, 2024

Market Pulse: January 15, 2024

As of January 15th, 2024, global stock markets exhibited cautious optimism for the year. Major indices posted modest gains year-to-date...

Market Pulse: December 2023

Market Pulse: December 2023

December 2023 marked a strong year-end rally for stocks, given several key factors:...

New Fund Lauch: ARIA Global Income Impact Fund

New Fund Lauch: ARIA Global Income Impact Fund

A fund that walks the walk. Not only targeting those companies truly leading a transition...

Picasso’s Portfolio: Dividends and Destruction

Picasso’s Portfolio: Dividends and Destruction

Long-standing structures, from bond bull markets to mega-cap dominance, are giving way,...

Bump and Grind

Bump and Grind

The markets have regained their composure, and then some, having digested the pyrotechnics witnessed in early April,...

Podcast Politics

Podcast Politics

The financial markets have cast their vote, and Bidenomics was clearly second choice.,...

Regime Change: Taking Tech Down

Regime Change: Taking Tech Down

Our Quad Regime has indicated a change in ‘regime’ – moving from Reflation to ‘Goldilocks’,...

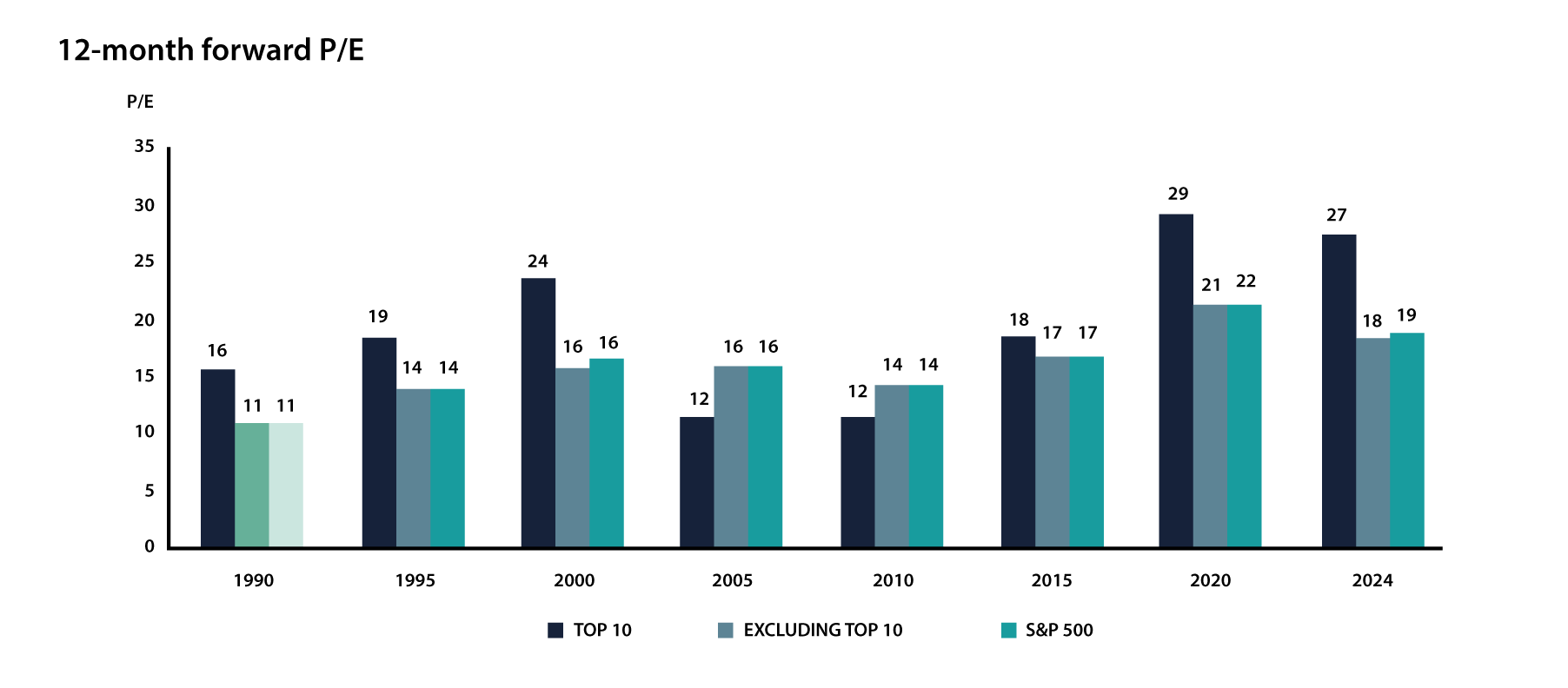

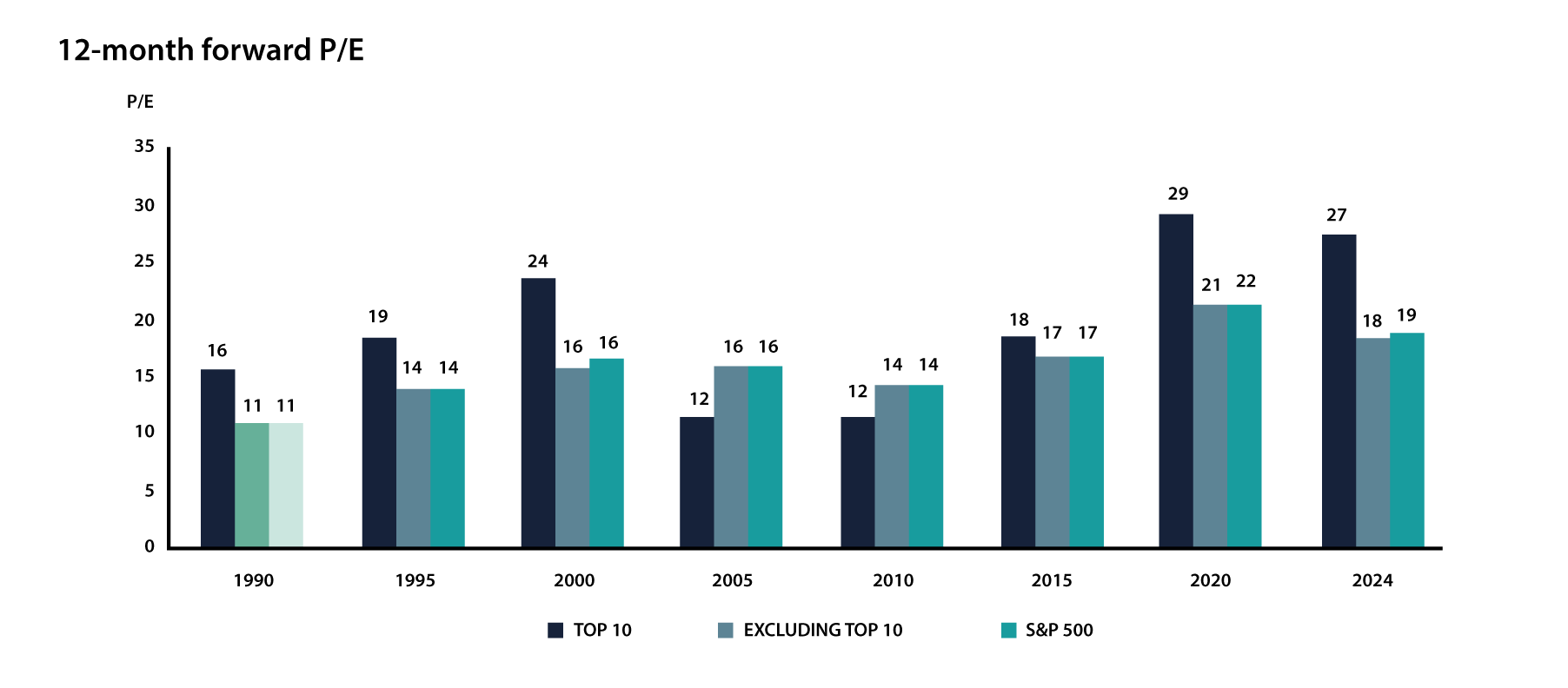

Bits, Bytes and Base Pairs

Bits, Bytes and Base Pairs

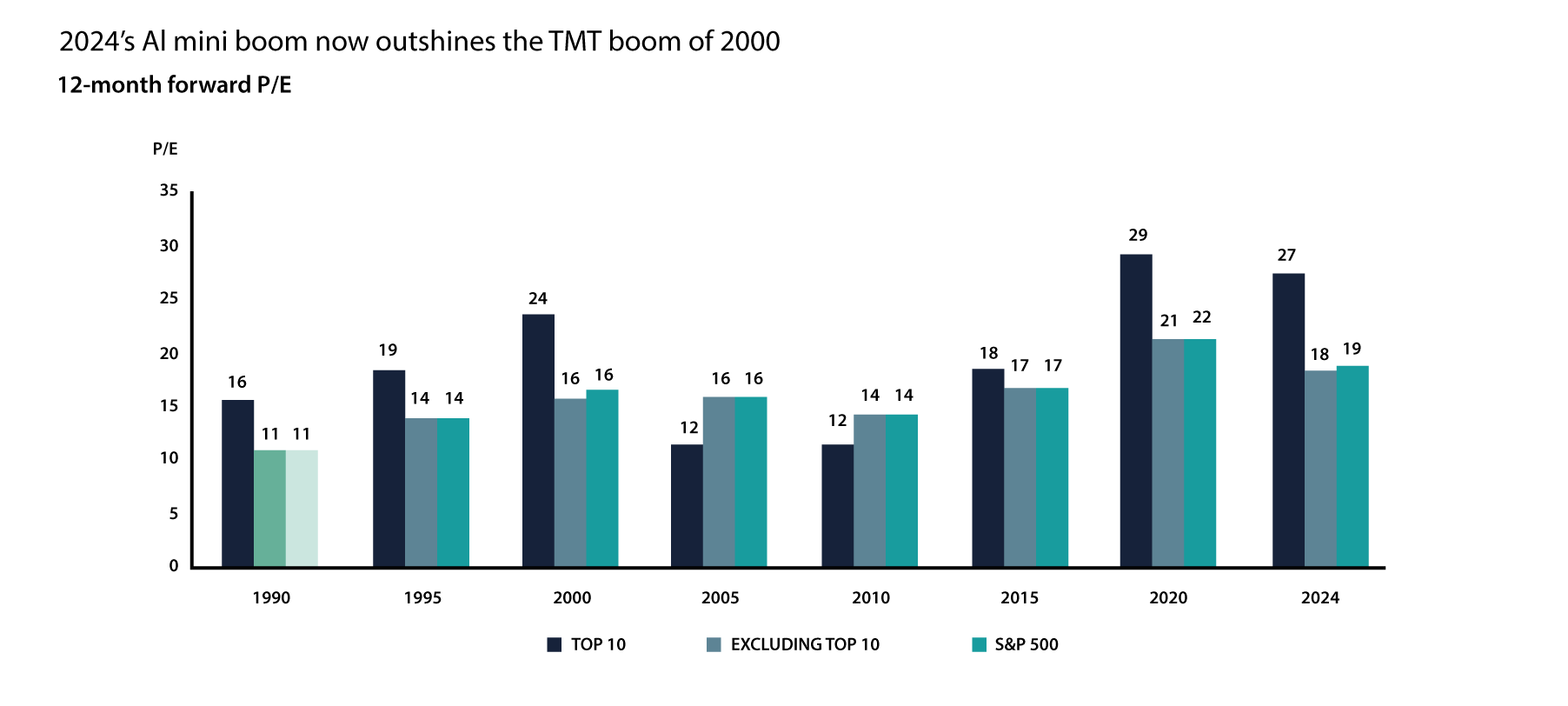

AI’s ‘mania’ by some measures already dwarfs that of the 2000’s TMT bubble,...

All’s Well That Ends Well

All’s Well That Ends Well

Despite the jungle drums telegraphing recession at the beginning of the year, and some ensuing banking crises induced volatility,...

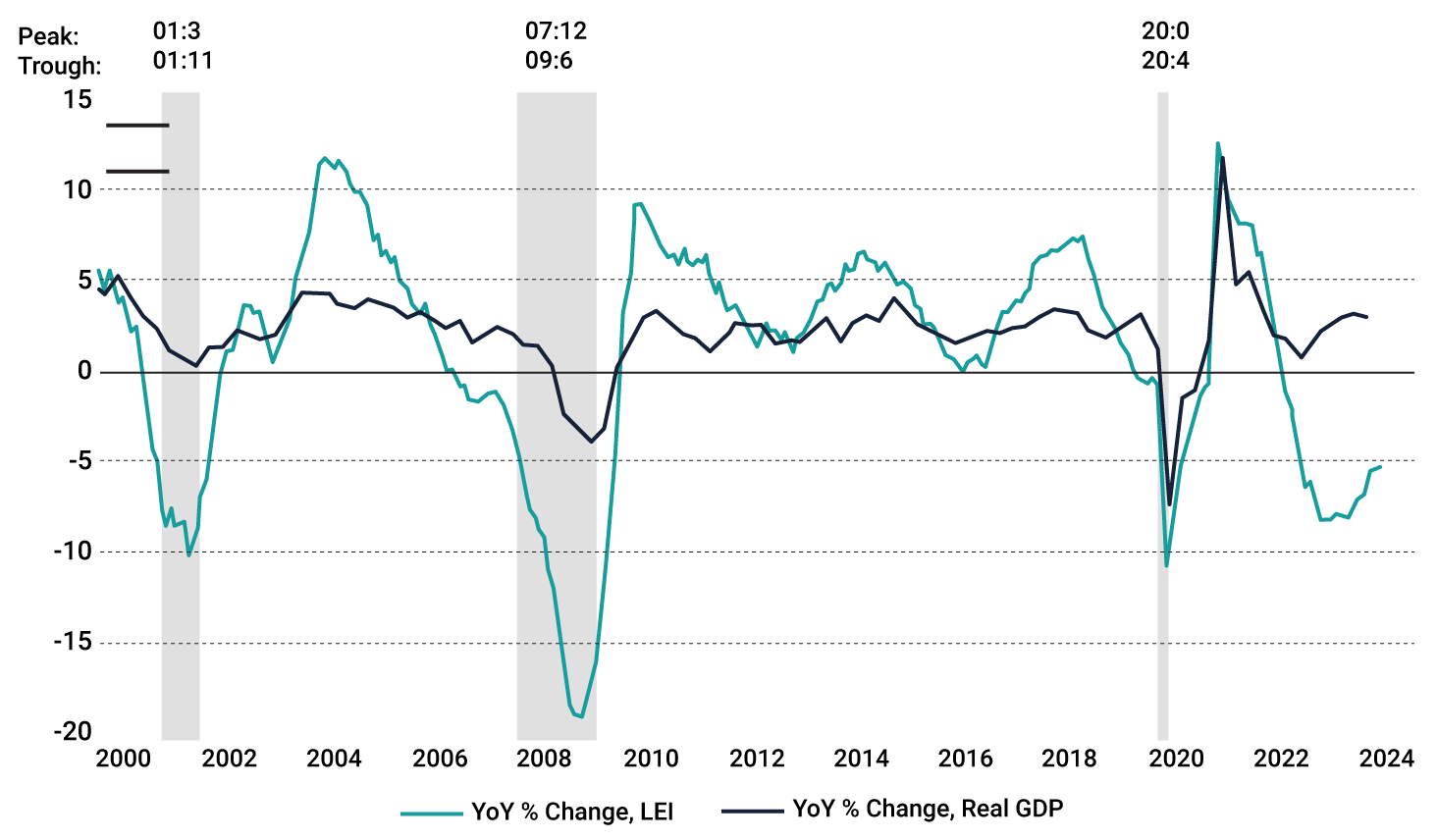

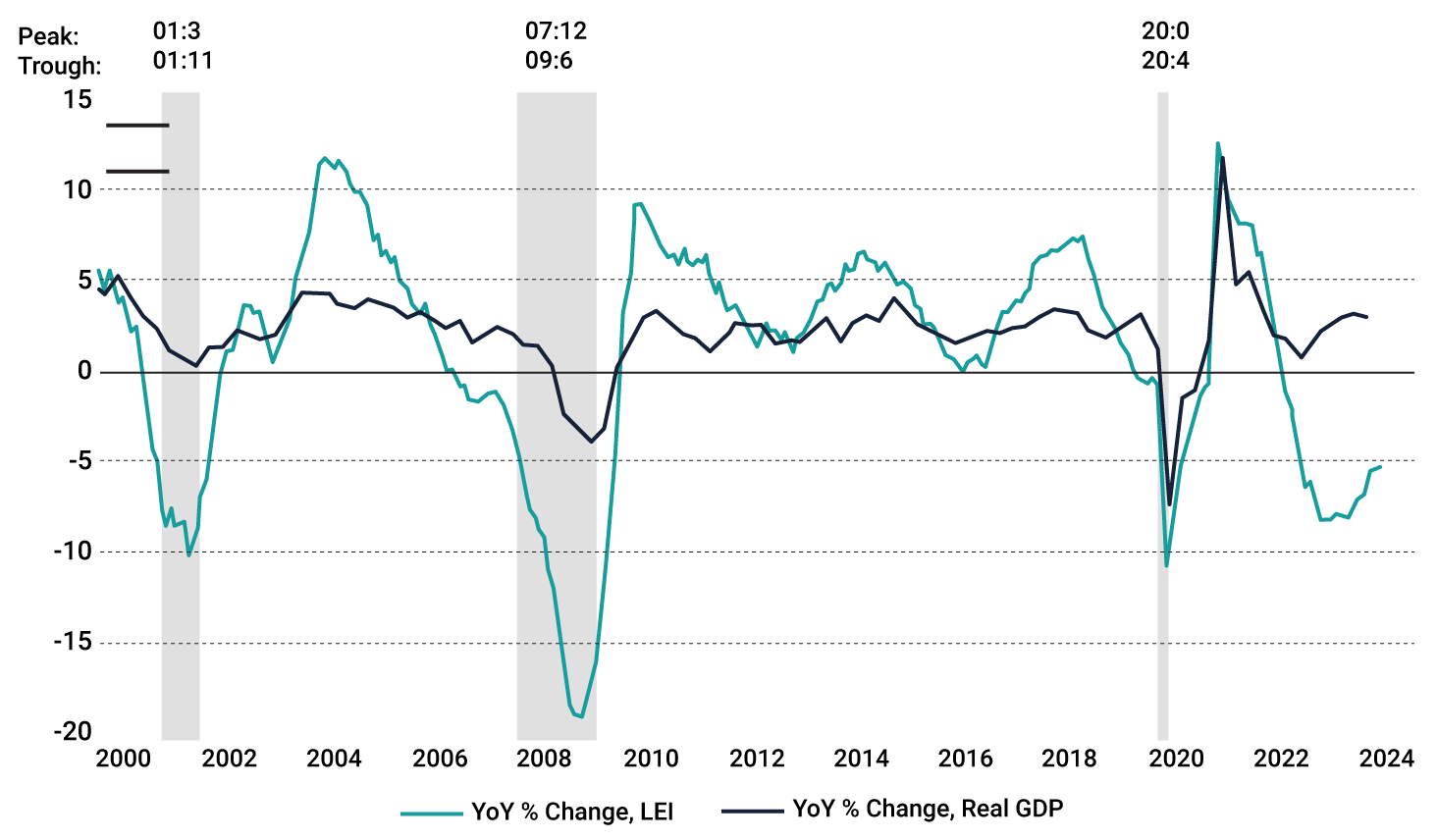

Recession Obsession

Recession Obsession

We feel economic data may yet surprise on the upside in the first half of 2023...

Bear With Me

Bear With Me

A bear market which is in essence a valuation reset is very different (typically shorter and...

Inflation in things we want, deflation in things we donʼt want

Inflation in things we want, deflation in things we donʼt want

The war in Ukraine, China’s sweeping lockdowns, soaring inflation, shortages of energy and key commodities, and ...

Gone Viral

Gone Viral

From the outset we just wanted to make mention of the fact that this must be the third iteration of the...

Role Reversal

Role Reversal

The storm clouds are gathering for 2022. After years of ultra-accommodative fiscal and...

Vaccination Variation

Vaccination Variation

Johnson and Johnson’s news that the vaccine is effective against the Delta variant should help to...

The Great Unwind

The Great Unwind

Perhaps in contrast to the common conception, we believe the biggest trend in the world...

Planes Trains and Automobiles

Planes Trains and Automobiles

We believe that vaccine prospects are likely to make 2021 a year of global economic recovery...

CLIMATE FINANCE

CLIMATE FINANCE

April 5th, 2023

Until recently, the idea of a carbon-neutral combustion engine seemed like a distant dream. However, emerging technologies and innovations are bringing us closer to making this dream a reality...

Energising Europe

Energising Europe

March 10th, 2023

A stock take on Europe’s rapid progression towards its Renewable targets...

Net Zero Fiscal Trilemma

Net Zero Fiscal Trilemma

February 5th, 2023

Governments worldwide find themselves at a crossroads, grappling with a challenging trilemma that involves balancing the imperatives of achieving net-zero emissions...

MPS Bulletin: Semi-Detached

MPS Bulletin: Semi-Detached

Markets shifted towards ‘risk on’ after US Fed Chair Powell’s comments on Friday were deemed to cement a September rate cut....

MPS Bulletin: The Virtue of a Proportionate Response

MPS Bulletin: The Virtue of a Proportionate Response

Whilst Donald Trump may not be well versed in the treaties of David Ricardo, and...

MPS Bulletin: Deep Heat

MPS Bulletin: Deep Heat

AI stocks have received something of a bloody nose, as the Chinese upstart DeepSeek has led investors to...

MPS Update: Superficially Sentient and the Magnificent Bribe

MPS Update: Superficially Sentient and the Magnificent Bribe

In a remarkably prescient piece, the social critic Earnest Mumford in ‘Technics and the Nature of Man’,...

MPS Bulletin: Santa Falls

MPS Bulletin: Santa Falls

As widely anticipated, the Federal Reserve reduced the official interest rate by 0.25% in the last meeting on the year.,...

MPS Bulletin: The Bull Market nobody is talking about

MPS Bulletin: The Bull Market nobody is talking about

Often described as a chameleon asset, (one whose performance can be influenced by ever changing causal factors),...

Asset Allocation Bulletin: 24th June 2024

Asset Allocation Bulletin: 24th June 2024

Our Quad Regime has indicated a change in ‘regime’ – moving from Reflation to ‘Goldilocks’,...

Asset Allocation Bulletin – Starting Gun

Asset Allocation Bulletin – Starting Gun

This was one of Lenin’s weeks – when a decade’s worth of events all fell upon one unsuspecting row on the calendar...

Asset allocation trends – May 2024 update

Asset allocation trends – May 2024 update

The importance of getting the asset allocation decisions right has long been engrained in the thinking of investors and financial professionals...

AlphaPredictor Indices A Risk Targeted Approach to Multi Asset Investing

AlphaPredictor Indices A Risk Targeted Approach to Multi Asset Investing

Multi-asset strategies continue to dominate investor flows in recent years, given their ‘plug and play’ solution to diversification...

Rethinking Asset Allocation

Rethinking Asset Allocation

In a financial world where change is the only constant, some of the tried-and-true principles of asset allocation are ripe for reassessment...

‘Quality’ ETF’s have unique sensitivities to the Business Cycle

‘Quality’ ETF’s have unique sensitivities to the Business Cycle

Since we have heard a lot of talk about investing in ‘quality’ lately from active managers and many rules-based ‘quality’ ETFs have been launched over the last decade as well...

6 Trends in Asset Management Outsourcing

6 Trends in Asset Management Outsourcing

As the asset management industry continues to evolve and face new challenges, outsourcing investment management to outsourced ,...

Kami-Kwasi Budget

Kami-Kwasi Budget

Last week the new UK Chancellor Kwasi Kwarteng announced a “mini-budget” package of...

Central Banks Conundrum

Central Banks Conundrum

The developed world is experiencing the highest level of inflation in 40 years...

The King Dollar

The King Dollar

Most individuals are indifferent to changes in valuations of currencies; and it is only when they go on...

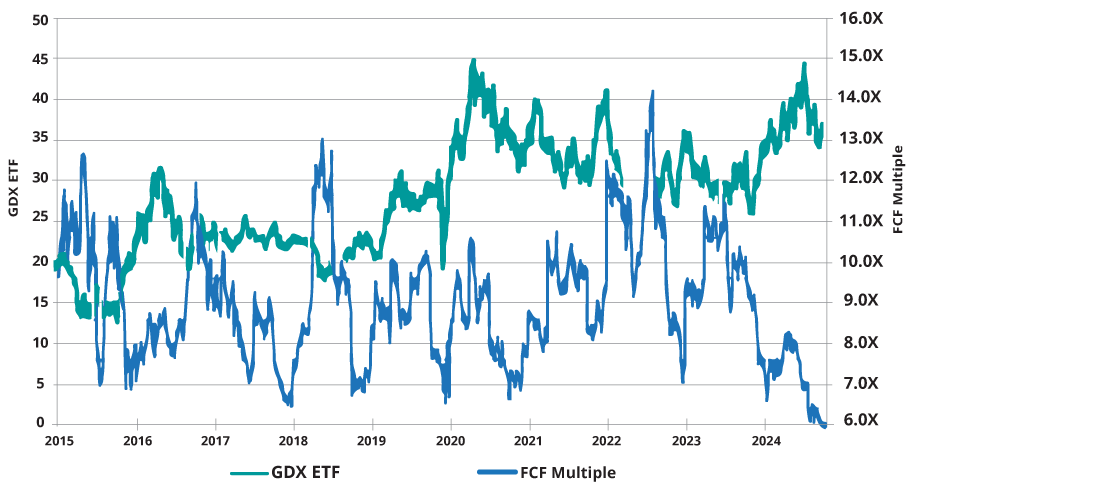

We are still very bullish on precious metals. The miners themselves offer compelling value. Esteemed gold stock analyst Garrett Goggin notes on miners:

“Gold Miners are trading at 6.4X FCF the lowest multiple since at least 2015. I've never seen value like this.“

During volatile market conditions, gold miners often act as a good alternative hedge for equities and on this metric present some of the

cheapest sector valuations around.

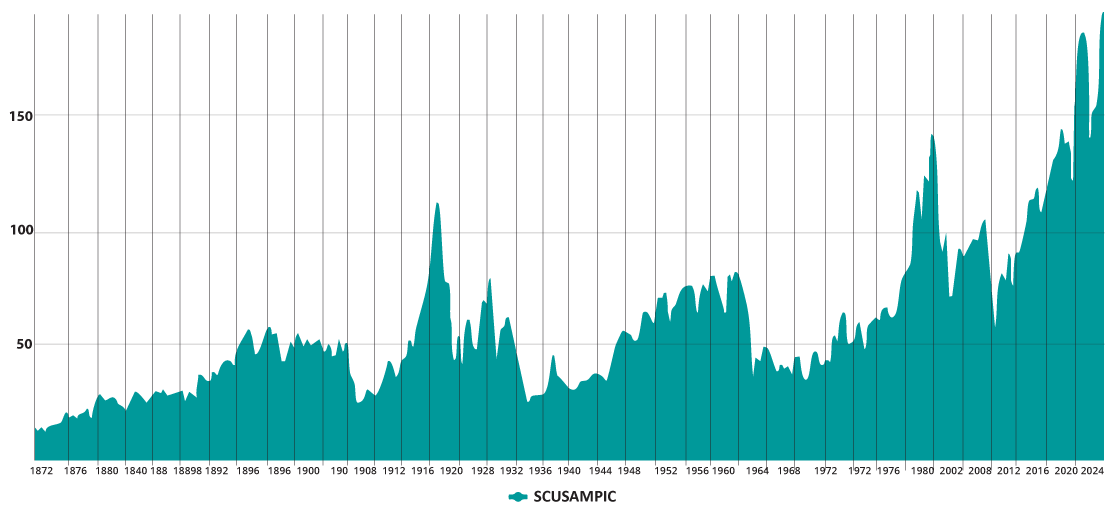

The Market Cap to GDP Ratio gives an indication of how big the financial world has gotten relative to the real one.

Previous extremes have often portend of significant set backs in equities ahead.

Most noticeable is that for the first time in history the US stock market capitalisation to GDP ratio has broken through the 200% mark.

A reflection of the time we live in with regards to US leadership in global markets, but also the stage we are at in the market cycle.

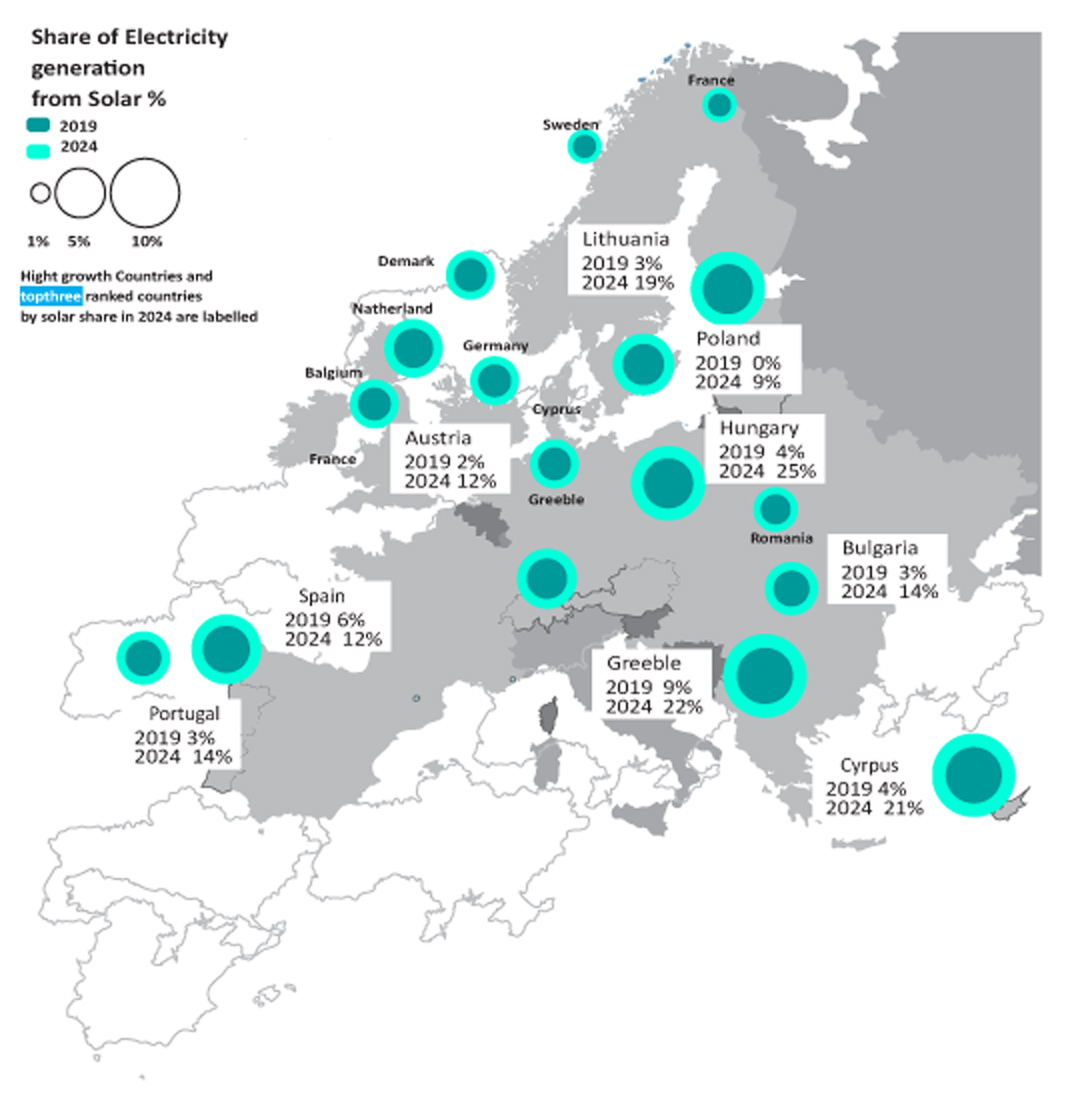

The EU’s solar success story continued in 2024, as the bloc saw a record annual increase in solar generation.

In fact, 2024 marked a record annual increase in solar generation, up 54 TWh (+22%) compared to 2023, when solar

generation had already increased by 40 TWh compared to 2022. 2024 was also a record year for annual capacity additions:

the EU solar fleet grew by 66 GW, equal to over 450,000 panels added per day

An accelerated rollout of batteries and smart electrification will be key to cost-effectively sustaining solar’s impressive growth.

Solutions such as batteries and smart electrification are already mature and ready to deploy, but require policy action to reach

their full potential.

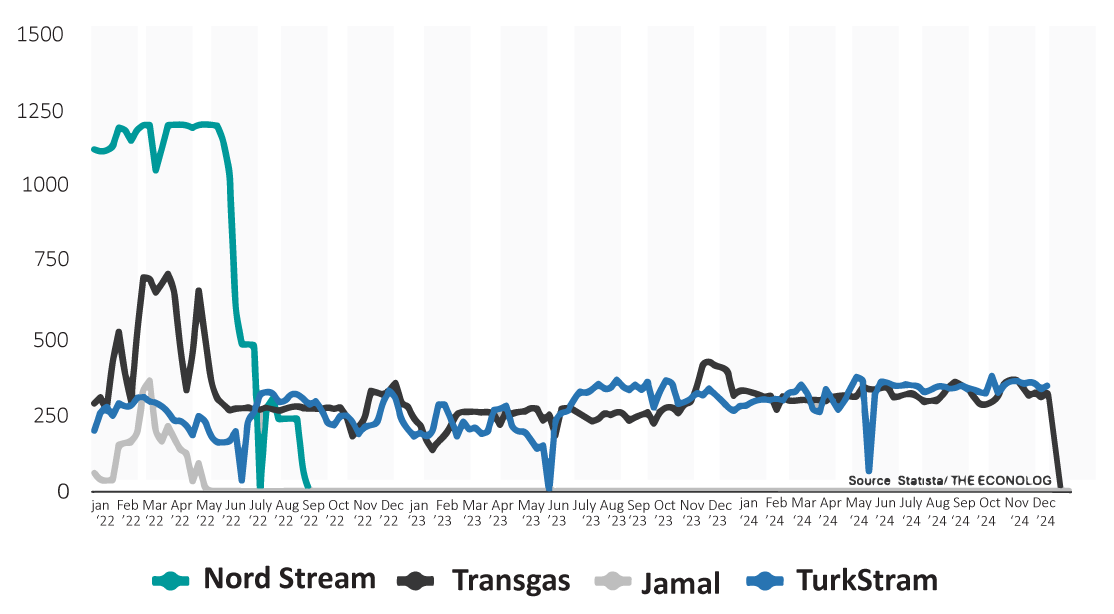

On December 26, 2024, Ukrainian President Volodymyr Zelensky announced he wasn’t going to renew a contract to route Russian gas to Europe.

It was another unwelcome surprise for European consumers and companies. The Ukraine route was the last pipeline connecting Russian gas directly

to central Europe, delivering about 320 million cubic meters per week to Slovakia, Hungary, and Austria. When the contract expired on January 1, 2025,

deliveries dropped to zero.

After shutting down Transgas, TurkStream is the only remaining supplier of Russian gas to Europe.

Last Man Standing

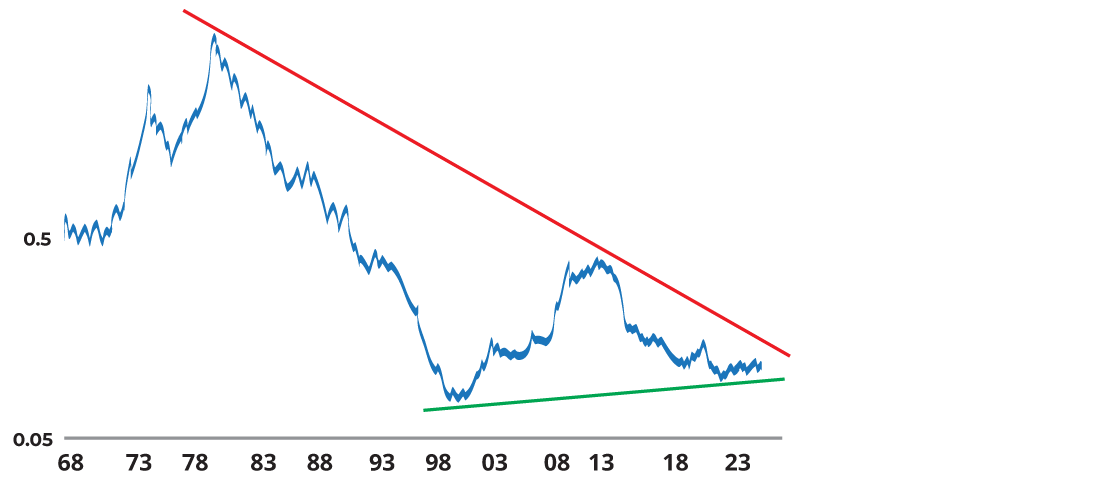

Despite the epic bull run in gold, it’s “only” just kept pace with US equities at the time of writing - circa 26% YTD. Moreover, the below suggests there is still a long way to run. The most likely reason for this chart to turn up (if it does), would be for equities to enter a correction/bear market, and gold to either hold its ground or continue to move higher. These triangle patterns can be very reliable and the longer the time frame, (30 years), the more powerful the signal would be

Gold VS Stocks

(Stocks=S&P 500 Index ,including dividends)

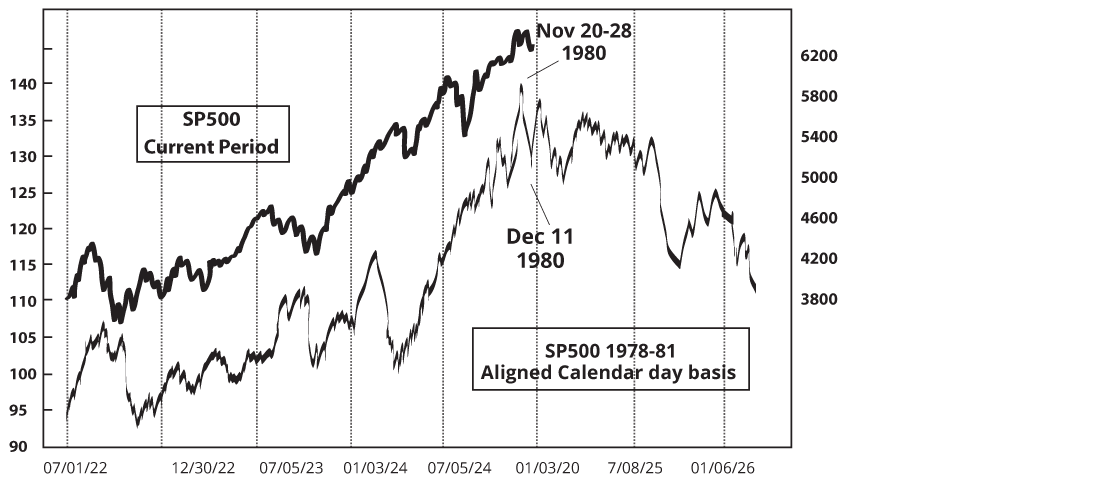

The below sets out an uncanny development – it appears that things are largely following a former Republican presidential beginning. As Jason Goepfort points out: “Reagan's victory [in 1980] was both anticipated and celebrated by Wall Street, as he was seen as a "transformative" candidate with the promise of solving all of the problems which faced the country then. And Reagan arguably was a transformative president, but the first two years were not a pleasant time to be a stock investor”

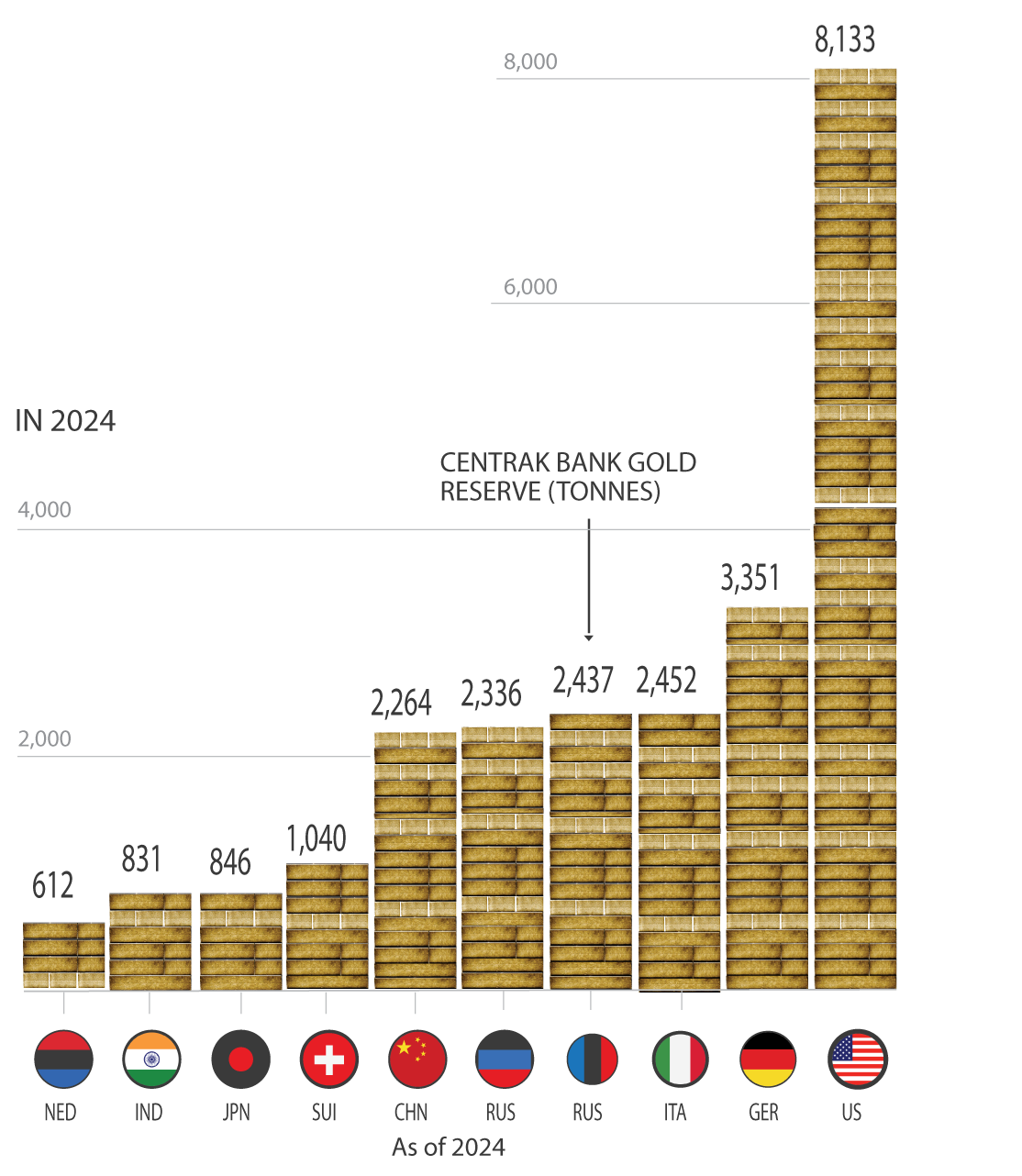

Countries with the Most Gold

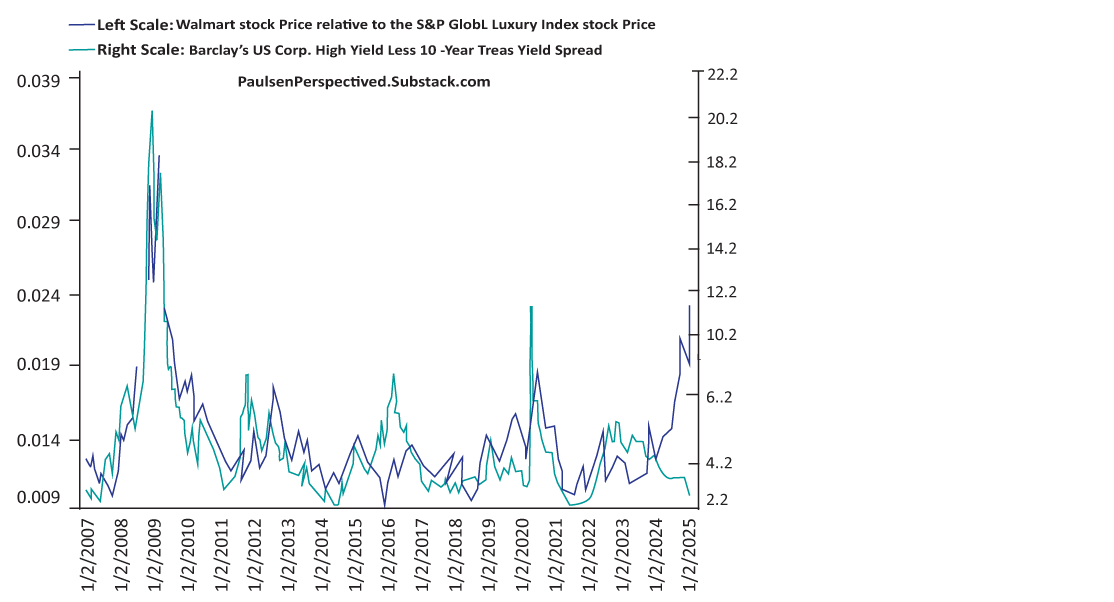

While there are no glaring obvious signs of recession right now, there are some indicators alerting us to stay on guard, for example the chart below which shows the relative performance of Walmart vs global luxury stocks. The idea is that staples like Walmart hold up during recession, while luxury stocks suffer from cutbacks in consumer spending. It’s also worthy of note though, that some of the weakness in global luxury stocks may be more of a reflection of the economic slowdown in China (and Europe, not to mention Russia). However, consumer data in the US is undeniably weakening, and credit card delinquencies moving higher suggesting a consumer that is stretched….

WallMart Recession Signal Vs. US Corporate Credit Spreads

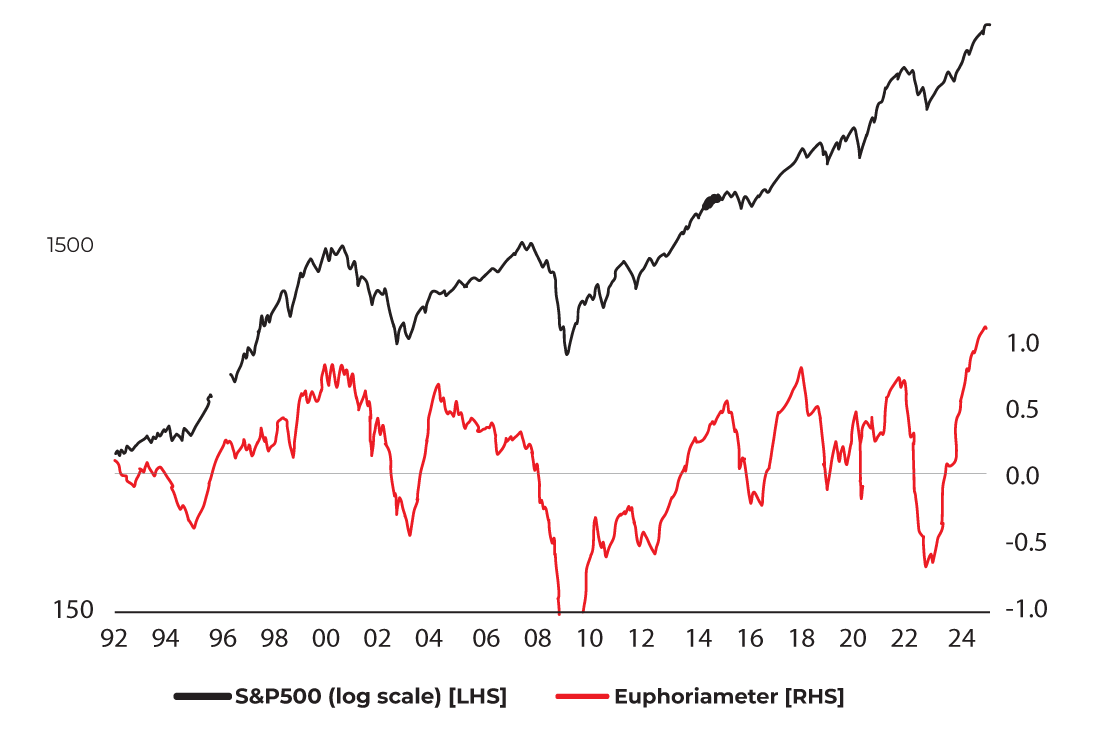

Peak Euphoria: After a string of back-to-back new all-time highs in this indicator, the flash December reading has come in ever so slightly lower than the November reading. One thing to note with indicators like this is that they send the most powerful signals when they reach an extreme and then turnaround — was November a climax in stock market euphoria? The market is more than overdue a reset.

The Euphoriameter

Combination of Forward PE , VIX , Bullish Sentiment

This chart shows the top 10 countries by Central Bank Gold Reserves — while it might be old news for some (and it is May 2024 data), the standout is how even though China + Russia have been important buyers, they still trail well behind the USA and the combined holdings of Eurozone countries. Perhaps the Federal Reserve and Jerome Powell knows something the rest of us don’t.

Countries with the Most Gold

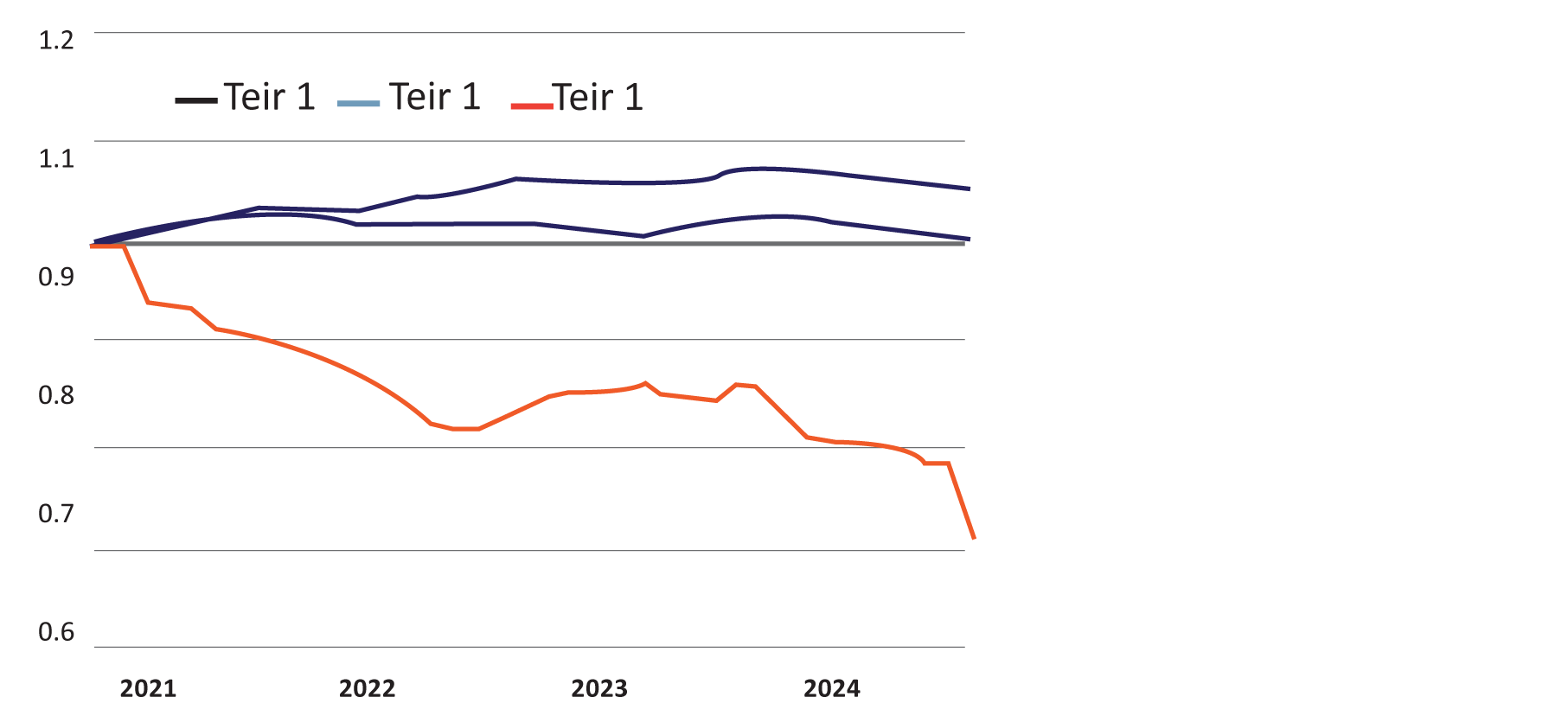

China’s real estate market continues to concern. Between 2008 and 2023, household debt rose from less than 20% to over 60% of GDP. This development was directly linked to the credit-financed real estate boom, which drove cities such as Beijing and Shanghai into extreme price bubbles. The ratio of house prices to income is now twice as high as in London - an unmistakable sign of overheating. However, the situation is even more serious in the smaller cities, which contribute around 60% of China's GDP.

Price Variation

China’s smallar tier 3 Cities have seen the sharpest slide in property prices.

(house price chnages by city ties ; Jan .2021=1)

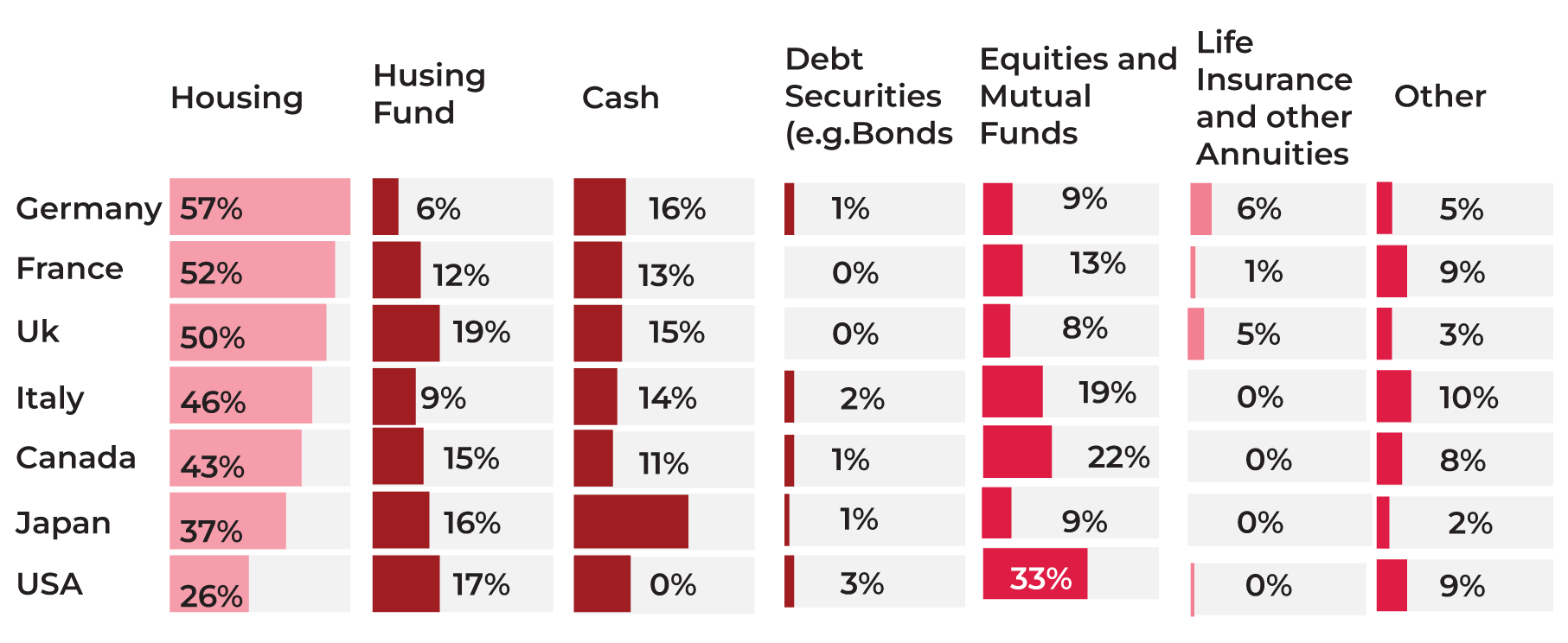

A recent report from Abrdn which found that UK adults hold the smallest percentage of their wealth in equities or mutual funds of any G7 country (8%) and that almost half of UK adults think property is a better long-term investment than pensions. That is in stark contrast to UJ households – but perhaps less surprising when the last 15 years of returns of the FTSE 100 vs S&P 500 are taken into consideration.

How people’s personal wealth is split across assert classes

Based on abran analysis of data from individual countries' financial accounts. Figures are the latest available data, released in 2023. Cash includes currency deposits and money market funds

The notoriously power-hungry president of the country, Recep Tayyip Erdoğan, is in a position to recreate the Ottoman Empire, if not politically then economically: sourcing oil and gas across the Middle East and distributing it to southeastern Europe and up until Hungary and Austria, plus Greece and Italy. Such a strategy will provide Turkey with massive political and economic influence over large parts of Europe. The population belt that stretches from Istanbul to Jakarta could in itself have parallels to that of China’s post 2004 growth explosion.

A new Ottoman Energy Empire?

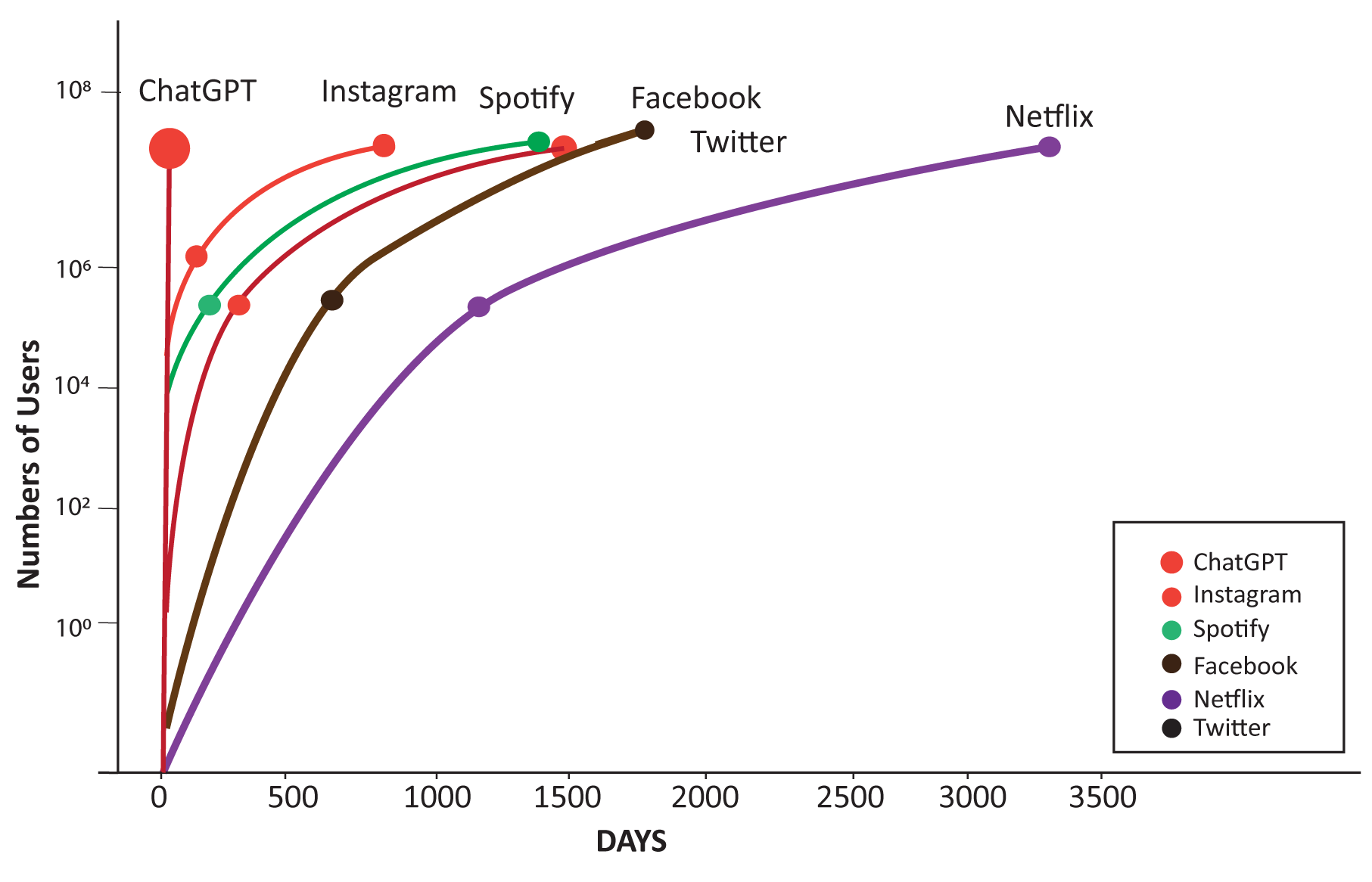

ChatGPT has made the term generative AI mainstream. But more importantly, it also saw the fastest user adoption ever, attracting 100 million users in just two months after its launch.

This is clearly a big deal, as we can see the meteoric rise of ChatGPT in the chart below compared to popular applications today like Instagram, Facebook and Netflix. Nothing else is quite like it. This growth was unprecedented.

# of days to 1M and users by technology

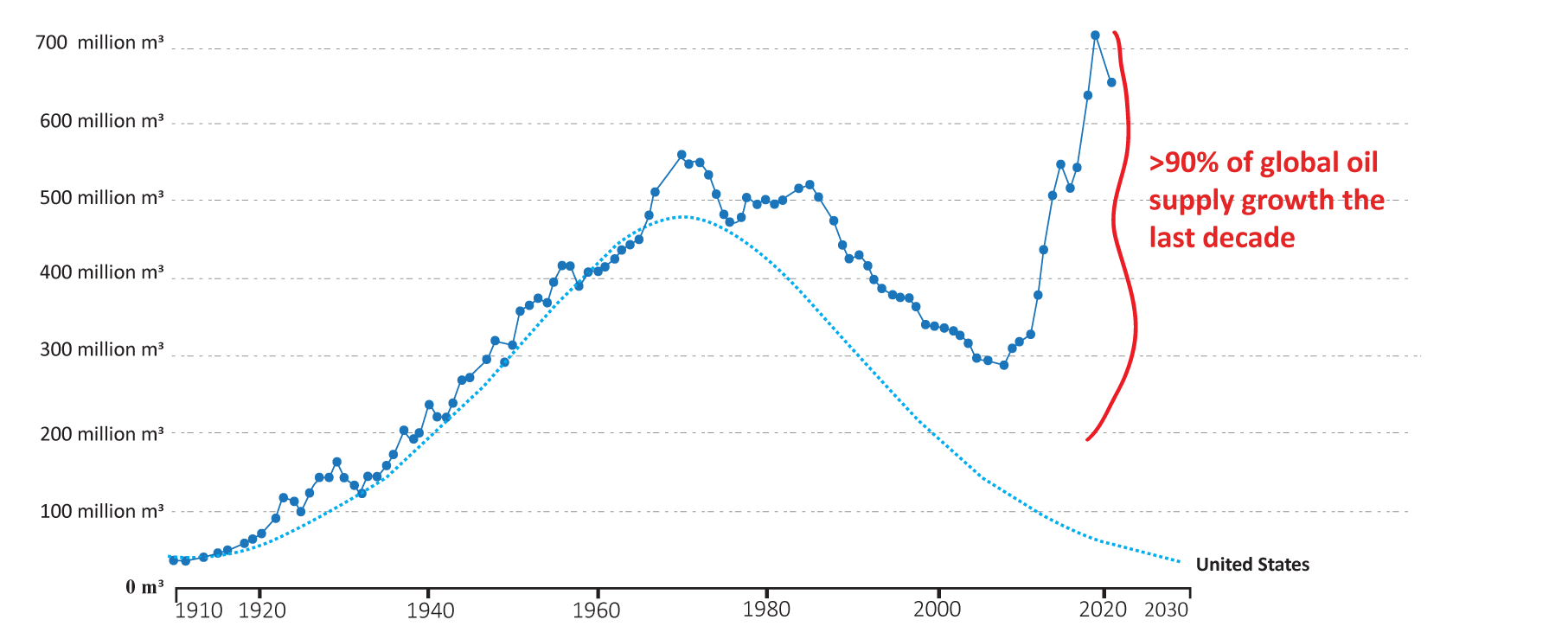

It was less than a decade ago, that hands were still wrung as to the foreseeable end of oil supplyies. Replacing conventional oil and gas's historic decline rate, which fell to 4-5% per annum, was no small task, but the speed by which it arrested – and the implications for the global order, was not seen by many.

Shales' arrival on the scene was timely, as it plugged the gap that was opening up between conventional supply and demand. What’s less understand was the magnitude - the US shales provided the energy equivalent of two Saudi Arabias with impeccable timing.

Hubbert's peak prediction vs. actual oil production in the United States

Hubbert's hypothesis of peak oil production in the United States, alongside actual oil production trends in the United States, both measured in cubic meters per year.

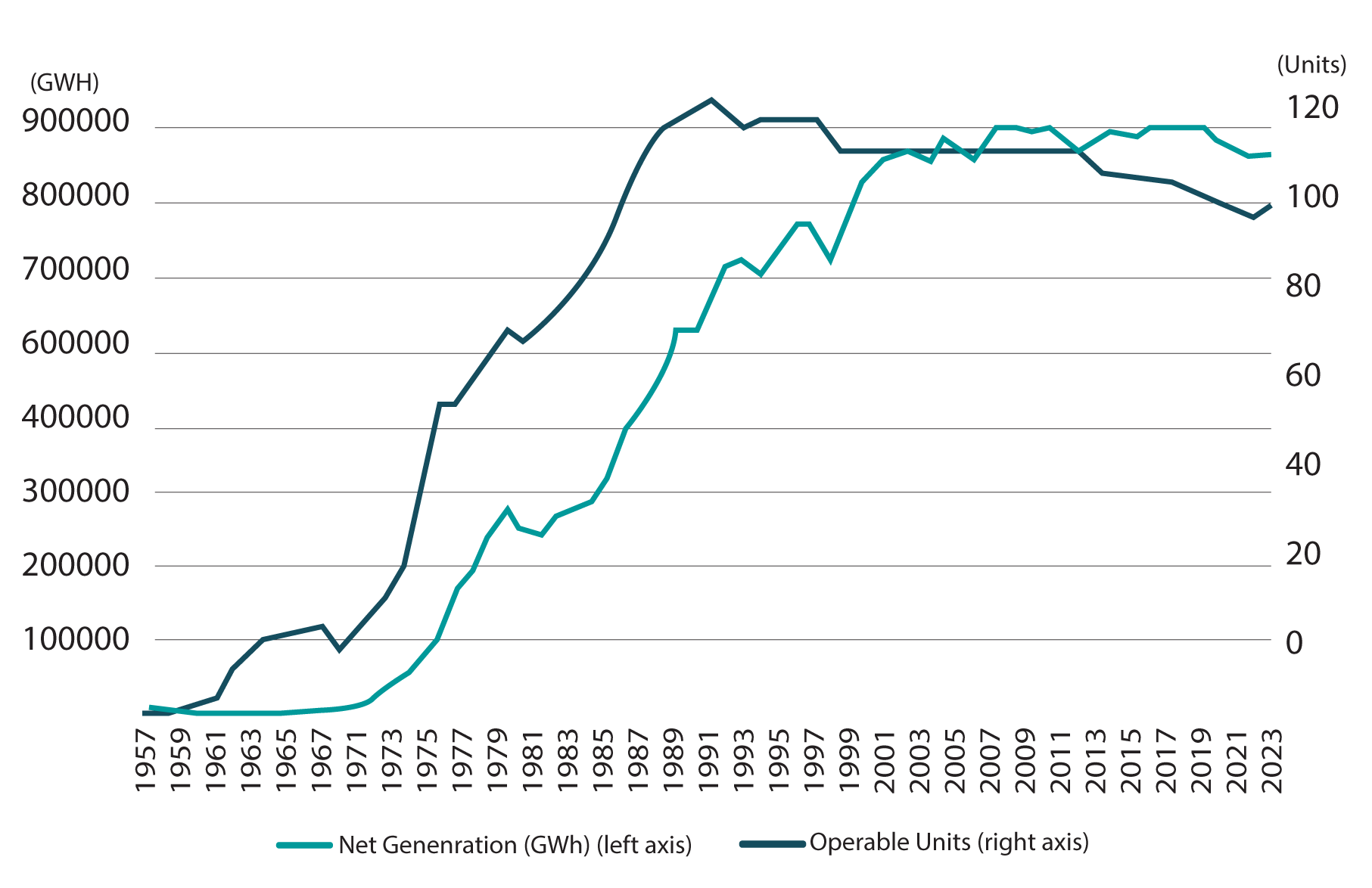

The nuclear power industry in the United States has been stagnant for over thirty years. The number of operable units peaked in 1987 and net generation has been flat since the late 1990s. The average operating U.S. nuclear power plant is 42 years old.

The two most recent new reactors, completed in 2023 and 2024 at Georgia’s Vogtle plant, were not driven by datacenter demands but instead marked the completion of a project than began construction in 2009, delivered fourteen years later at a total cost of over $30 billion for just 2,200MW of generating capacity. Until small nuclear reactors can deliver timely, reliable base load, renewables will continue to account for most load growth.

Nuclear Stagnation

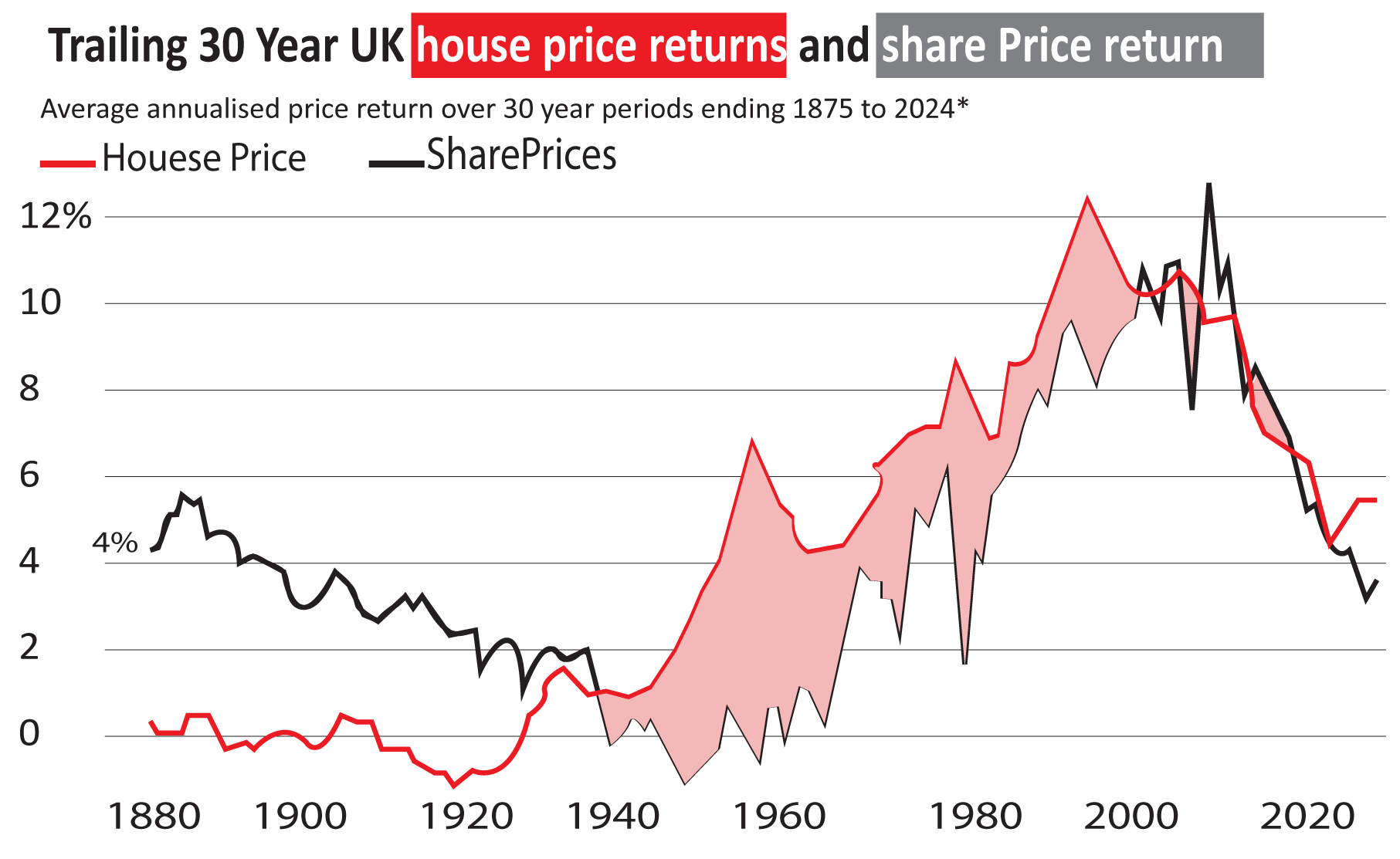

The following considers whether investors are better to hold UK property or UK shares. As we can see, a longer time horizon shows three distinct periods. Share price outperformance in the 19th century, house price outperformance in the 20th, a more mixed picture in the 21st.

We can see how neither house prices nor share prices always go up, even over long time periods (although most of the time they do, and since 1945 they consistently have done, although this doesn’t account for inflation). In that respect the performance of both assets have tracked higher, with trailing 30-year returns rising steadily during the post war period.

Finally, since the turn of the century, 30-year returns for houses and shares have been quite similar, which may reflect the role of falling interest rates in driving all asset prices since the early 1980s.

*Data from 1845 to 2015 is from the Bank of England. For 2016 to 2024 the share price series has been extended using price returns of The FTSE All Share Index. House price index has been extended using annual returns from the Land Registry: 2024 house prices are as of October 2024

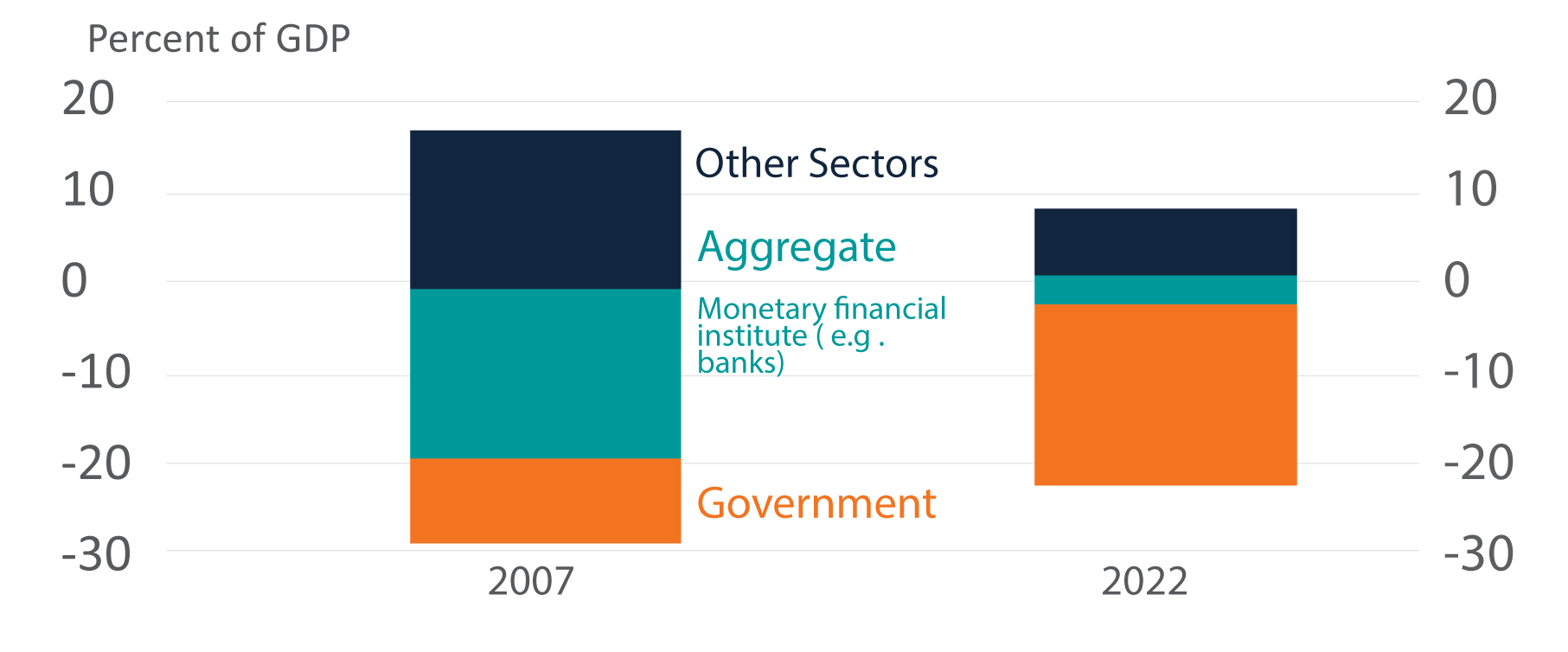

The UK has become increasing dependent on international investors to buy its government bonds. It wasn’t But that changed following the global financial crisis and above all Brexit, as the chart below from the Bank of England’s Bank Underground journal shows. Now if Brits are to continue to live beyond their means, we will need to fund the current account deficit by selling gilts to foreigners.

Post Brexit, banks have become a smaller percentage of GDP, and the Government a large proposition, which brings the reliance of Gilts used to fund government spend.

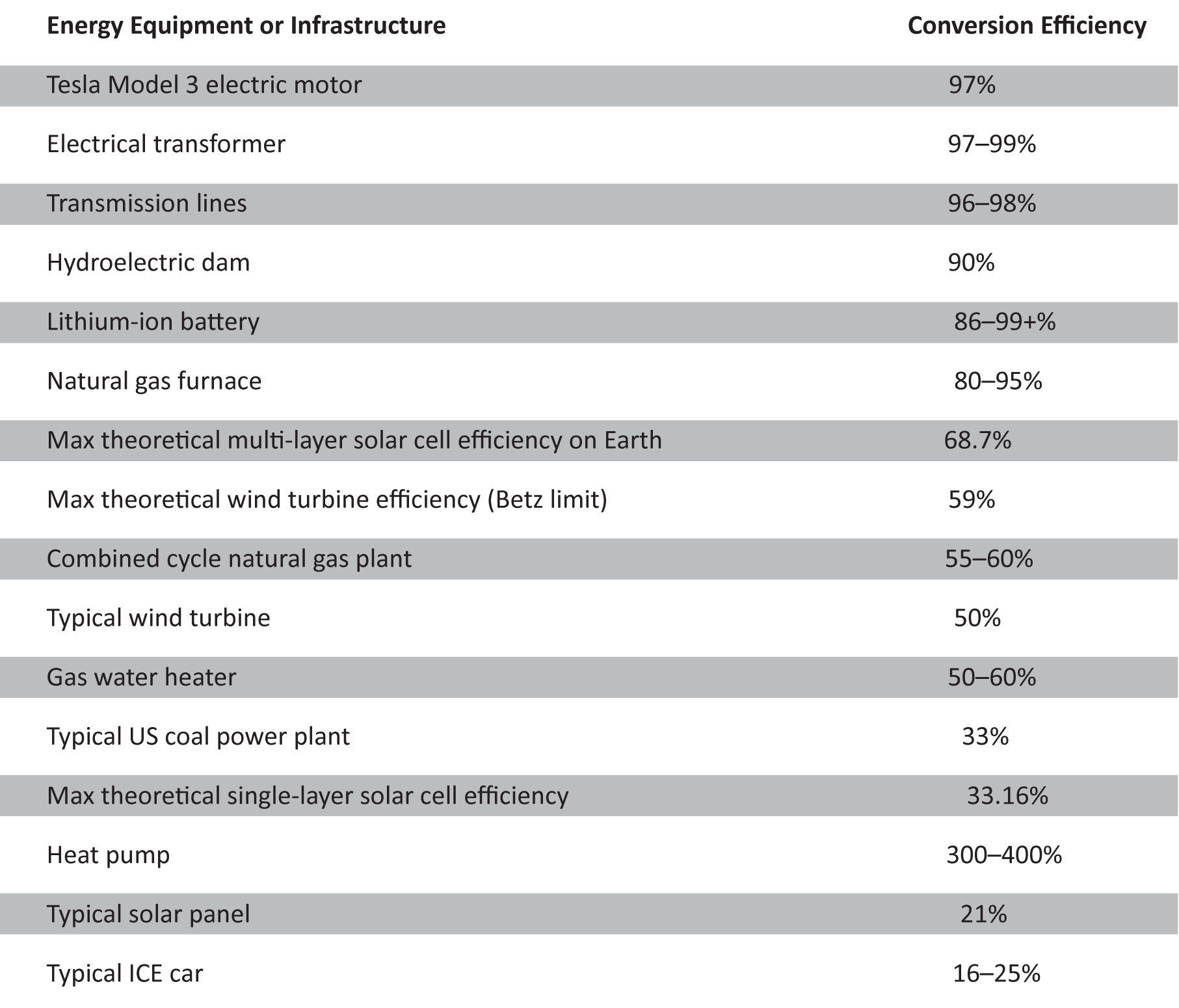

Moving electricity along transmission and distribution lines results in losses as some electrical energy gets converted into heat. Electrical transformers, which minimize these losses by transforming electrical energy into high-voltage, low-current before transmission, operate at around 98% efficiency or more.

The table show the conversion efficiencies of various pieces of energy infrastructure: The low thermal efficiency of ICE cars and heat engines in general and the high efficiency of electrical equipment (especially things like heat pumps) are the biggest counterweight to the high energy capacity of hydrocarbons.

Energy conversion efficiency

Conversion or transmission efficiencies of various pieces of energy infrastructure.

Source: IFP, ARIA

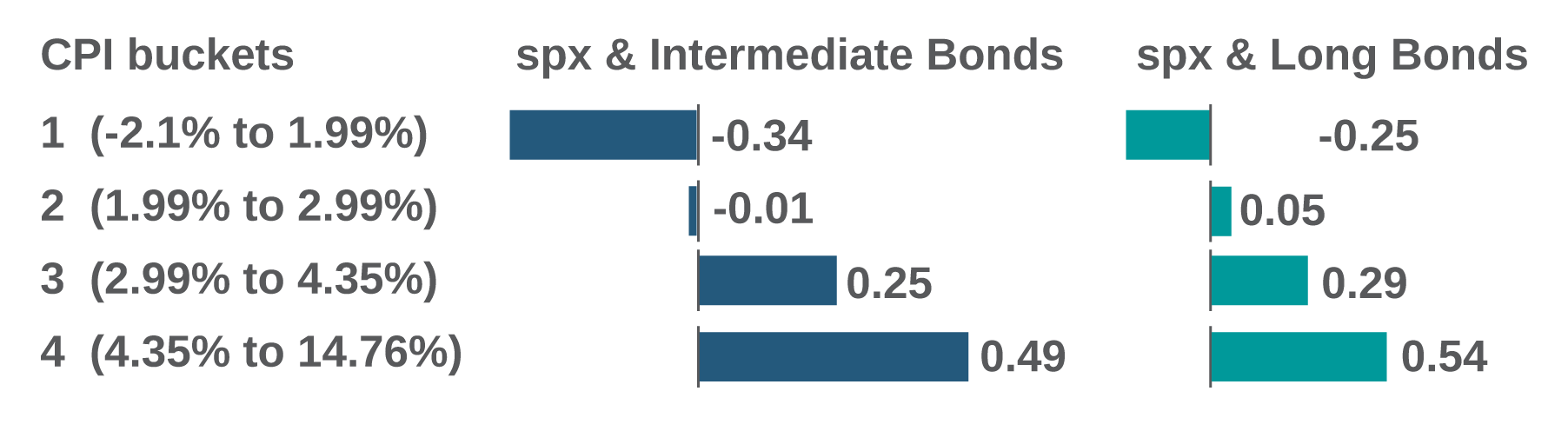

Bonds and their role as portfolio hedges are pivotal to portfolio asset allocation decisions. However, bonds do not always rally, when equities fall, and vice versa. Instead, the relationship is a little more nuanced than that, and is significantly influenced by how high inflation is. As per the table above, when CPI is below 2% or even negative, stocks and bonds are negatively correlated - giving rise to the 60/40 portfolio and bonds acting as a “portfolio hedge”. When inflation is 2-3%, that relationship breaks down, but beyond that, in highly inflationary times, when inflation is >4.35%, stocks and bonds are positively correlated and it is very tough sledding for both.

The correlation of stocks and bonds depending on the level of inflation (as measured by the Consumer Price Index – CPI)

Source: Thundersaid Energy

It’s widely reported that EV sales globally are on a tear. Since 2019 indeed, every year has seen a significant increase. Only in the first quarter of the year, sales grew by 25% compared to the same period in 2023. Moreover, we're predicted to see 17 million in sales by the end of 2024. Electric cars could account for 20% of total car sales by then. The IEA sees a great growth potential, especially outside of the core markets of China, Europe and the USA.

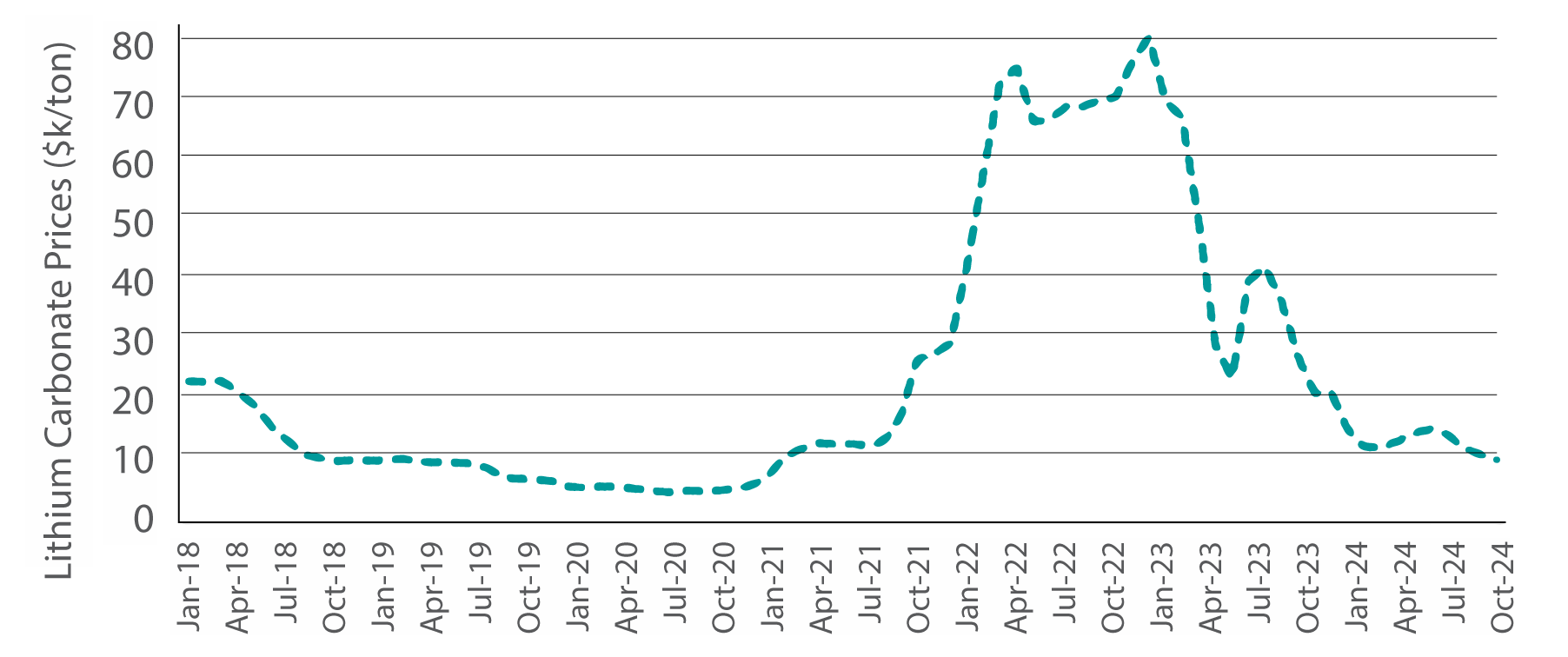

However, prices for lithium carbonate, (and inevitably heavily influenced by supply), have been going in the other direction – might sales going forwards not be at such a blistering pace?

Chinese Lithium carbonate prices have collapsed

Source: Thundersaid Energy

Bonds have historically been the defenders in the football teams that are portfolios. When equities fells, typically bonds rallied, providing stability in returns. That was the case for 30 years at least, until recently for nearly 30 years. However, before that, we had a 30 year periods were by equities and bonds both rallied and fell together – and during a higher inflationary regime. The question is what is before us? Do we return to a positive correlation, or was Covid inspired supply chain shortages and commensurate inflation, a shorter term diversion.

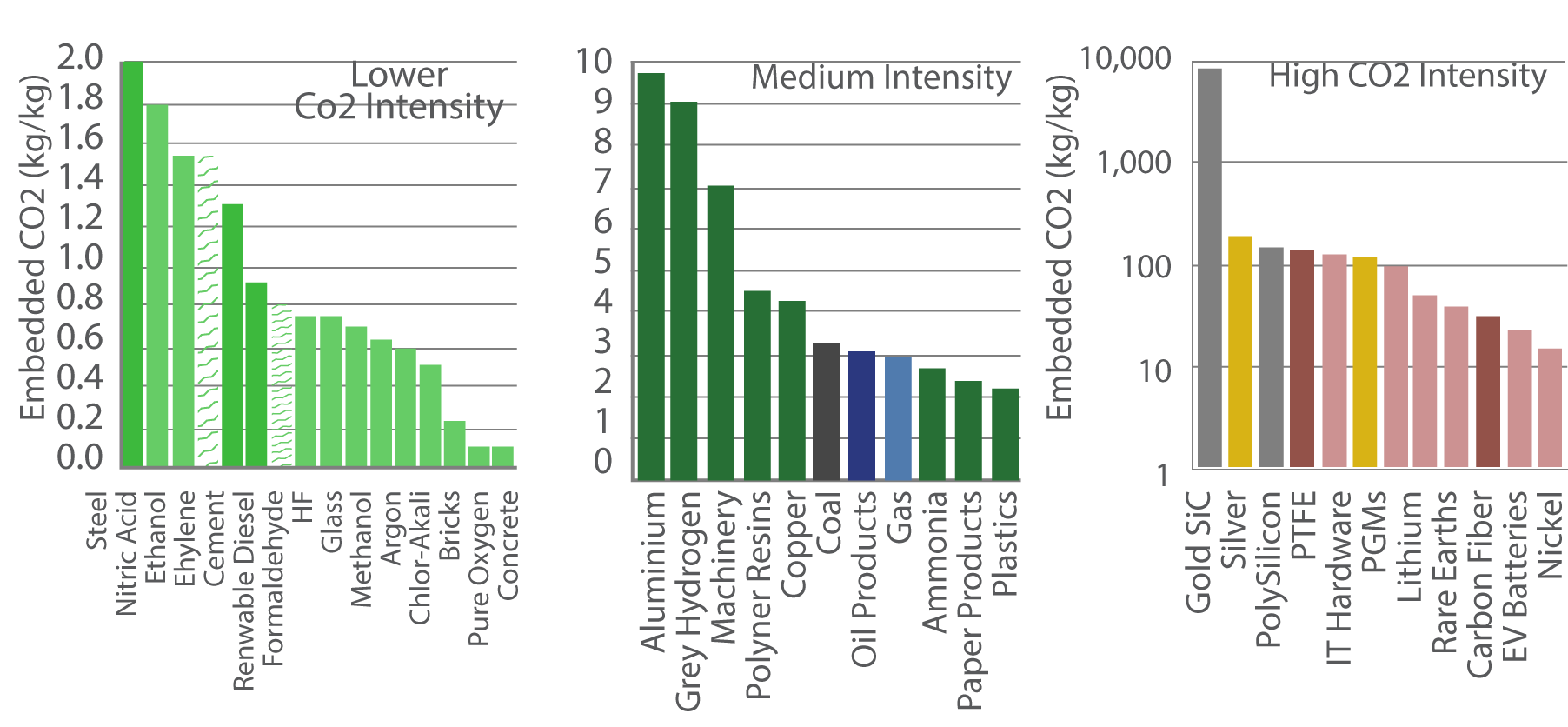

Comparing the CO2 intensity and energy intensity of materials, many used in our daily lives appear to be ‘less expensive’ in terms of the resources they take to produce. That’s to say when measure in tons/ton of Co2, kWh/ton of electricity and kWh/ton of total energy, EV batteries,. Lithium can be very costly to produce when compared to methanol or concrete

Co2 intensity of materials

Source: Thundersaid Energy

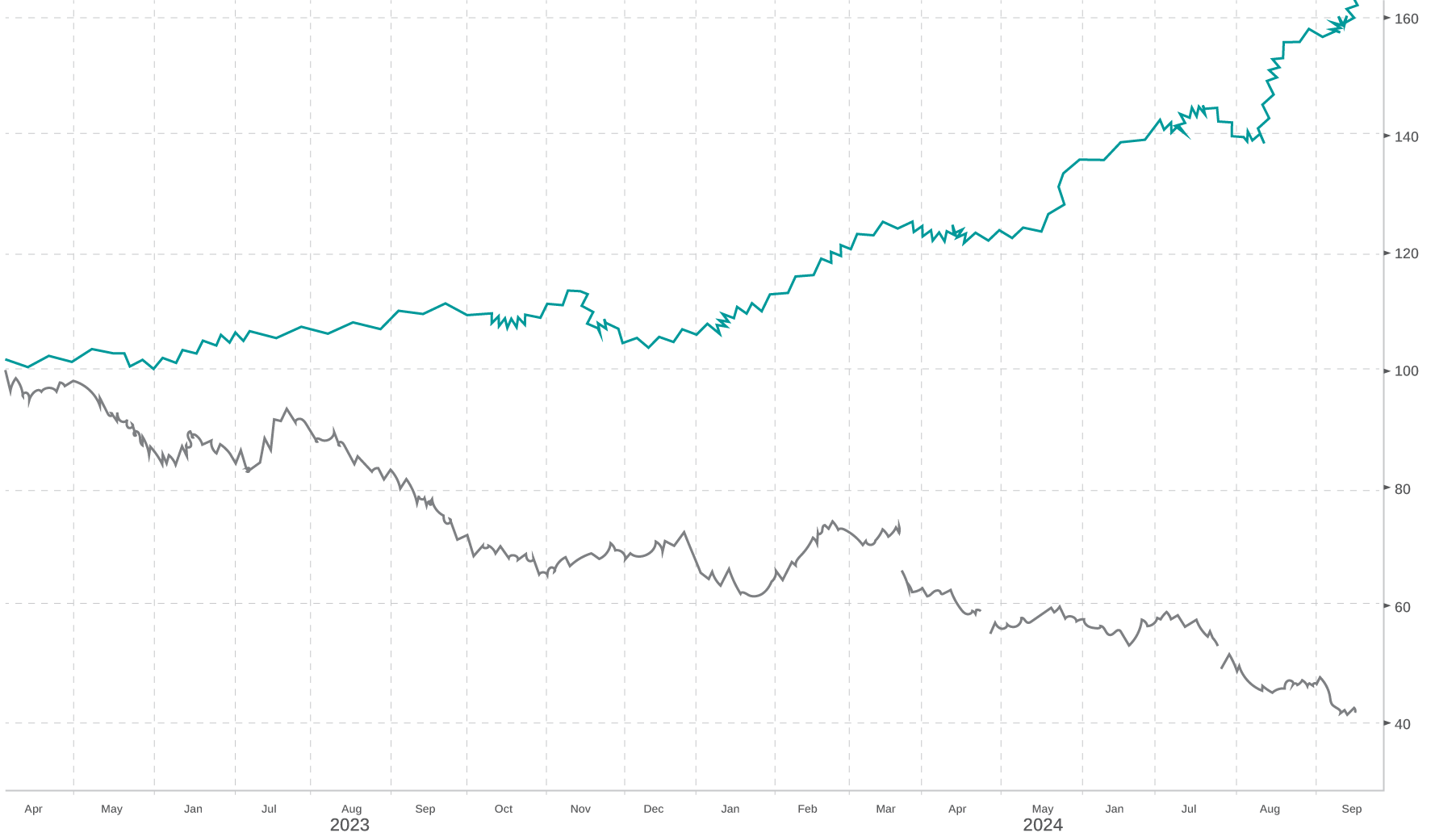

perhaps if the global slowdown was to be believed, then this would support it. As global consumer perhaps pulls in its horns, Kering SA, listed in the EU and owning brands such as Gucci and Yves Saint Laurent has a had tough time compared to Walmart in the US – a discount retailer known for its miserly prices.

year performance of Kering SA versus Walmart

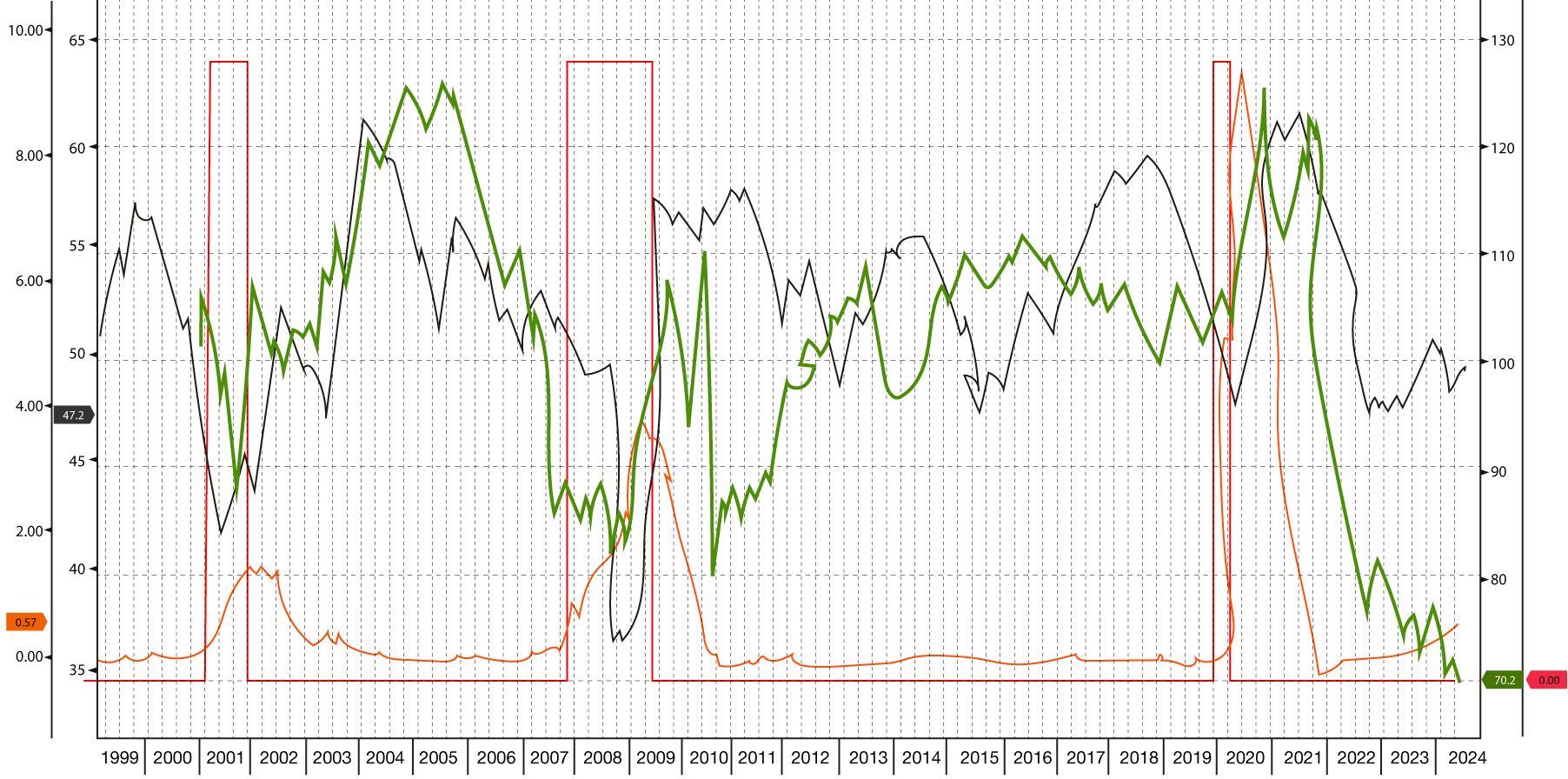

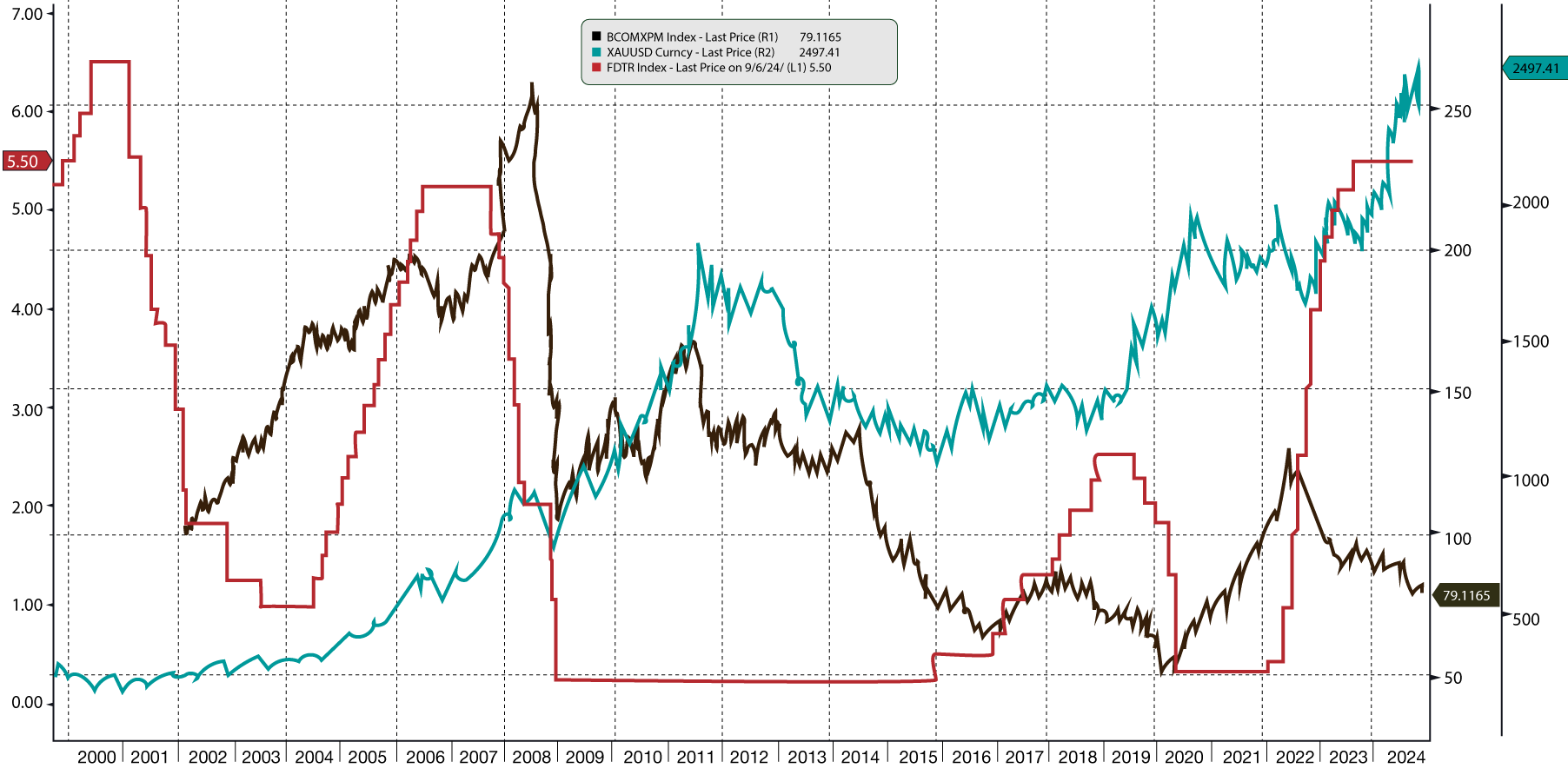

It’s often held that as interest rates are lowered by Central Banks, and particularly in respect of the US Federal Reserve and the green back, commodity prices rally – alongside other asset classes such as bonds and property.

During the last three cutting cycles – show where the purple line is falling 2001, 2008 and 2020 grains, oil, metals and Gold have all responded differently. Of course, each cycle has had different rationales for lower rates. Most obviously gold seems to respond to lower interest rates most positively, yet oil and metals, tied to the economic cycle are less likely to benefit, as having fallen in each period of lower interest rates.

Grains, Metals, Gold and Crude Oil – performance in cutting cycles

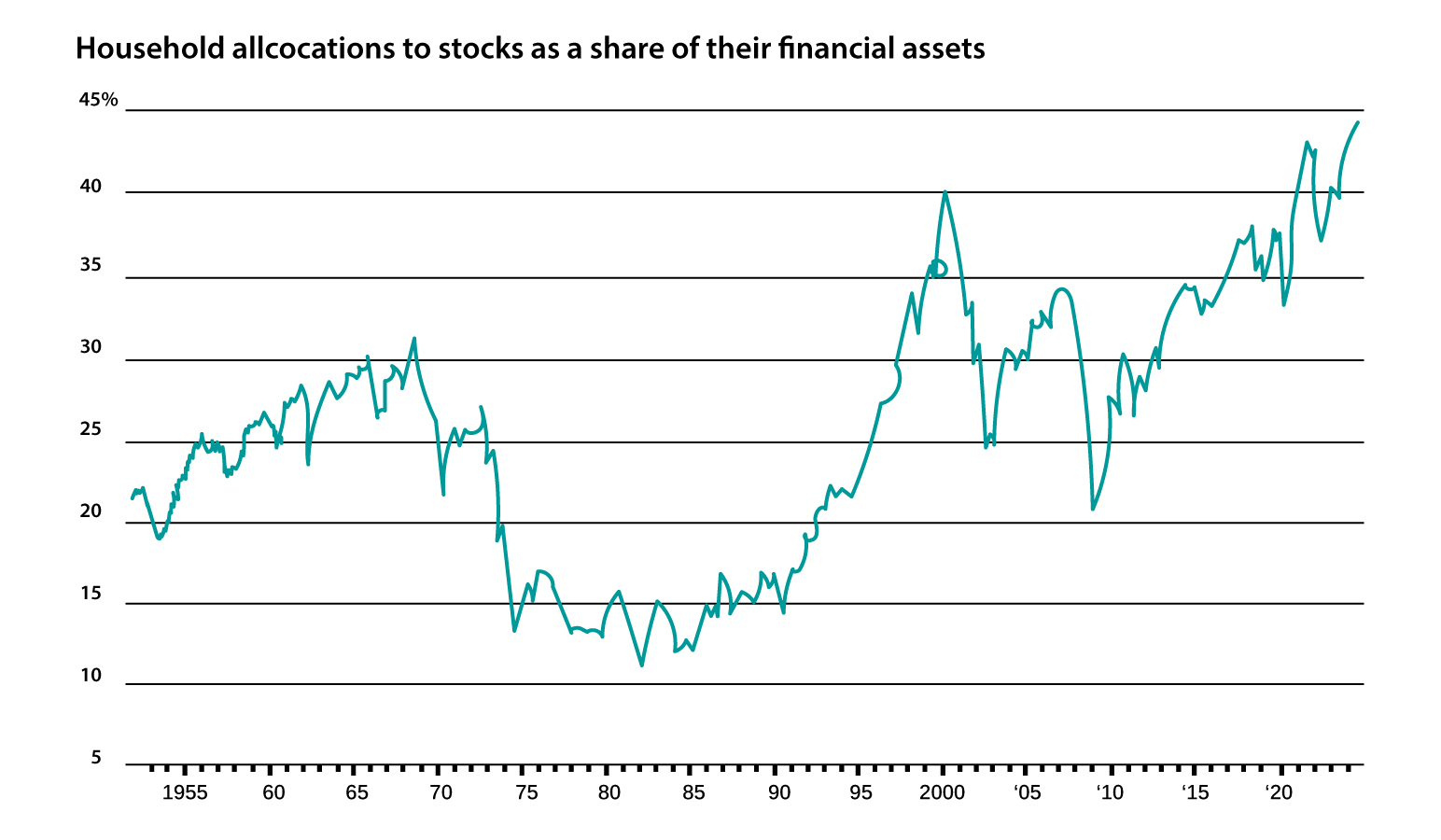

Household stock allocations have reached an all-time-a clear sign that the bull market, ongoing sine 2009, may be in its absolute late stage.

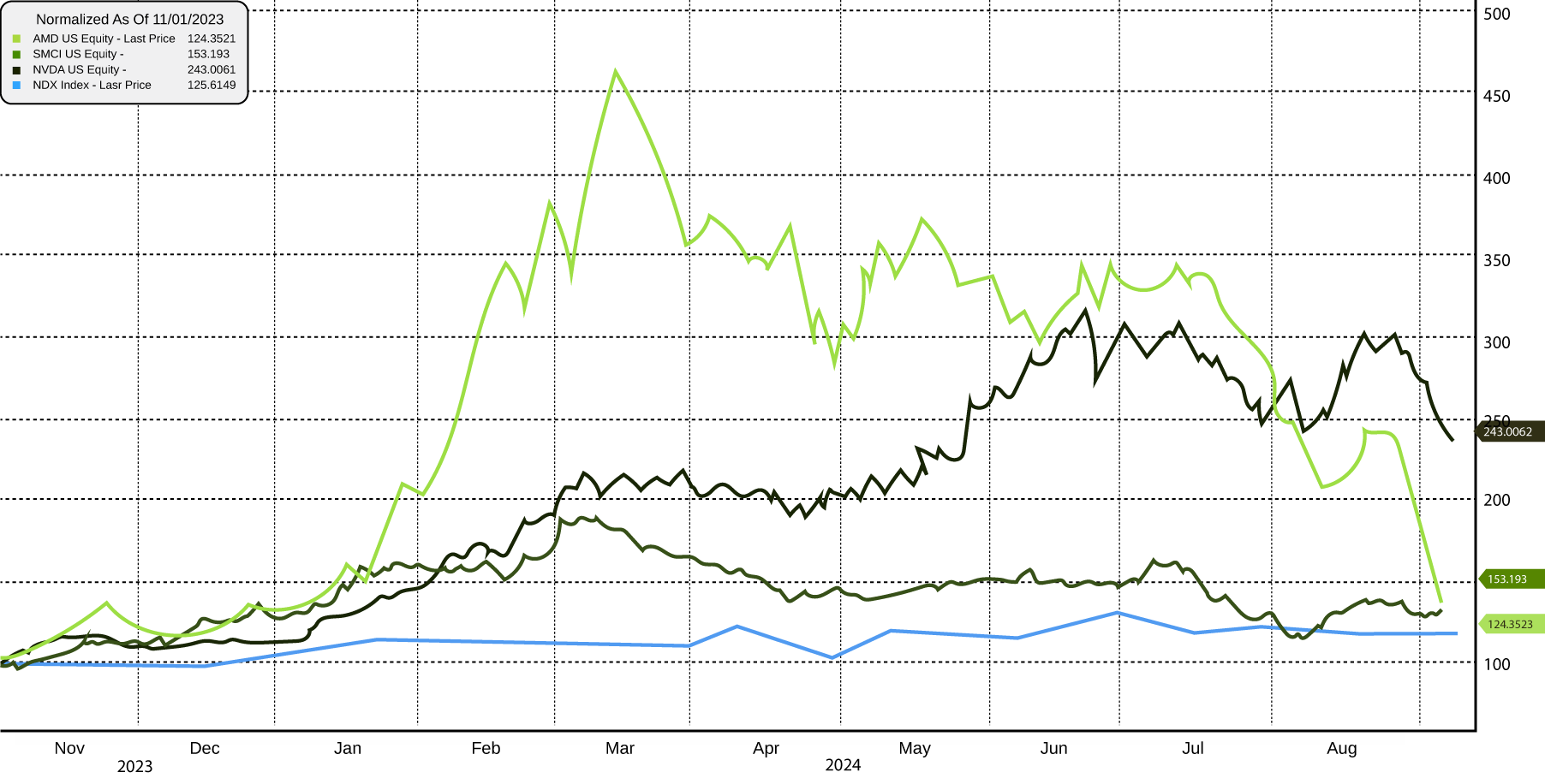

Chart showing 2024 YTD price action and AMD, SMCI, NVIDIA and ultimately the Nasdaq topping in sequence.

Source: ARIA

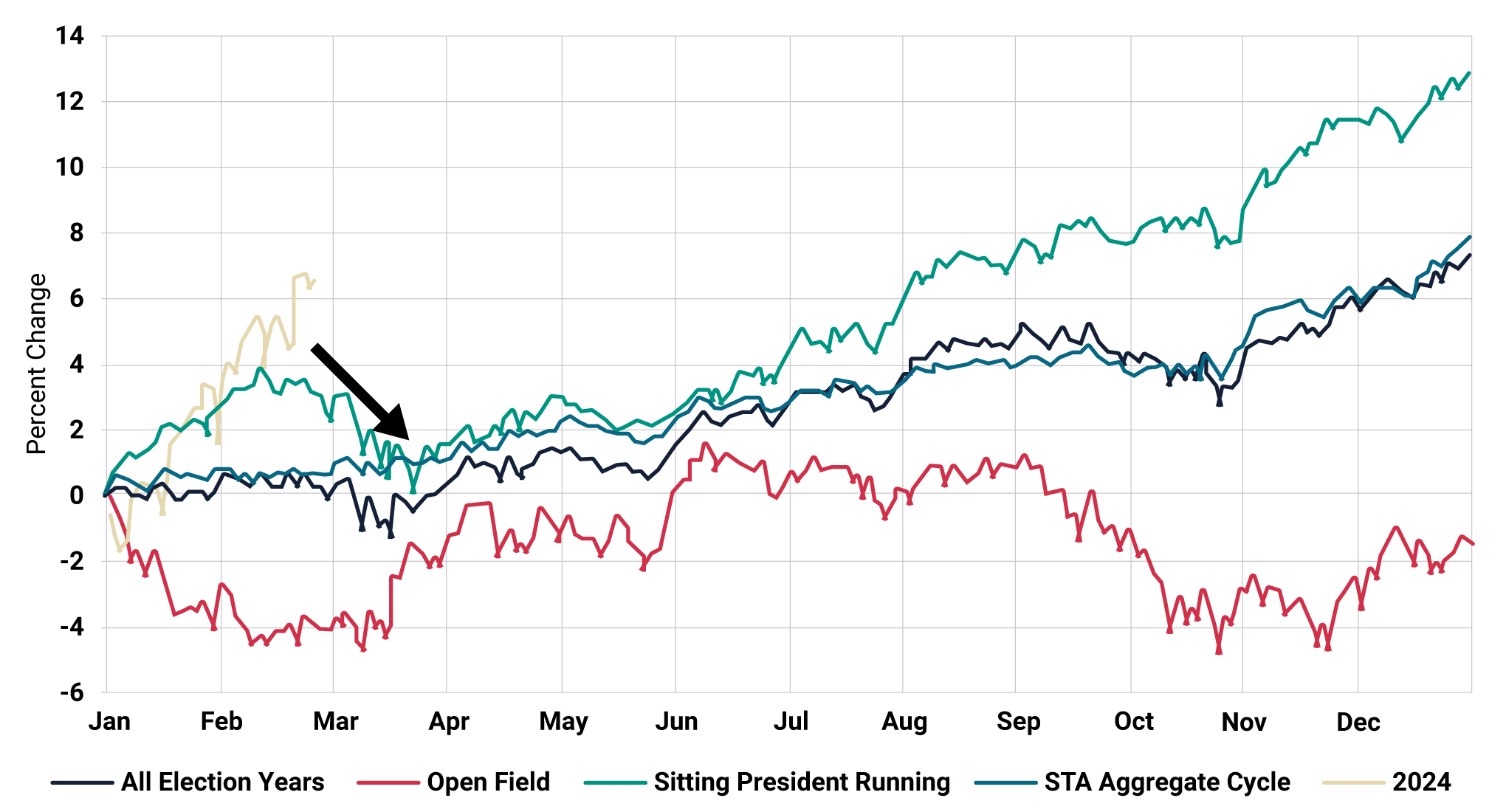

Historically, ‘Sitting President Running’ Election years are strong performers, and 2024 has been no exception. The seasonal pattern below confirms just that. However, with now a greater degree of uncertainty, it is very possible that we fall into the ‘open field’ pattern as recorded below as the Democrats look to switch their Presidential candidate.

Seasonal Patterns in Election Years

Source: Almanac Trader, ARIA

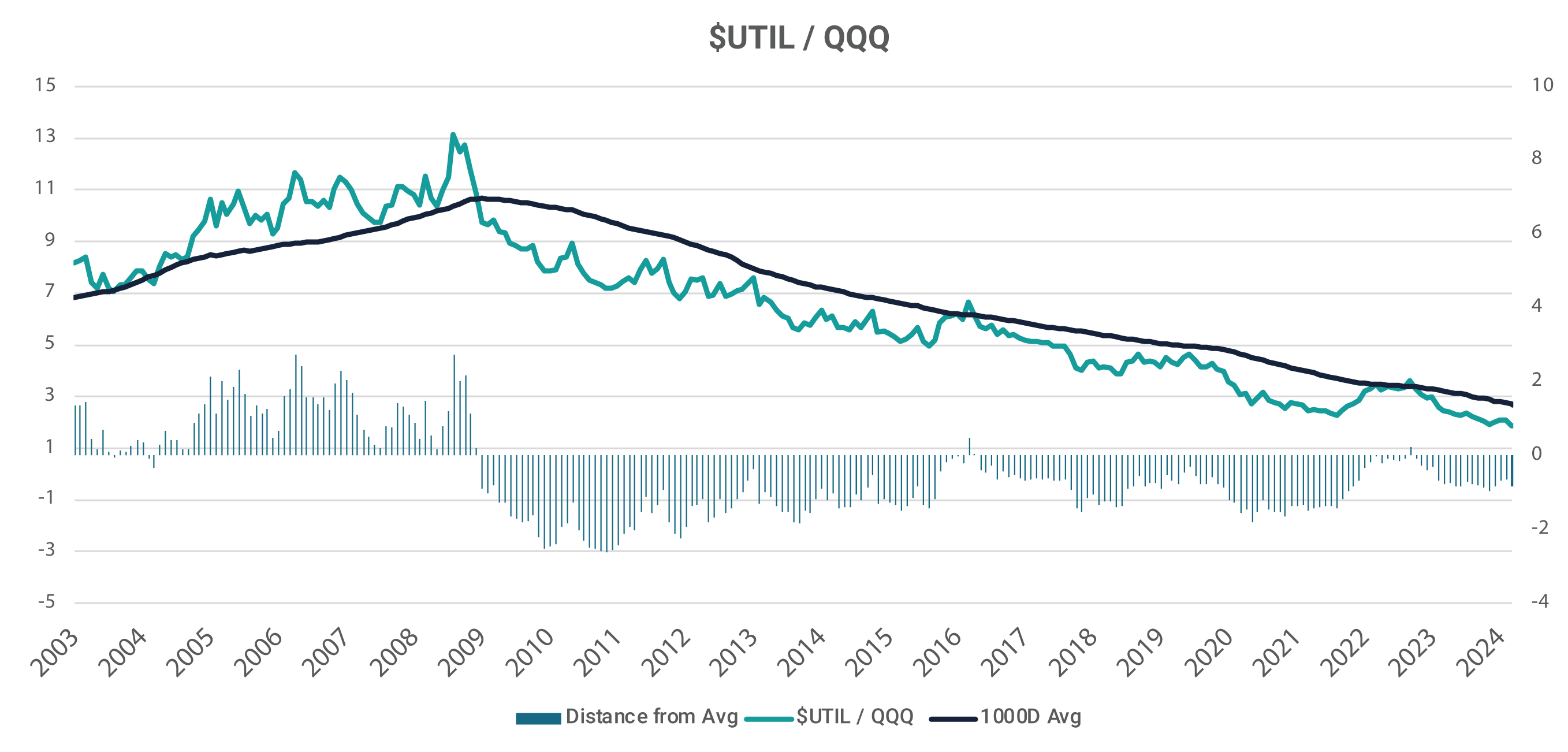

Such asset allocation changes include utilities and consumer staples sectors, which have been out of favour for some time. The below chart shows perhaps that that tide has turned, and specifically markets may for a period of time take on a more defensive leadership. A housing and retail led slowdown is long overdue.

Performance and valuation discrepancies between defensive and growth sectors is at an extreme

Source: ARIA, Bloomberg

Such asset allocation changes include utilities and consumer staples sectors, which have been out of favour for some time. The below chart shows perhaps that that tide has turned, and specifically markets may for a period of time take on a more defensive leadership. A housing and retail led slowdown is long overdue.

US Federal Reserve Balance Sheet as Percentage of GDP

Source: ARIA, Bloomberg

Whilst central banks have been reducing their post pandemic bloated balance sheets, it has been for governments and fiscal policy to do the stimulus heavy lifting. In fact, the US Federal Reserves’ monetary support, as a percentage of GDP, is now back to pre-COVID levels, although massive infrastructure spend has offset the removal of central bank’s monetary support, and kept nominal growth upbeat.

Source: ARIA

Our forwards looking macro regime investing approach, which uses growth, inflation and liquidity as a macro compass, helps to determine which of the four quads or market regimes – goldilocks, reflation, deflation or decline, best describe the current market conditions. We then reflect in our portfolio’s, asset allocations sympathetic to which quad we sit in. Each quad as you can see below has historically favoured certain assets. Our data indicates a move from Reflation back to Goldilocks – although favouring defensive low growth sectors such as utilities, consumer staples.

Quad Positioning

Source: ARIA

To what degree are we witnessing a ‘mania’? As the poster boy for the bull market, NVIDIA’s recent price action is parabolic and a trend ending signal. By some historical benchmarks, such as valuation metrics, the AI bubble is bigger than its TMT brethren in 2000. AI companies have raised billions, and have spent billions on a capex cycle, creating the demand for Nvidia’s chips. As we stand, many are still awaiting a product to match the capital committed to date.

Source: Bloomberg, Apollo Chief Economist, ARIA

To what degree are we witnessing a ‘mania’? As the poster boy for the bull market, NVIDIA’s recent price action is parabolic and a trend ending signal. By some historical benchmarks, such as valuation metrics, the AI bubble is bigger than its TMT brethren in 2000. AI companies have raised billions, and have spent billions on a capex cycle, creating the demand for Nvidia’s chips. As we stand, many are still awaiting a product to match the capital committed to date.

Source: Bloomberg, Apollo Chief Economist, ARIA

To what degree are we witnessing a AI fuelled stock market ‘mania’? By some historical benchmarks, such as valuation metrics, the AI bubble is bigger than its TMT brethren in 2000. AI companies have raised billions, and have spent billions on a capex cycle, creating the demand for Nvidia’s chips. As we stand, many are still awaiting a product to match the capital committed to date.

Source: Bloomberg, Apollo Chief Economist, ARIA

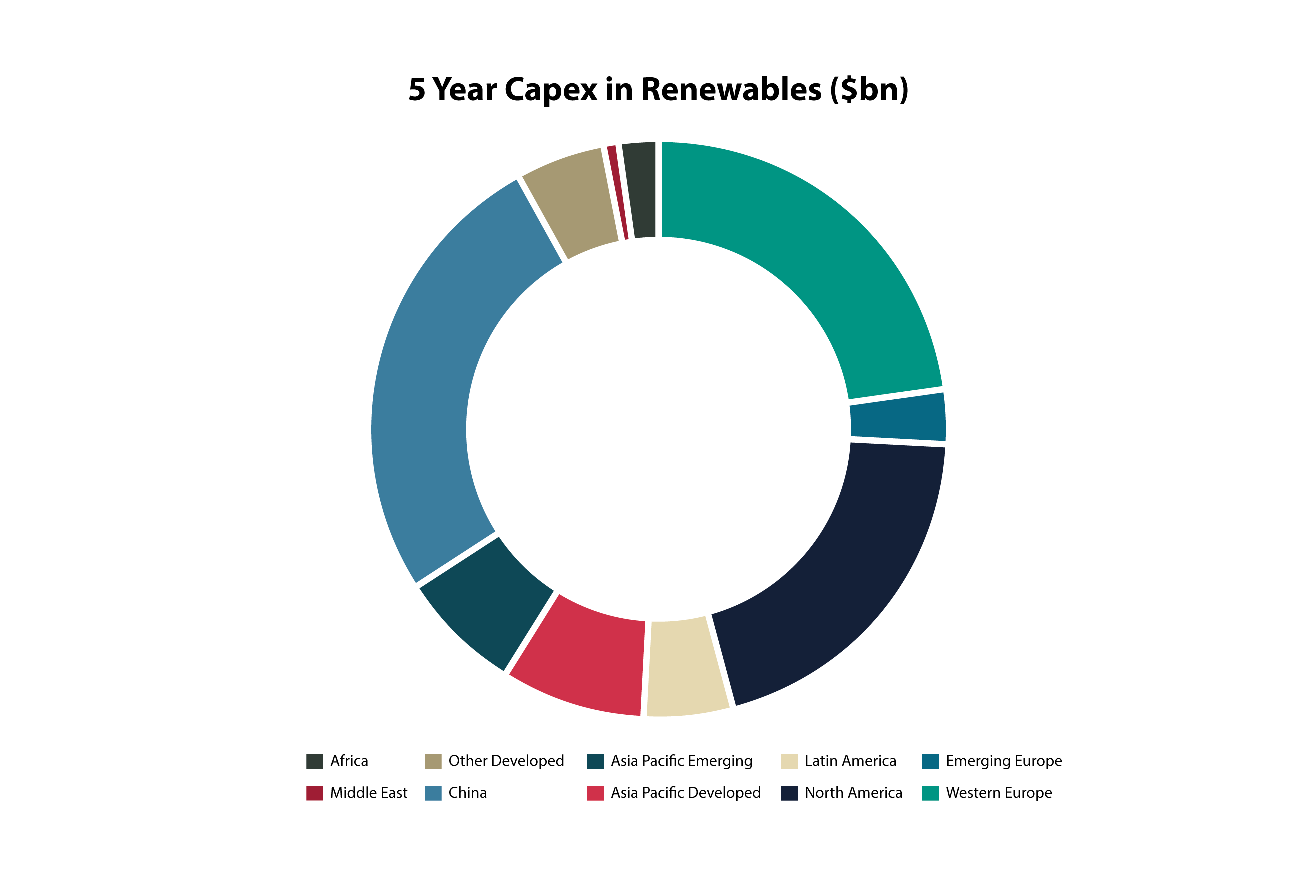

Whilst sub-Saharan Africa continues to struggle with massive energy deficits, it only accounts for approximately 2% of new renewables energy spend. A continent blessed with solar irradiation resources is particularly well positioned, and in need of, realising the transition as soon as it pragmatically can.

Source: ARIA, Bloomberg

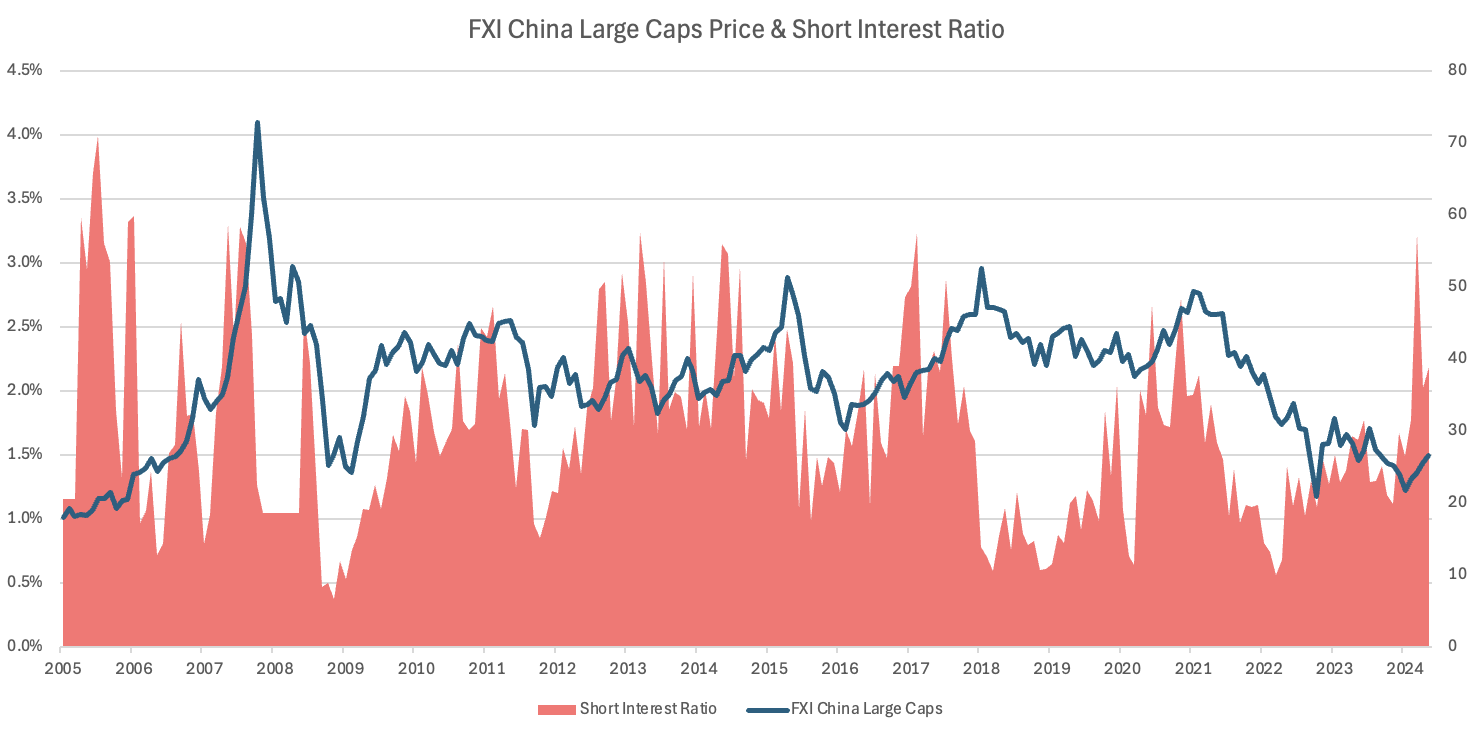

There are more than a few reasons to suspect the Chinese stock market has seen an intermediate, and probably long term bottom. Not least the historic spike in short positions in the Chinese FXI ETF, suggests selling had reached an extreme.

Source: ARIA, Bloomberg

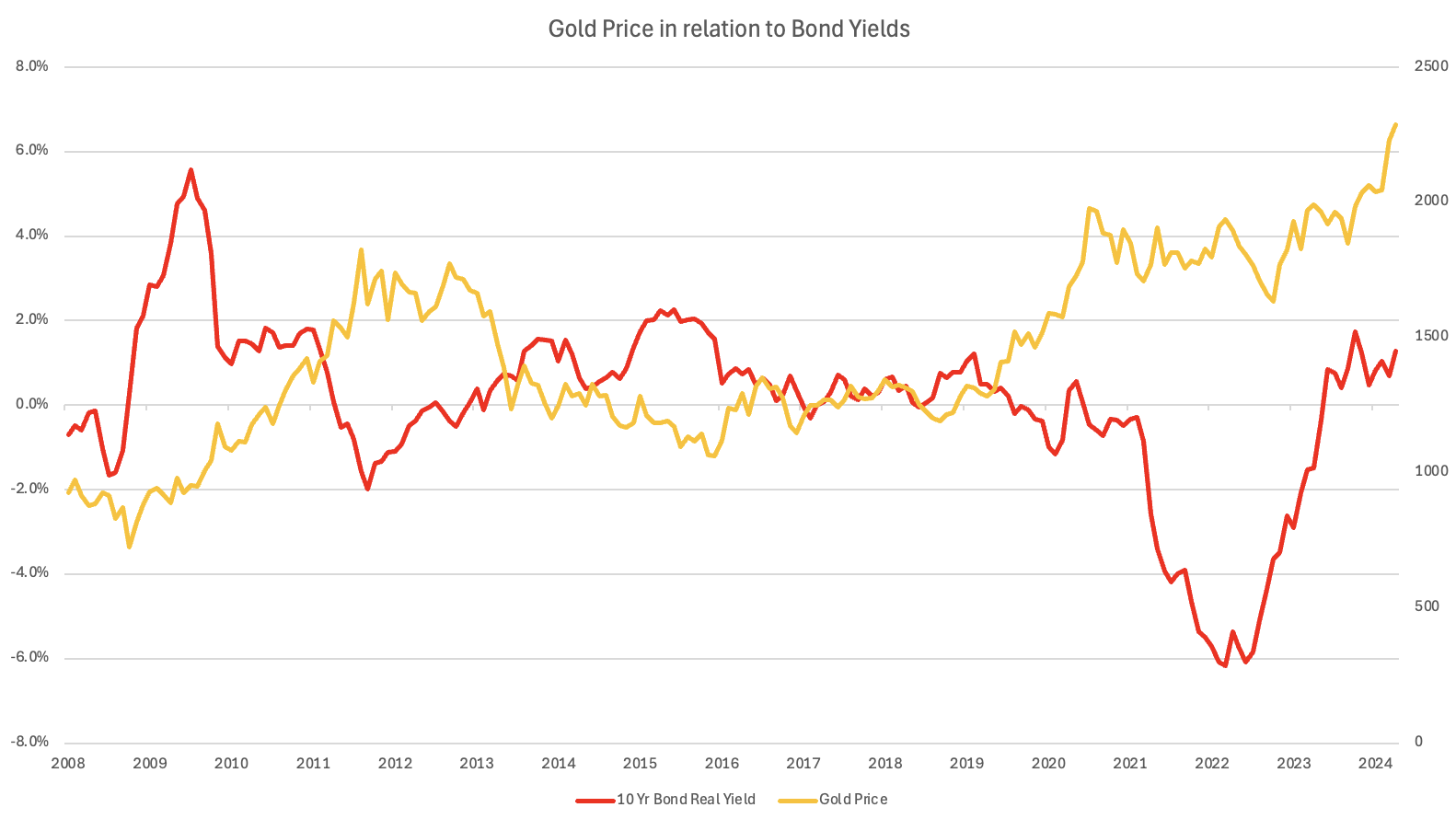

Usually rising interest rates would at least cap Gold's price appreciation. In fact, often the two demonstrate an inverse relationship. However, in the recent past, even whilst bond yields have moved higher, Gold has appreciated nonetheless - in part no doubt driven by geo-political tensions perhaps.

Source: ARIA, Bloomberg

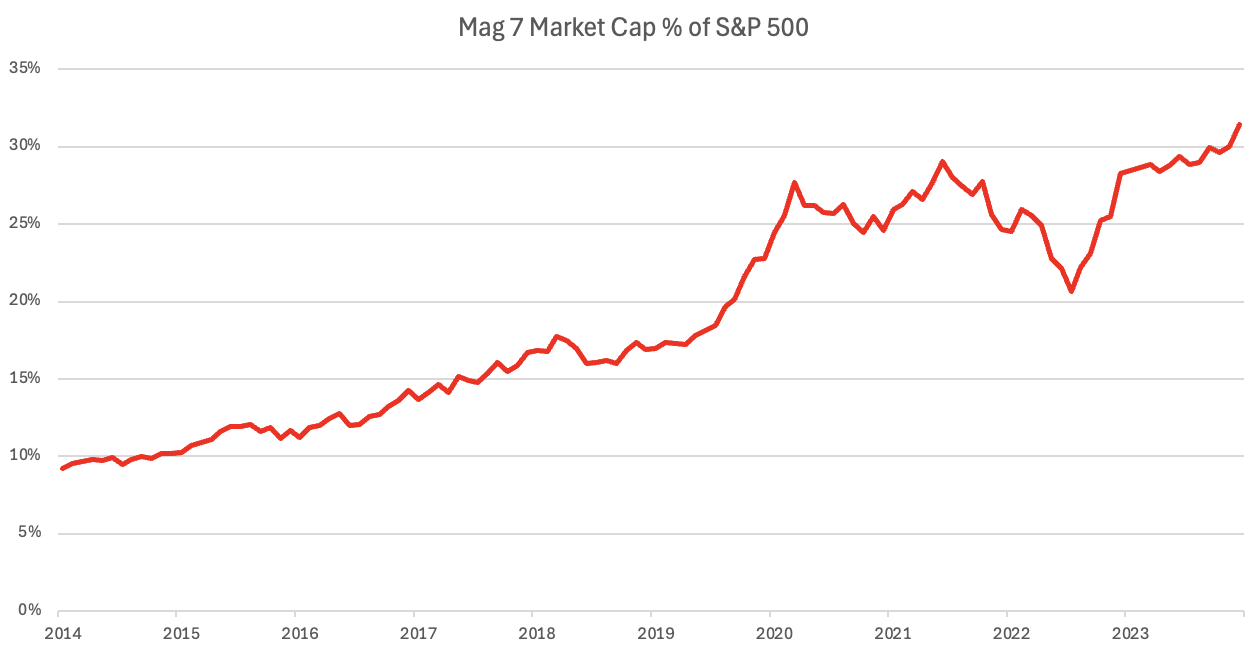

US large cap tech, notably Nvidia in recent times, have often accounted for much of the wide US market's performance. However, rarely have they accounted for our 30% of the market's capitalisation.

Source: ARIA, Bloomberg

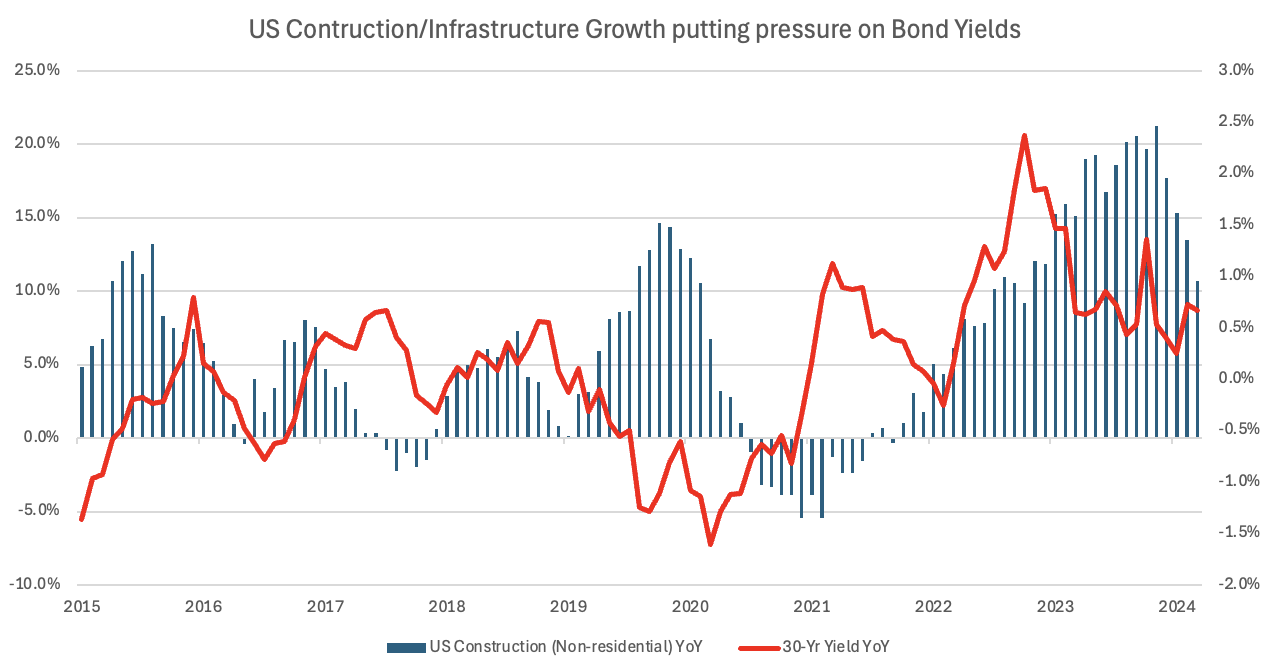

Biden's tenure has been characterised with three major pieces of legislation, including the Inflation Reduction Act, that has generated massive infrastructure spend. Such large government fiscal stimulus tends to lead higher interest rates, although the pace has begun to slow more recently, perhaps removing one tailwind for the 'higher for longer' narrative.

Source: ARIA, Bloomberg

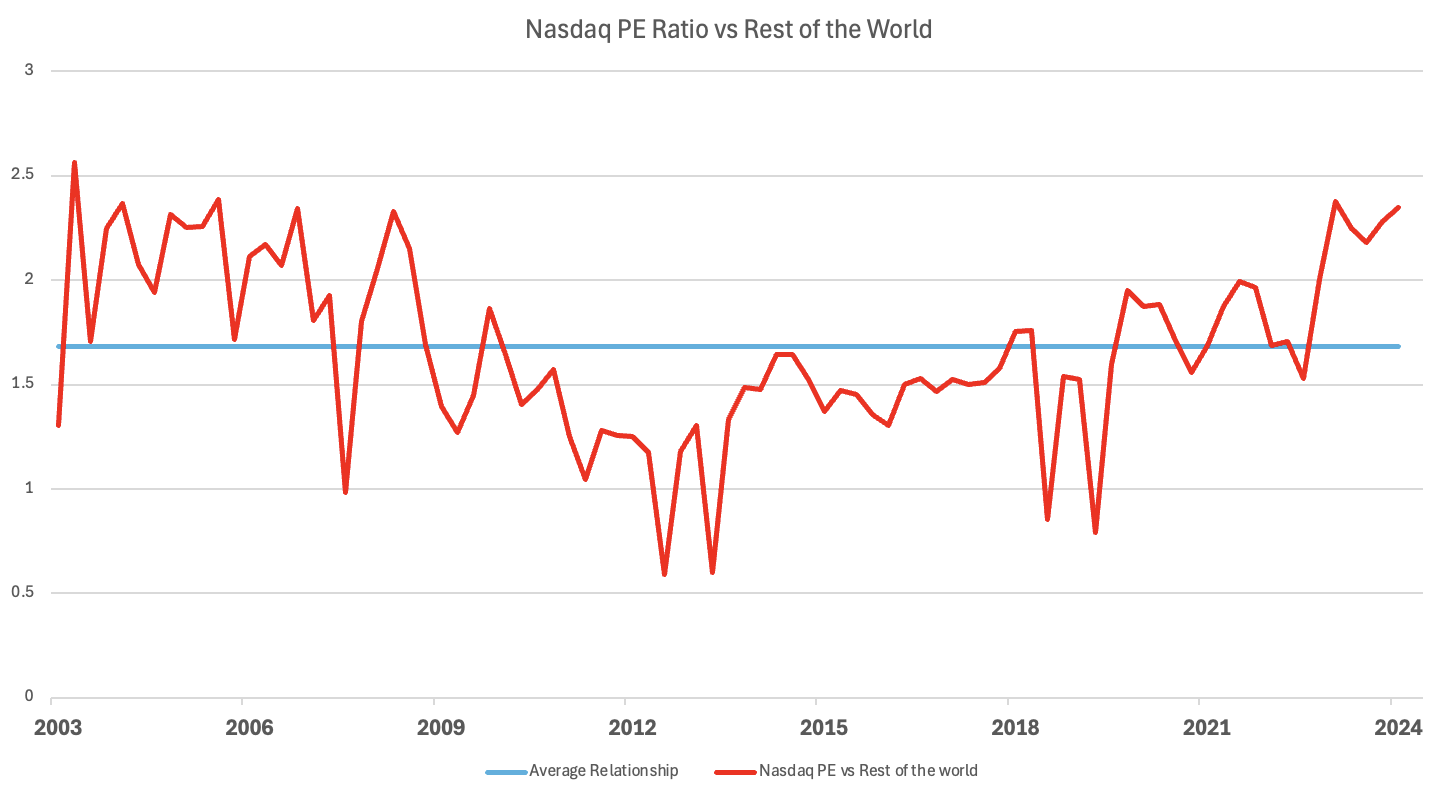

The outperformance of US tech is not new news, and much of it justified by earnings. However, relative valuations have reached levels where historically, the gap has then closed. US Tech will need to continue to deliver outsized earnings, or else mean reversion will likely set it.

Source: ARIA, Bloomberg