Game Boy Asset Allocation Outlook Q1 2025

Game Boy Asset Allocation Outlook Q1 2025

Executive Summary

Introduction

Games are thought to be older than written language and have been deeply intertwined with the arc of history. War games shaped the outcomes of real wars in the nineteenth and twentieth centuries. In the opinion of some, game theory influenced, if not strained our conception of human behaviour to such a degree we stood on the brink of mutual destruction, yet still is a powerful influencer of political and economic thought. Games have yielded all pervasive mathematical insights, given rise to probability theory and drive new ideas in artificial intelligence. We wonder to what degree they will shape the first 100 days of a Trump presidency and the far-reaching impact of posturing in respect of trade and tariff policy. They may even have a role to play in determining US domestic monetary and fiscal policy.

It was the pandemic which really exhausted, for a time, central banker’s ability to vivify an economy through the printing presses and lowering interest rates. The inflationary consequences put paid to zero interest rate policies in the Western World, and so governments returned to the fiscal playbook once more (reducing taxes, increasing government spend), to keep the economic wheels turning. Professor Deborah Lucas pegged the cost of the 2008 bailouts at 498bn USD, whereas the Pandemic exposure the US to losses of up to 4$trn – i.e. the stimulus required costs even more to generate 1 USD of GDP.

Fiscal stimulus is more effective in generating personal real income or wage growth, whereas cheaper money from QE encourages credit fuelled expansions. Put another way, infrastructure programs, are considered to be a more surgical means of improving consumer’s bottom line, through wage increases, whereas quantitative easing tends to exaggerate asset prices and stock markets rather than main street. The extended business cycle in the US has been demand driven, by a consumer and government spending in lock step, beyond what many could imagine.

But continued fiscal benevolence is hardly surprising in a year which counted an unprecedented 70 elections happening globally. That means 70 incumbent administrations all leaning on the public purse to curry favour with the electorate. As fiscal deficits, as a percentage of GDP, are fit to bursting, it leaves little scope for further government given generosity, and every reason to believe that that both dominant drivers of demand, consumer and government, will tighten the purse strings in the coming months.

Quadronomics:

As per convention, we review quarterly which quad, regime or which of the four seasons in our economic weather vane most accurately captures the current economic environment.

The rate of change of growth, inflation and liquidity give us a lead steer on the direction of the economy, and how to position accordingly. Whilst earnings estimates seem in need of revising lower, it will be growth, inflation and liquidity which will ultimately have the greatest bearing on stock market performance over any given 1-year horizon.

Market Regime Summary

Figure 1: Quad Regime

Global Regime : Reflation

Reflation is a risk-on regime in which investors are generally rewarded for increasing risk because policymakers are supporting or unlikely to restrain nominal economic growth that is perceived to be accelerating or persistently better than expectations.

However, as we detail in this report, we believe we are susceptible here to a change in regime towards deflation/stagflation in relatively short order.

Goldilocks Portfolio Characteristics:

| Risk Assets | > Defensive Assets |

| High Beta | > Low Beta, |

| Cyclicals | > Defensives, |

| Growth | > Value, |

| SMID Caps | > Large Caps, |

| International | > US, |

| EM | > DM |

| Corporates | > Treasurys, |

| Short Rates | > Middle of the Curve > Long Rates, |

| High Yield | > Investment Grade, |

| Industrial Commodities | > Energy Commodities > Agricultural Commodities, and |

| Gold | > FX > USD |

The US Dollar is the predominant driver of global liquidity, and when it rallies, it suggests that it is in shorter supply. Inflation has likely bottomed in sequential terms, and it seems unrealistic that it can durably remain at 2-2.3% which is the Fed’s intended target. Upside surprises in inflation would likely presage a drift to risk off sentiment in markets. Finally, to reinforce much of this commentary, growth is likely to slow in the medium term as government spending is curtailed and a slowing in US labour supply – with considerable political motivation to do so.

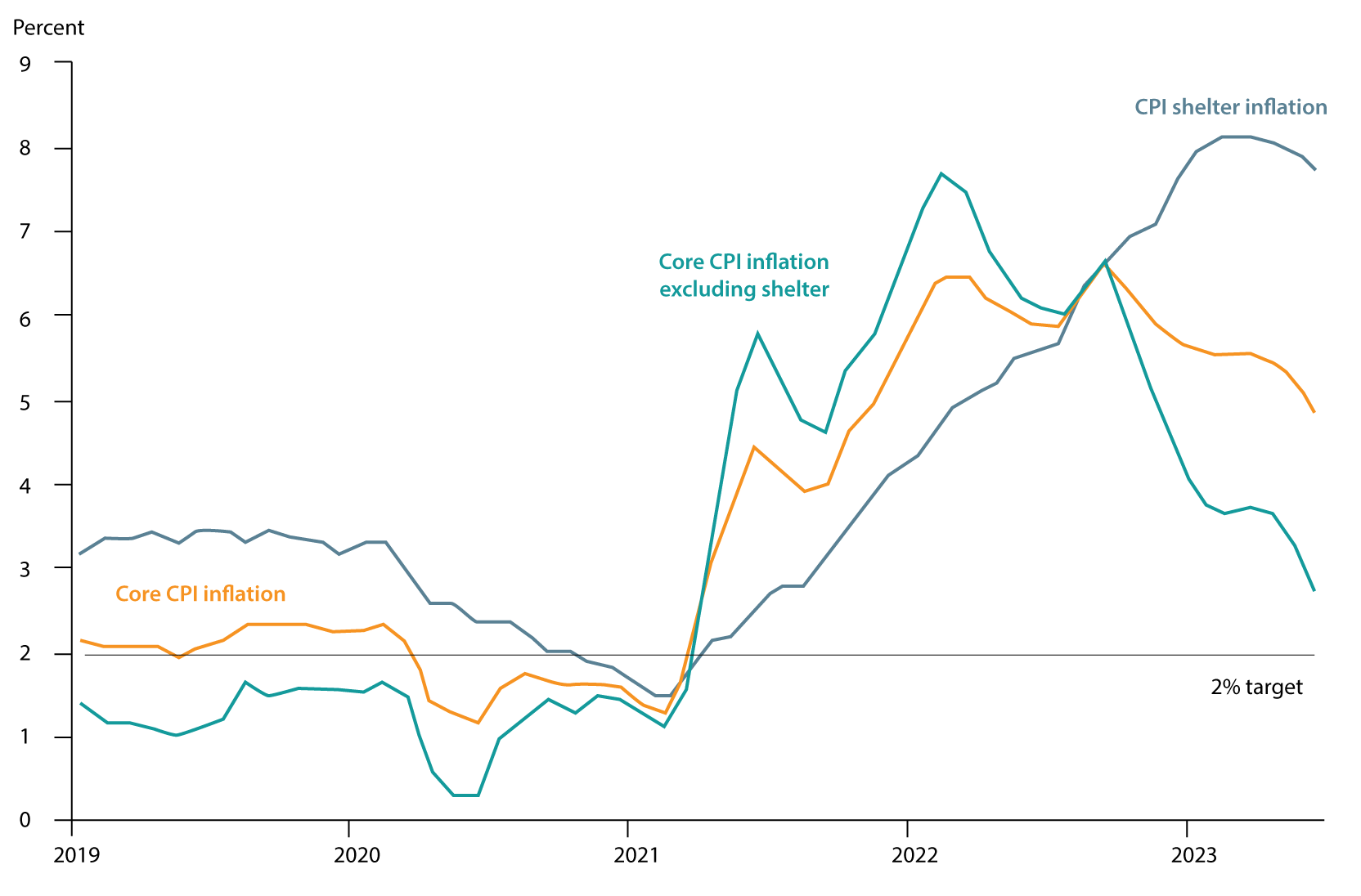

The Godot Recession

In November 2022, when the Economist featured that a global recession in 2023 was ‘inevitable’, we were leaning the other way, unconvinced that the odds were as loaded in one way as others were. It would have been particularly prescient to have anticipated an immaculate disinflation too, which is what has come to pass, whereby the Federal Reserve engendered a relatively inconsequential, as measured by job losses, slaying of the inflation dragon. In fact, if inflationary measures back out ‘shelter’, which is conventionally a lagging indicator, then price pressures arguably met the 2% target the central bank had underlined. Mission accomplished, a soft landing achieved whereby the air was let out of the inflationary ballon without significant economic repercussions.

Figure 2: Inflation with Shelter Backed Out

Source: Federal Reserve Bank of San Francisco, ARIA.

Admittedly, even as we close the books on 2024, US GDP nowcasts are running at a healthy clip, around 2.4%, but that mirrors the late 2007 period too – recessions arrive with little forewarning.

Up until recently, consumers have been well positioned – substantial pandemic savings cushions which could be drawn on, the ability to fix mortgage rates at anaemic levels, and sidestep the worst ravages of sharp interest rate hikes, and finally job openings at levels that prevented unemployment from creeping higher. As one hired door closed another would swiftly open. However, such comforting surroundings seem to be wearing at the seams now and we’re beginning to lean more bearishly, even if any recessionary period is a short run affair.

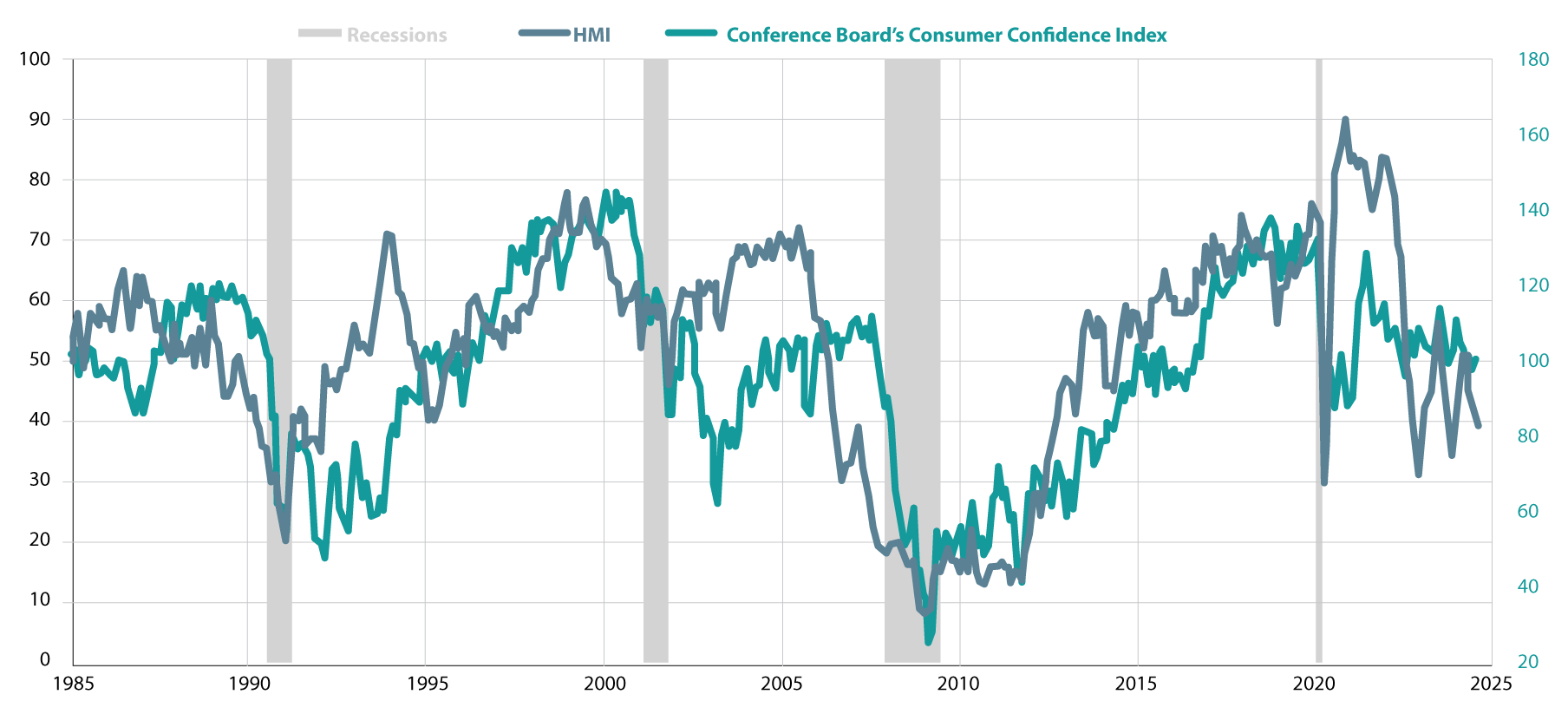

Figure 3: Housing Market Index and Consumer Confidence

The inexorable rise in housing prices has improved many consumer’s balance sheets – at least on paper. Housing is an important contributor to many economies, and the US, as the world’s largest (still), is no exception. Housing data has begun to disappoint and with it, we expect economic data too.

For months now, interest rates have consistently surprised on the upside, alongside the strength of the US consumer. That’s to say ‘bond bulls’ had to continually temper their expectations for interest rate cuts throughout 2024. On December 19th, Jerome Powell, Federal Reserve Chair, further took the wind from their sails in slashing interest rate cut expectations from 4 to 2 in the coming year. (Rather than interest rates falling by 2.00% the Fed is now predicting only 100 basis points of cuts). Housing by its nature, is a big-ticket item being funded largely by borrowings, hence it is interest rate sensitive. Housing numbers are a lead tell for the economy. If housing data is weakening, at a point in time when employment growth and hence wage growth is too, then de facto the consumer will likely begin to feel a little less buoyant. Having churned through pandemic bestowed stimulus savings, savings rates, already unsustainably low, will need to rise. This is all to describe a less than virtuous cycle where consumption growth will trail income growth, and the US consumer powers 70% of the economy.

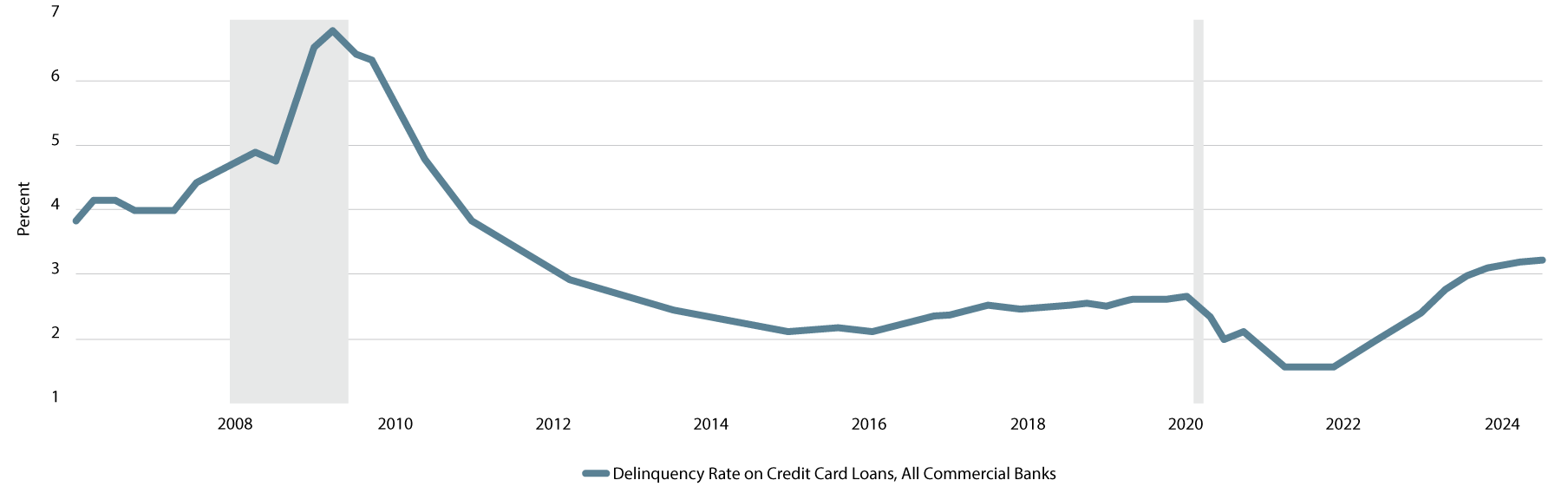

Figure 4: Rising Delinquency Rates on Credit Cards

Source: Federal Reserve, ARIA

Another indication of a consumer starting to look a little worse for wear is credit card delinquency data – rates now are consistent with those of 2011. Interestingly, by comparison unemployment was at 8% then, rather than 4% now, although we are certainly not in the realm of the GFC yet. In a very mean reverting data series, unemployment has room to drift higher once more.

Therefore, in the first half of 2025, we expect to see markets recognise a hangover of sorts and turn heel. This is before the potential for Donald Trump to stoke tariff fears, which could well light the touch paper heralding a range of global slowdown concerns. Despite geopolitical risks punctuating every news cycle, commodities pricing demonstrates how manufacturing remains weak globally. The US has been the standout performer globally, benefitting from Biden’s massive infrastructure programs, whilst the rest of the world languishes in its wake.

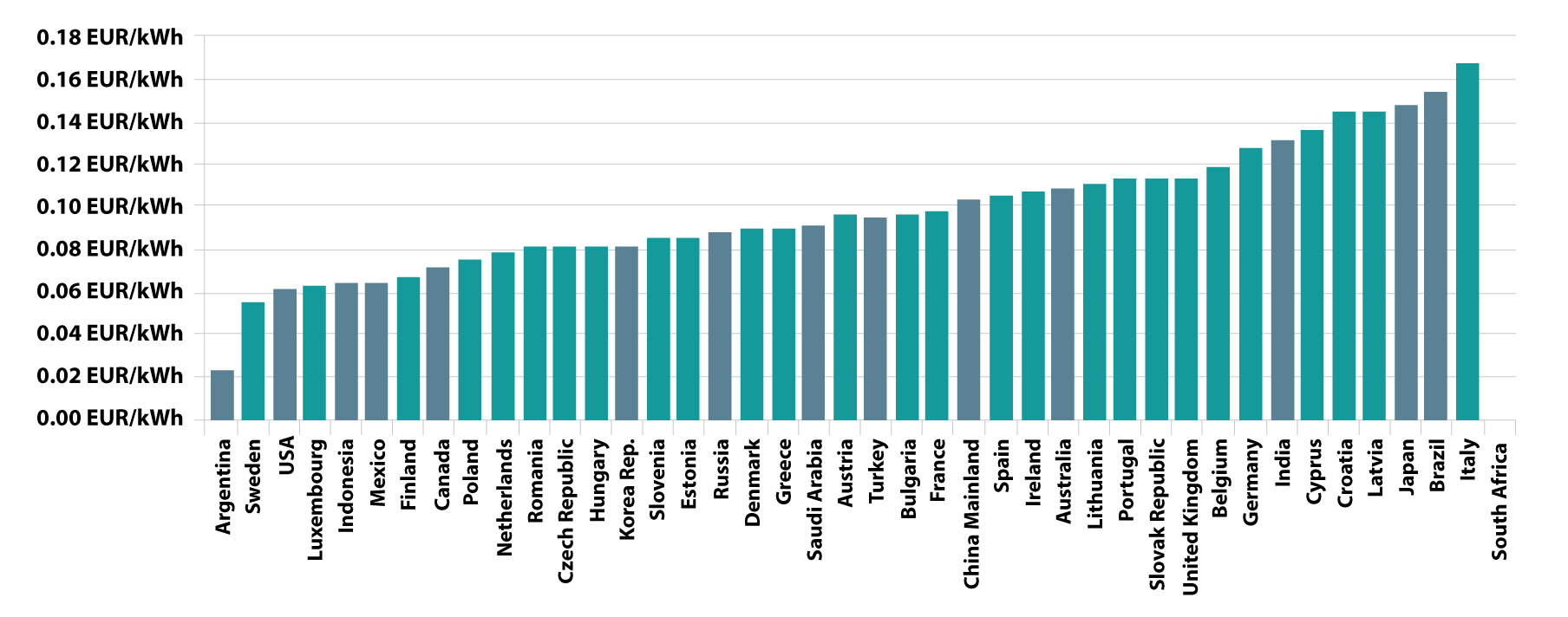

Europe and in particular Germany, is beset by challenges. One of the enduring legacies of outsourcing its energy policy to Russia, is not just the Ukrainian invasion. Given nearly 50% higher energy prices than its competitors, namely China, the industrial sector has been obliterated including its car sector. Volkswagen is the cause celebre and just this past week announced 35,000 job cuts and reduction in production by a quarter – yet still saw its shares fall as the market fears the retrenchment efforts do not go far enough. Crossing the Channel, Keir Starmer’s budget presented in the UK appears to be anything but pro-business and having disincentivised companies to hire further, casts a rather long shadow on the immediate future.

Figure 5: Comparative Energy Prices Germany versus Rest of the World

Source: IMD, Eurostat, CEIC, ACCC, ARIA

France economically is also more dependent on its government, than perhaps the UK or the US which has a more dynamic private sector. Mired in political turmoil, much like Germany, it seems likely to register GDP growth rates of less than 1.00%. The Eurozone ocean liner relies on both France and Germany as its tugboats to set sail. France is becoming a real time fiscal rejection to the ‘new Keynesian’ promise that generous welfare programs, high taxes and a strong socialist leaning precipitate healthy economic growth. It has the largest government relative to the domestic economy in the OECD, has suffered three what might be considered stagnant decades, in growth terms at least, as measured by living standards and moreover even its citizens, which benefit handsomely from a generous welfare state, are very unhappy with their lot. The political landscape too offers little by way of fiscal alternative – the ‘middle’ and the left wing – both favour high taxes and high government spend, the former insufficient to offset the latter, leading to ever greater debt burdens. An interesting yardstick by which to compare the efficacy of large social welfare programs to improve economic outcomes is to consider certain EU countries relative to some of the weakest States in America.

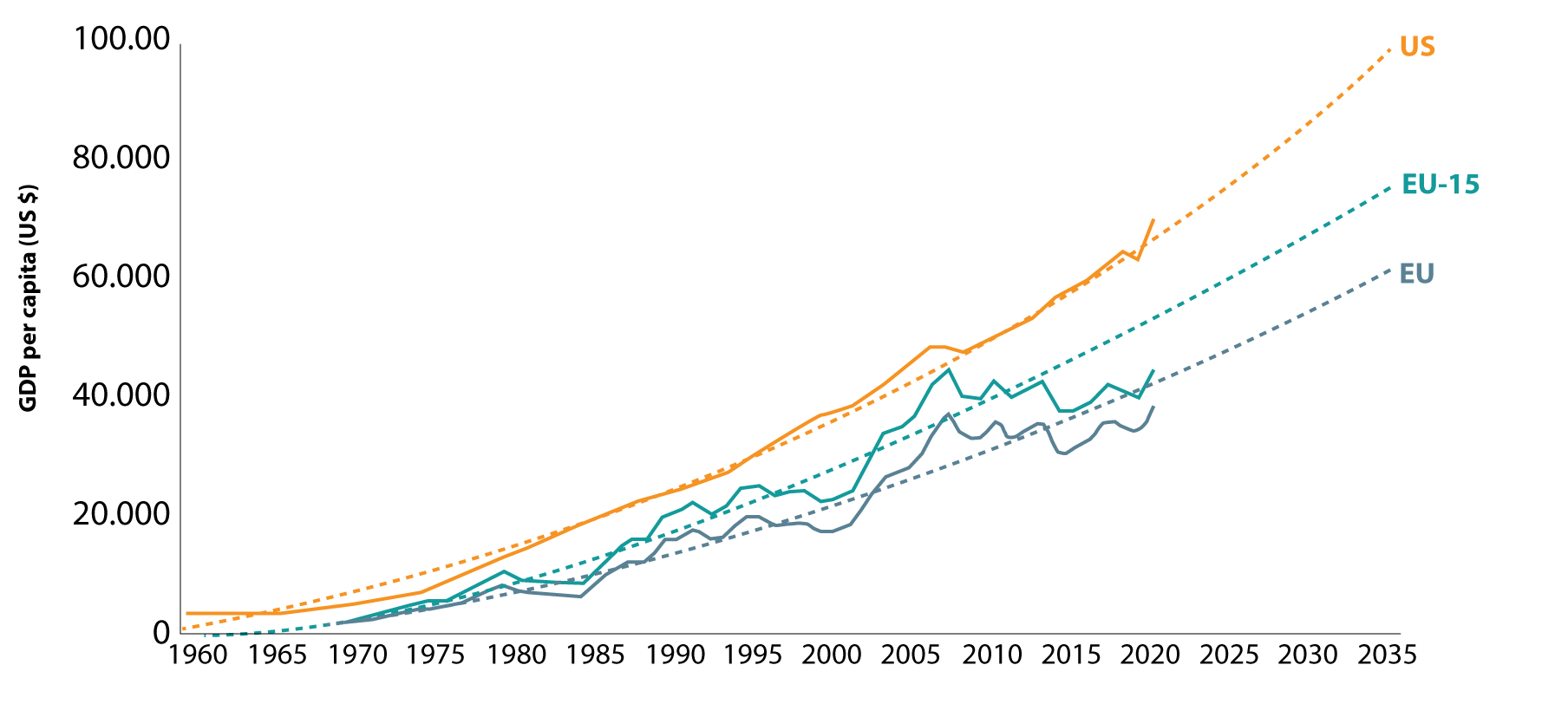

Figure 6: Development of EU versus USD GDP per Capita

Source: World Bank, ARIA

Sowing the seeds of discontent

The chart compares the GDP per capita relative to the size of the government spend. In an economy where earnings are on average taxed by 60%, the middle class and above are frustrated by ravaged take home pay, and the beneficiaries of those transfer payments, those in the lowest earnings income quintile, are frustrated by lack of opportunity in an economy strangled by high government debts. Those new to the workface, faced with limited economic opportunities, increasingly lean left, looking to governments to redistribute wealth. Those of greater means increasingly vote with their feet in looking for more productive, innovative environments. It’s not difficult to understand the increasingly polarisation political views amongst the global electorate.

Of course this is all reflected in the relative interest rate outlook too. Whilst the ECB looks set fair to cut rates to 3.00%, the Federal Reserve are reigning back market expectations of lower rates. We see this disparity in economic fortunes evidenced in a higher US Dollar against most currencies.

Remember there are no votes in preventative action. Politically, fixing the roof whilst the sun shines has limited mileage – to which Emanuel Macron can attest. The floored economic models of the UK and Germany may be chronic, but not acute enough to convince the electorate to accept the short-term costs to remedy the wider malaise – a crisis would be needed for that. There are bright spots on the European economic horizon, Greece, Portugal and Spain – all who had to take their medicine during the EU crisis.

The Plaza Accord of 2025

In fact, the strength in the US Dollar likely pleases nobody, neither the Trump administration, nor its trading partners. There are parallels with a bygone era, nearly 30 years ago in 1987. The Plaza Accord may yet provide a roadmap for the incoming Treasury Secretary, Scott Bessent. A hedge fund manager, noted for his part played in the huge fortunes made betting against the British Pound in Black Monday, he will be an important voice in a red-blooded White House, which will go to significant lengths to shape US economic destiny. Whilst tariffs, (which may not materialise to the extent currently promised), could prove inflationary, as well as mass deportations too, the President elect will ultimately prefer lower interest rates and a lower Dollar, given the revival of animal spirits that the new administration will hope to realise.

The Trump Bump, whereby markets have begun to price in greater growth prospects, when set against a moribund growth environment elsewhere such as Europe, has pushed the US Dollar higher. A stronger dollar mind makes US exports, a central pillar to the new economic agenda, more expensive. Given the credentials of those at the US economic helm from January 20th onwards, we would be very surprised if Tump 2.0 policies are allowed to hurt US growth, although we must make allowance for animal spirits to be definitively tempered as the Whitehouse initially ramps up Tariff rhetoric.

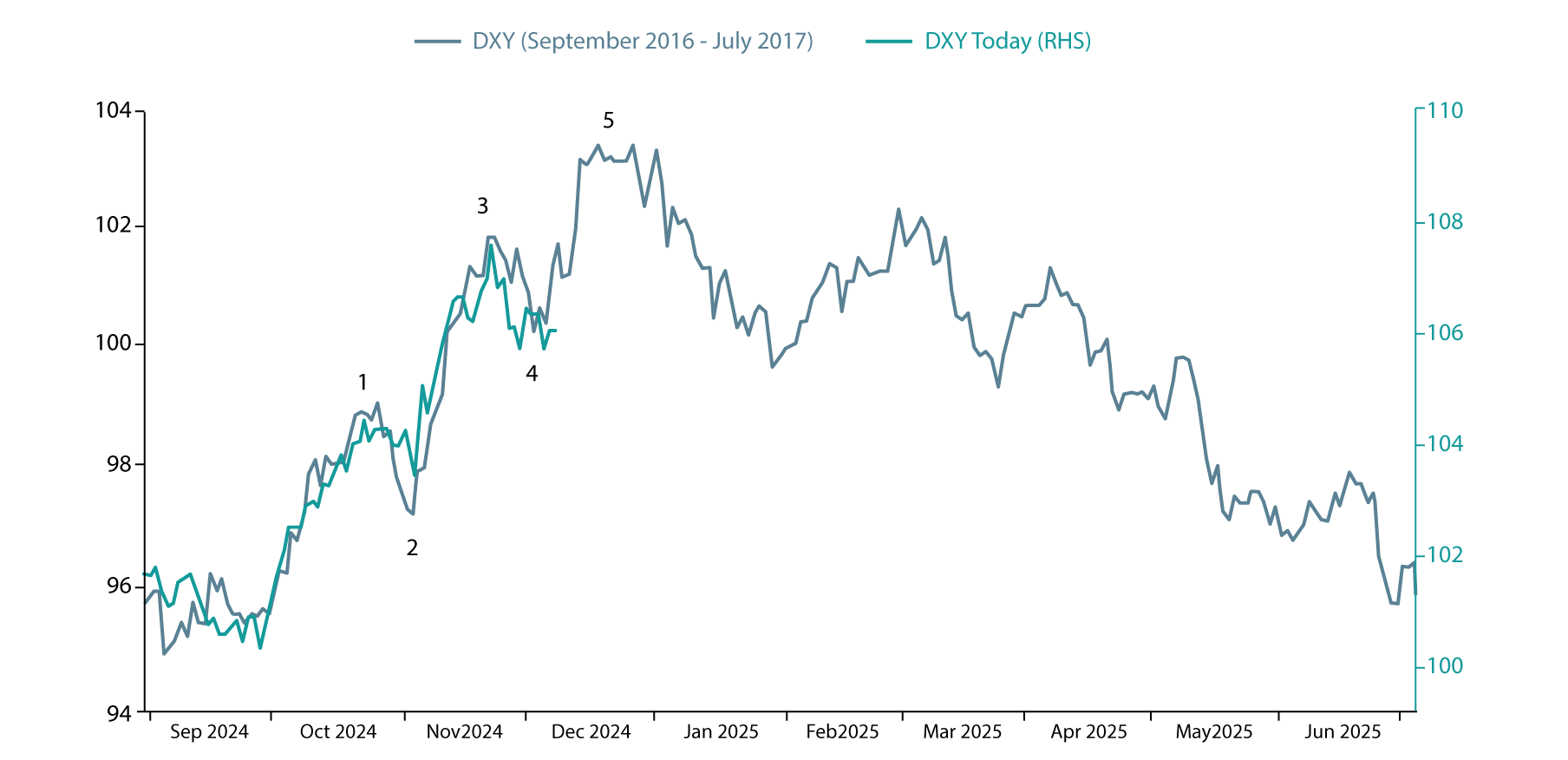

Trump has already softened his approach towards a strong US, and James Baker’s Plaza Accord sets outs a framework for a coordinated lowering of the US Dollar. In fact, if we follow the 2016 trajectory, the US Dollar could well top over the New Year period.

Figure 7: History suggests the US Dollar will top soon

Source: LSEG Datastream, Pictet, ARIA

Mar-a-Lago will likely lean upon the Bank of Japan to finally pull the trigger and implement a definitive rate hike. We expect the Japanese Yen to be one of the stronger performers in 2025, even if that is due to its ‘defensive characteristics’ during some of the inevitable turbulence that follows a period of relative stock market stability. To the extent that Wasthington imposed tariffs on Chinese made goods are punitive, the People’s Bank of China, (the PBOC), could well respond in kind with a competitive devaluation in the Yuan. Historically, this has caused significant ripples across Asian economies, notably in 2015, which we also anticipate to be a credible threat to market sanguinity.

Deregulation of course is an adrenalin shot to the banking sector, and we have already seen that in the sector’s performance since the November 7th election. Investment and Money Centre banks such as Citi, Goldman Sachs and Wells Fargo have led the charge recently, posting expectations beating numbers at a time when big Tech has found it more challenging to keep up with expectations.

A Pause that Refreshes

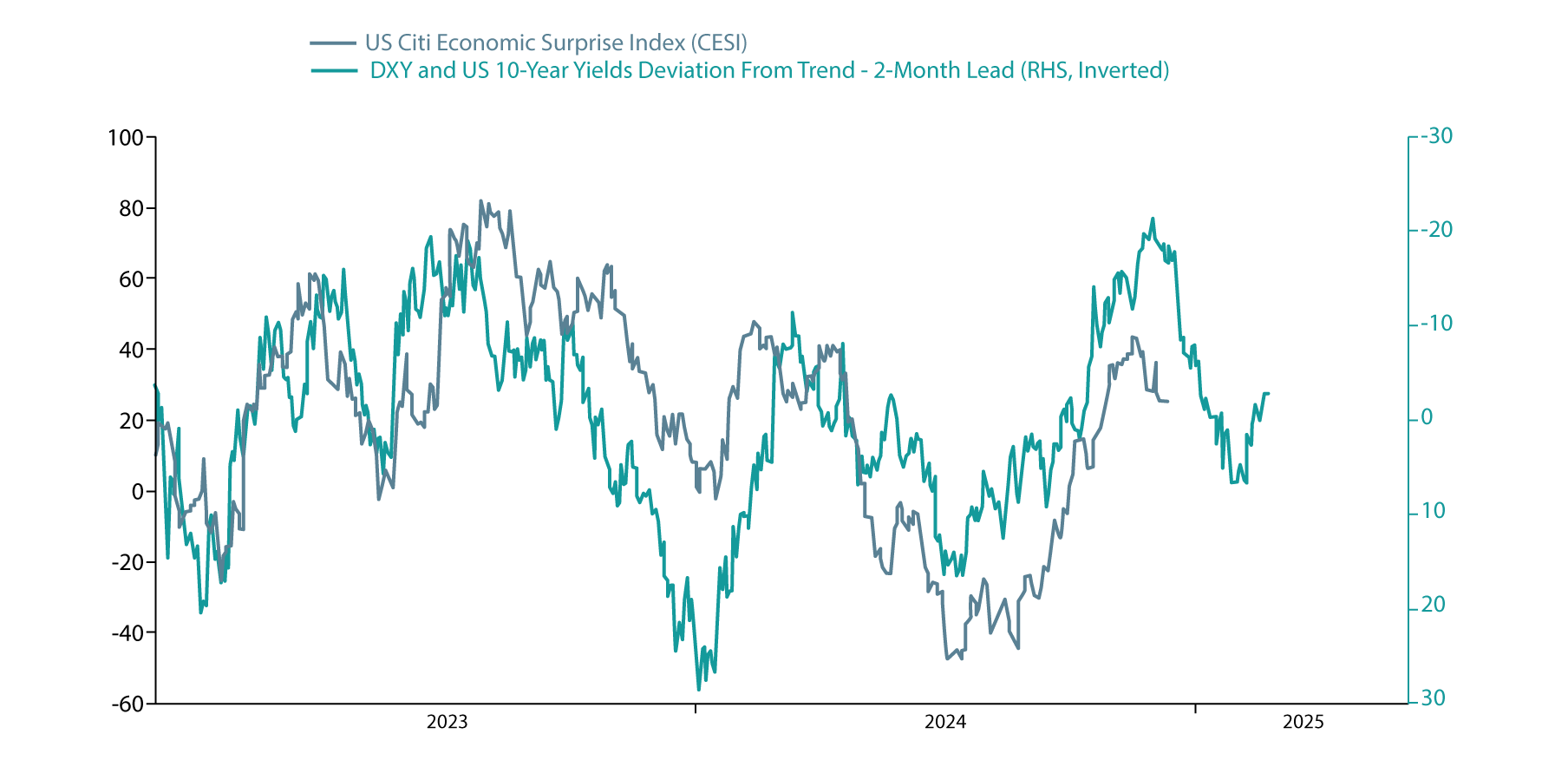

Recent US Dollar strength and higher US interest rates act as a handbrake on both stock market progression and for that matter the wider economy. These could well precede a period of disappointing economic data which could arrive sooner rather than later.

In fact, having avoided longer dated fixed income exposure for some time now, the risk reward of building exposure to longer term government bonds is becoming very attractive once more, just as the opposite can be said for equities. A more defensive portfolio posture makes sense in the interim, whilst we want for a new administration to increase the liquidity provision once more.

Figure 8: US Dollar, 10 Year Yields and US Economic Citi Surprise Index

Asset Allocation Outlook

| Asset Class | Short-Term | Medium Term |

| Equity Markets | December’s volatility perhaps precedes a continued corrective period for stock markets. The more economically sensitive sectors such as transports, basic materials and mining companies are already significantly lower than their election sugar rush highs. | We would expect several trading opportunities in 2025, whereby large corrections create significant buying opportunities. It will be interesting to see if Tariff Talk initiates the first of them. |

| Corporate Bonds | Corporate spreads are at all time lows, and offer little margin for error at these prices. | A slowdown would be more garden variety, rather than a balance sheet recession suggesting a reset rather than structural dislocation of the market. |

| Government Bonds | A spate of economic readings which come in below consensus is likely to cause risk assets to correct, and government bonds to rally. Bonds in the EU already reflect lower yields, but the US still offers good value as yields push towards their highs of 2024. | Extreme pessimism describes positioning in many government bond markets, and with lower nominal growth expectations for the medium term provide a good entry point once more in longer dated bonds. |

| Precious Metals | Having given up some of the YTD gains, gold has still returned circa 25% this year. We still believe this to be a healthy correction, providing a good entry point once more in the region of 2500 USD. | Gold continues to hold its own as more of a defensive, rather than cyclical asset. The run up into the election reflected concerns over the size of the fiscal deficit, and little urgency either side of the aisle to rein in spending. The appointment of a ‘hawkish’ new Treasury Secretary who has vowed to cut the deficit to size has taken the bloom of bullion’s rose for now. Silver has continued to consolidate and once the bull market resumes we would expect to take a leadership position once more. |

| Commodities | A rapidly deflating China has meant lower commodity prices generally across the board, as global manufacturing has also given little reason to rally. Trump’s ‘Drill Baby drill’ mantra possibly further increases the US’ importance as an energy exporter and keeps a lid on any supply concerns. |

Structurally, the sheer volume of copper for the electrification of the world would suggest better returns in the medium term than crude oil, being the hydrocarbons the world is seeking to exit. Ultimately, 2022 demonstrated what can happen when the energy markets are not in balance. Continued disinvestment from fossil fuels will ultimately put a significant bid in oil, as reserves dry up and supply with it. However, we see 50 USD oil before 100 USD as a higher probability at the moment. |

| Currencies | Short term long US Dollar positioning is extended and a correction overdue. If liquidity is slow to arrive, the world could see a more significant slowing and the Fed begins to cut aggressively, as would the ECB, BoE and BoC. But the Bank of Japan has less room to cut, and the Yen remains severely undervalued. |

Those interest rate differentials are going to move in favour of the yen, and the yen will likely strengthen. And so, our target for the yen for next year is 115 against the dollar, which does suggest quite a bit of upside for the yen. |

| Crypto | Bitcoin had broken above 100,000 USD only to give it up again in recent days. We anticipate this correction continues along with other equity markets. Ethereum, even whilst its transaction fees have dramatically dropped, has yet to break out to new highs along with Bitcoin. However, the Trump Presidency does seem to have removed one of the biggest risks it faced – namely the regulatory question mark – which seems to have been remedied now with a much more pro crypto Whitehouse. |

Bitcoin’s performance has been tracking early halving cycles although some indicators do suggest a shorter term top. Crypto tends to perform best in a stronger economic environment (when measures such as ISM are in expansionary territory), which they are not currently. We would expect ultimately that the new US administration to begin providing liquidity again to offset any material economic weakness. In fact, we would expect nothing less than Trump seeking to build a white-hot economy and in such an environment crypto would outperform all others. |

Concluding Thoughts

Games can conjure the illusion that we understand an (economic) system better than we do. They have historically been linked with divination, harbouring the notion that games can somehow afford predictions of the future. Whilst simulations maybe seductive, they usually do not translate into reality. Game theory, once a dusty corner of mathematics, now underpins much modern economic thought. But the vulnerability in games always finds root in the unpredictability of the individual actor – the human, company or government. Faced with brutish circumstances, any government may decide to retaliate in a manner that is not consistent with the ‘rules of the game’. We’re anticipating that politics, prejudices and priorities will provide consternation for investors in the upcoming twists and turns of any tariff spat.

We turn the page on this calendar year with rather unfavourable debt dynamics. Massive government spend has led to historic budget deficits, which leave little room to engage in material countercyclical fiscal policy should we see an abrupt economic slowdown. The consumer too may be tapped out in the short run, as pandemic savings have been largely eroded and delinquency rates on credit cards crimp personal borrowing capacity. Unemployment rises in these circumstances, and whilst it is a lagging indicator, we should expect a softer economic landscape in the near term.

That’s not to discard the potential for equity markets to post returns in the coming year. It is liquidity injections that drive markets – the question is who is picking up the tab and it may fall upon central banks again, rather than governments. The US economy has grown by approximately 2 trillion USD in Gross Domestic Product terms (GDP), yet the ‘deficit’ which is the difference in government income less receipts also tally to 2 trillion. So, there’s been little ‘real growth’, originating from the real economy, rather a transfer of cash from the public sector to consumers who have driven earnings of service companies higher – the ‘magnificent 7’ (Amazon, Meta, Microsoft and Amazon), would number in that group. That’s why companies more economically sensitive, for example, banking, manufacturing, transports have lagged until more recently. Elevated government spending will inevitably take a back seat, and new liquidity programs will be required from the US Federal Reserve, Europe’s ECB and China’s PBoC to prevent a more significant turn in the business cycle.

The investment implications are self-evident in the short term: the Fed will perhaps need to cut rates more quickly than currently priced in, given the recent reset in market’s expectations. Long dated government bonds, now underweighted by most investors offer compelling value. We do expect material equity market corrections in 2025, a much bumpier ride than its predecessor, but one which affords significant trading opportunities for those which are more nimble-footed.

Calling for a short sharp recessionary type dynamic is a bold call – it typically requires a spike in oil prices, or unexpected rise in interest rates or possibly a reason that global trade is curtailed with limited warning. Many attribute the 1930’s depression to the signing of the Smoot Hawley Bill, which derailed global growth in a hurry. Could it be so that after the turn in the New Year, Donald Trump ramps up the tariff rhetoric to a point that causes a major risk off moment? In seeking to gain an outcome against an adversary steeped in the rules of Go, a game that is characterised by relatively simply set of rules, yet leads to an incredibly complex set of dynamics.

ARIA Capital Management (Europe) Limited is authorised and regulated by the Malta Financial Services Authority, with Firm Reference number FEXS. A Limited Company registered in Malta No: C 26673. ARIA Private Clients is a trading name of ARIA Capital Management (Europe) Limited. Padraig O'Riordan and Paul Dee act as tied agents of ARIA Capital Management (Europe) Limited in Ireland.

ARIA CAPITAL MANAGEMENT

REGISTERED OFFICE:

Nu Bis Centre,

Triq il- Mosta Road,

Lija LJA 9012,

MALTA

ALL MATERIAL CONTAINED ON THIS WEBSITE IS PURELY FOR INFORMATION PURPOSES ONLY AND IS NOT INTENDED AS INVESTMENT ADVICE. INVESTORS SHOULD SEEK FINANCIAL ADVICE BEFORE MAKING ANY INVESTMENT DECISIONS. THE PRODUCTS AND SERVICES ARE MAY NOT BE AVAILABLE TO RESIDENTS OF ALL JURISDICTIONS. THE INFORMATION ON THIS WEBSITE DOES NOT CONSTITUTE AN OFFER FOR PRODUCTS OR SERVIES, OR A SOLICITATION OF AN OFFER TO ANY PRESONS OUTSIDE OF THE EUROPE WHO ARE PROHIBITED FROM RECEIVING SUCH INFORMATION UNDER THE LAWS APPLICABLE TO THEIR PLACE OF CITIZENSHIP, DOMICILE OR RESIDENCE. ARIA CAPITAL MANAGEMENT (EUROPE) LIMITED IS AUTHORISED AND REGULATED BY THE MALTESE FINANCE SERVICES AUTHORITY IN MALTA. THE PRODUCTS MANAGED BY ARIA CAPITAL MANAGEMENT (EUROPE) ARE TYPICALLY AVAILABLE VIA PROFESSIONAL ADVISERS, RATHER THAN INDIVIDUAL INVESTORS, WHO SHOULD NOT RELY ON THIS INFORMATION BUT CONTACT THEIR FINANCIAL ADVISER.

The investments underlying the Company and its sub-funds do not take into account the EU criteria for environmentally sustainable economic activities.

ARIA CAPITAL MANAGEMENT (EUROPE) LIMITED IS AUTHORISED AND REGULATED BY THE MALTA FINANCIAL SERVICES AUTHORITY (WWW.MFSA.MT), AUTHORISED ID: FEXS. MALTA COMPANY NUMBER: C 26673. REGISTERED OFFICE: Nu Bis Centre, Triq il- Mosta Road, Lija LJA 9012, Malta.

ARIA Capital Management (Europe) Limited Homepage Website terms of use

This website is not suitable for individual (retail) investors. If you are a retail investor, please contact your financial adviser.