Role Reversal

Role Reversal

INTRODUCTION

The storm clouds are gathering for 2022. After years of ultra-accommodative fiscal and monetary measures, policymakers have set their stall out, and look set to remove the punch bowl next year. At year end, markets face the prospect of at an accelerated tapering, rising Central Bank interest rates, and for those of a US inclination, what would portend to be a relatively austere mid-term election year. Unfortunately, by our lights, any correction would begin with US markets in particular approximately 30% overvalued.

Whilst we ultimately anticipate any correction would be:

a) medium term in nature and

b) doesn’t ultimately end the bull market, the odds of a 2022 bear market are in the ascendancy. This is premised on the following five considerations:

1. Inflationary pressures are becoming more entrenched – that is to say structural as housing costs rise

2. This could coincide with a growth slowdown in the H1 – OECD leading Indicators suggest so

3. Prices will remain firm for crude – there isn’t much spar capacity

4. Mid Term election years in the US are often weak

5. Valuations for stock markets are at elevated levels, even when we factor in bargain basement interest rates

ASSET ALLOCATION HIGHLIGHTS:

• Whilst trillions on pandemic stimulus continue to slosh through global economies, central banks have begun a new interest rate tightening cycle.

• We expect continued underperformance of those recent darlings of the stock markets – those with limited earnings and high sensitivity to liquidity conditions.

• We are well overdue a ‘geopolitical’ event and there are any number of pockets of tensions which could become the catalyst.

• Equities could well form a large trading range, with opportunities to build exposure again after significant set backs.

• We cannot see any reason that the emergent bull market in commodities provides continued outperformance, even if prices retrace during an first half economic slowdown.

KEY MARKET THEMES

Ever since the pandemic, the current bull move in equities has been highly reliant on the generosity of central banks and fiscal spend of governments. However, the era of free money appears to be on borrowed time – at least for a cyclical interlude. The US Federal Reserve has brought forwards the end of its QE initiatives (from June to March), and an accelerated ‘tapering’ or reduction in the asset buying that central banks have engaged with paves the way for earlier interest rate hikes than current priced in.

Perhaps 2018 provides a comparable backdrop. Valuations were stretched at that point and the Fed were also raising interest rates. A review of the performance league table of asset classes then could be revealing: equities, bonds and commodities were ultimately down on the year – even the irrepressible Bitcoin. Ultimately, all asset classes fared poorly. However, the Fed pivot, i.e. when central banks decided to turn tail and begin easing once more, led to a significant rebound in performance. In that light, perhaps the year end returns of 2022 will be determined by whether interest rate rises end within the calendar year, or continue throughout it unabated.

What the last decade or so has evidenced without doubt is that money printing inflates asset prices. Whilst liquidity is abundant, the most speculative asset classes will outperform, such as cryptocurrencies and technology stocks, and those companies that would be considered more ‘value orientated’, i.e. lower growth potential, perhaps dividend paying, will lag. WE expect 2022 though, to be one a role reversal, whereby value assets, such as commodities, miners, financials and oil and gas related investments take pole position in the performance tables, as liquidity conditions tighten.

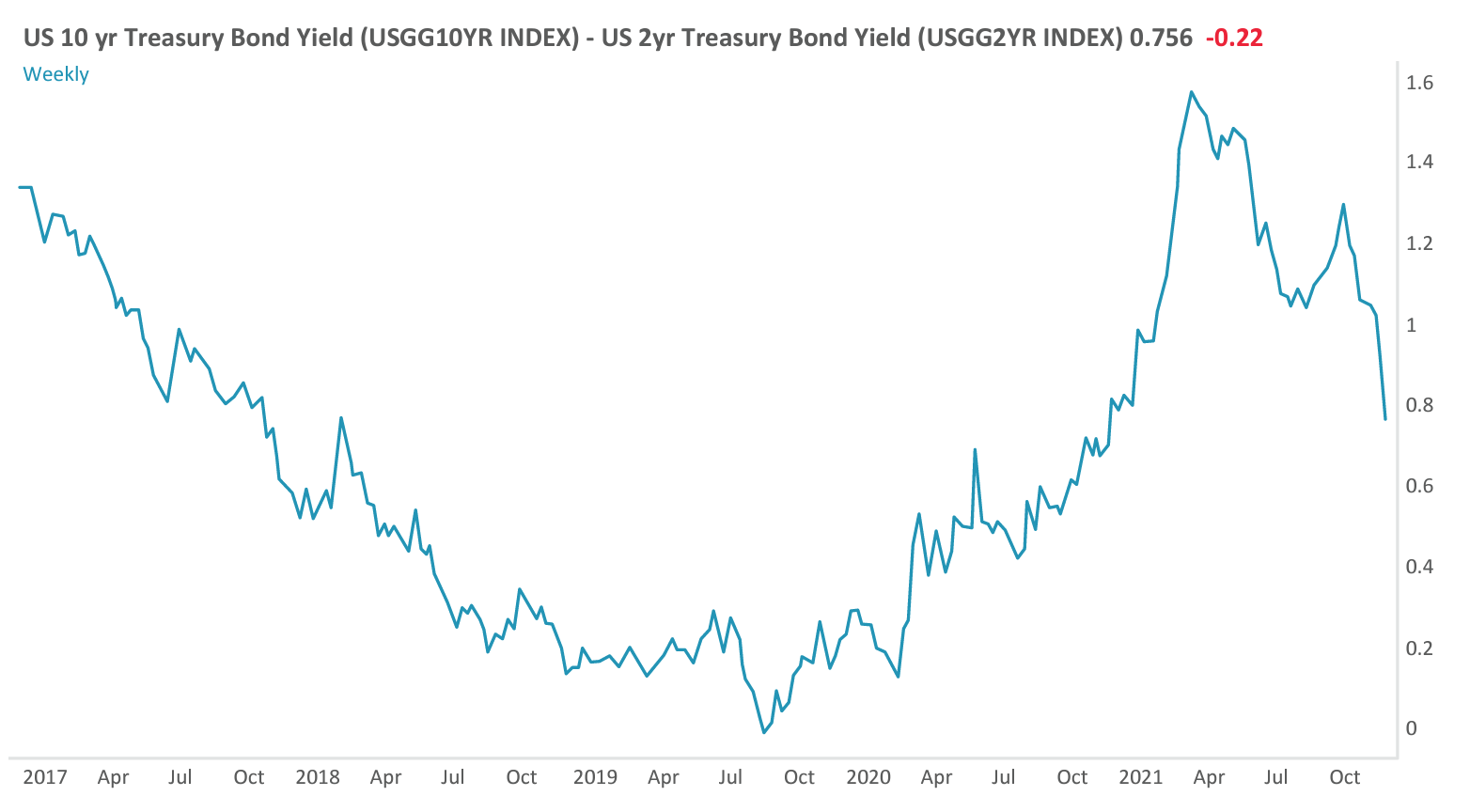

Clearly, no two market cycles are the same though. In 2022, a new interest rate rising cycle will likely begin when the yield curve has already peaked. The yield curve shows the interest rate differential between short term rates (such as short term bonds, money market instruments) and longer term government bonds such as those of the 10 or 30 year variety.

What is the message that the bond market is sending? Whilst inflationary pressures seem to becoming less ‘transitory’ and more likely a much more enduring consideration, and economic growth is strong, longer term interest rates are falling, which seems inconsistent with the anticipated interest rate hikes and strengthening global macro-economic picture.

One conclusion we can draw is that investors are looking through the near term, and believe that as financial conditions tighten it will cause a slowdown, which will naturally curb inflationary pressures. The bond market is suggesting it will be problematic for central banks to tighten policy as anticipated, and increase interest rates by 100 basis points or more. By our lights the fate of asset prices next year, will be highly dependent on the course of interest rates. Stock markets can usually absorb several rate hikes as economies strengthen. What would be more difficult to digest would be central banks forced into raising interest rates beyond which they have telegraphed, because whilst the economy may have cooled, prices have remained sticky and inflation continues to trend above expectations.

As we have begun to see, those sectors that are the most interest rate sensitive are struggling. For companies which are loss making, but trade on elevated expectations such as fintech or many of the ‘innovation’ stocks much vaunted in recent times, without access to cheap and plentiful liquidity, face severe headwinds when credit conditions begin to tighten.

However, all is not lost. Whilst aggressive central bank tightening will be bearish, history shows that following the first interest rate hike from the Federal reserve, markets typically perform well over the coming twelve months.

ASSET CLASS VIEWS

Equities

• As we stand, many markets are showing poor ‘breadth’ in recent weeks. That is to say the number of companies in indices that are still trending up is falling. After the big GFC rebound, stock markets also faltered whilst the initial round of stimulus was removed.

• Stock market fortunes will be highly correlated with inflation. If prices continue to trend up, and do not soften as many hope, central banks may be forced to raise rates more than is expected, which will be difficult for stock markets to tolerate.

Bonds

• To date, globally bonds have been firm, even as inflation worries rise.

• As alluded to above, as credit conditions tighten, medium term corporate bonds and high yield may see some turbulence, even as long term government bonds hold their own.

• Many emerging markets have already witnessed significant tightening cycles – i.e. several rate hikes already, and maybe surprise outperformers.

Commodities

• Crude Oil’s swift decline over the last couple of weeks is likely a shorter term pause – as OPEC+ has increasingly less spare capacity, prices will remain firm. Oil and gas stocks will continue to outperform in the short term.

• Gold continues to build support and could easily attract greater attention as a safe-haven during a broader stock market decline. Silver remains attractive given its industrial applications and potentially inflationary hedging capabilities.

• Agricultural commodities remain one of the most attractive asset classes in our view. The global supply picture has been hampered by Brazilian frosts, French floods and prices will track any increases in input prices such as fertilisers.

Currencies

• The Bloomberg Dollar Index remains in a consistent uptrend, which also portends rising risk aversion.

• As the US Dollar has strengthened, Sterling has been weaker in recent times, but there seems to be a Bank of England commitment to higher interest rates, and moving first could give GBP a bid.

• Within the EM FX space, (Lat am) commodity currencies should continue to perform well (including those of developed nations too being CAD/NOK and AUD), but any growth slowdown we would expect to see more cyclical currencies such as the Korean Won be priced lower.

CONCLUSION

The year ahead appears to have more obstacles in its way than we have faced since the beginning of the rebound in April 2020. There is a substantial risk of ‘policy error’, namely that central banks raises interest rates too aggressively and sew the seeds of the next recession. However, aggressive tightening may be a difficult choice they are compelled to make, should inflationary pressures become a more permanent trend that does not seem to abate.

Many of the issues that contributed to inflation were already likely to moderate next year. However, the new COVID variant appears to be much more transmissible than its predecessors and it remains unknown whether it is likely to incur serious symptoms.

We expect one, if not two very noticeable corrections in markets next year – which for the more nimbled footed investors, should provide good buying opportunities. However, we also believe it will be fertile ground for active managers – that’s to say not overstaying one’s welcome and being prepared to take profits when they arise during the year too. Overall, we expect a continuation in the rotation out of ‘growth’ or the more fashionable names of the last 18 months, into real asset related investments, including precious metals, which is due its moment in the sun once more.

DISCLAIMER

This communication is from the ARIA SICAV, which is, as well as the above referenced sub-fund in Malta and regulated by the Malta

Financial Services Authority. Prospectus, annual report etc. are available free of charge from Fexserv Fund Services (Malta) Ltd. The Hub, Triq Sant ’Andrija, San Gwann, SGN 1612 Malta.

The information in this marketing communication does not constitute an offer, solicitation or recommendation for the purchase or sale of

any securities or other financial instruments nor does it constitute advice of any kind, whether in relation to legal, compliance, accounting,

regulatory matters or otherwise, a personal recommendation (as defined by the rules of the Financial Conduct Authority, or otherwise or an

expression of our view as to whether a particular financial product is suitable or appropriate for you and meets your financial or any other

objectives.

This document does not create any legally binding obligations on the part of ARIA and/or its affiliates. It is not intended for distribution or

use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication or use would be

prohibited. All recipients are (a) persons who have professional experience in matters relating to investments falling within Article 19(1)

of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (b) high net worth entities, and other

persons to whom it may otherwise lawfully be communicated, falling within Article 49 (1) of the Order (all such persons together being

referred to as “relevant persons”).

The Fund may neither be offered for sales nor sold in the USA, to US Persons or persons residing in the USA. The Fund mentioned herein

may not be appropriate for all investors and before entering into any transaction you should take steps to ensure that you fully understand

the transaction and have made an independent assessment of the appropriateness of the transaction in the light of your own objectives and

circumstances, including the possible risks and benefits of entering into such transaction. Please refer to the relevant fund’s full prospectus

and the relevant Key Investor Document for more information on the Fund which is available in English on request or on ariacm.com.

The information contained in this document is believed to be correct, complete and accurate and every effort has been made to represent

accurate information. However, no representation or warranty, expressed or implied, is made as to the accuracy, completeness or

correctness of the information contained in this document. ARIA assumes no responsibility or liability for any errors or omissions with

respect to this information. The information contained in this document is provided for information purposes only. In the case of any

inconsistency with the relevant prospectus of a product, the latest version of the prospectus shall prevail. This material contains results

that are simulated. Returns of the strategies/indices prior to their launch date represent simulated results based on historical data and

retroactive application of a model designed with the benefit of hindsight. Simulations are based on a number of working assumptions

that may not be capable of duplication in actual trading. Simulated performance results have certain inherent limitations. Unlike an actual

performance record, simulated returns do not represent actual trading. Also, since the trades have not actually been executed, the results

may have over or undercompensated for the impact, if any, of certain market factors such as liquidity constraints, fee schedules and

transaction costs. No representation is being made that future performance will or is likely to achieve profits or losses similar to those

shown.

ARIA CAPITAL MANAGEMENT

REGISTERED OFFICE:

Nu Bis Centre,

Triq il- Mosta Road,

Lija LJA 9012,

MALTA

ALL MATERIAL CONTAINED ON THIS WEBSITE IS PURELY FOR INFORMATION PURPOSES ONLY AND IS NOT INTENDED AS INVESTMENT ADVICE. INVESTORS SHOULD SEEK FINANCIAL ADVICE BEFORE MAKING ANY INVESTMENT DECISIONS. THE PRODUCTS AND SERVICES ARE MAY NOT BE AVAILABLE TO RESIDENTS OF ALL JURISDICTIONS. THE INFORMATION ON THIS WEBSITE DOES NOT CONSTITUTE AN OFFER FOR PRODUCTS OR SERVIES, OR A SOLICITATION OF AN OFFER TO ANY PRESONS OUTSIDE OF THE EUROPE WHO ARE PROHIBITED FROM RECEIVING SUCH INFORMATION UNDER THE LAWS APPLICABLE TO THEIR PLACE OF CITIZENSHIP, DOMICILE OR RESIDENCE. ARIA CAPITAL MANAGEMENT (EUROPE) LIMITED IS AUTHORISED AND REGULATED BY THE MALTESE FINANCE SERVICES AUTHORITY IN MALTA. THE PRODUCTS MANAGED BY ARIA CAPITAL MANAGEMENT (EUROPE) ARE TYPICALLY AVAILABLE VIA PROFESSIONAL ADVISERS, RATHER THAN INDIVIDUAL INVESTORS, WHO SHOULD NOT RELY ON THIS INFORMATION BUT CONTACT THEIR FINANCIAL ADVISER.

The investments underlying the Company and its sub-funds do not take into account the EU criteria for environmentally sustainable economic activities.

ARIA CAPITAL MANAGEMENT (EUROPE) LIMITED IS AUTHORISED AND REGULATED BY THE MALTA FINANCIAL SERVICES AUTHORITY (WWW.MFSA.MT), AUTHORISED ID: FEXS. MALTA COMPANY NUMBER: C 26673. REGISTERED OFFICE: Nu Bis Centre, Triq il- Mosta Road, Lija LJA 9012, Malta.

ARIA Capital Management (Europe) Limited Homepage Website terms of use

This website is not suitable for individual (retail) investors. If you are a retail investor, please contact your financial adviser.