Quad Regime Investing

Considering the Alternatives: Navigator Approach to Portfolio Management

How best to protect and grow wealth? The conventional approach is to diversify an investment sum across certain asset classes – both defensive and growth orientated, such as equities and bonds. We’ve spent the last 15 years considering the optimal means of doing so, across a range of economic scenarios.

Our portfolios are well known to have stood up very well indeed to the vicissitudes of 2008 – some of our clients even seeing positive returns when many benchmarks had lost half of their value. However, in order to do so, that required an approach to asset allocation that draws upon other strategies or asset classes that thrive in challenging environments. Just last year, in 2022, the traditional asset allocation of 69% in equities and 40% in bonds was called into question again, when bonds did not perform as a defensive asset class as required to do in market set backs.

When savings and investments fundamentally alter the course of our lives – be that retirement plans, or providing for children, the promise of diversification needs to deliver just that, reduce risk for a given level of return when global markets are confronted by headwinds. That is why we have spent years consistently considering and refining an approach we hope will deliver diversification properties that are robust, and hold up when circumstances require them to do so.

Diversification then, has two principal aims:

- To generate sufficient portfolio at a future date: that is to say maximising the long term growth potential of a portfolio for a given level of risk;

- Ensuring sufficient pool of assets in the interim: that is to say enough monies to cater for unexpected life events – a unexpected illness, a health emergency – perhaps even a pandemic induced loss of employment;

Even in 2008, portfolios diversified across equities, bonds, commercial property, real estate and commodities did not have the resilience that may have been expected. Effective diversification then needs to look beyond those traditional sources of return – and risk.

Brownian Motion

We consistently research the means to improve upon approaches that have wobbled when needed most. One of the prices of research we had historically come across, and sought to improve upon, was originally designed in the 1970’s by (at that point), a little know finance professional in the US called Harry Browne.

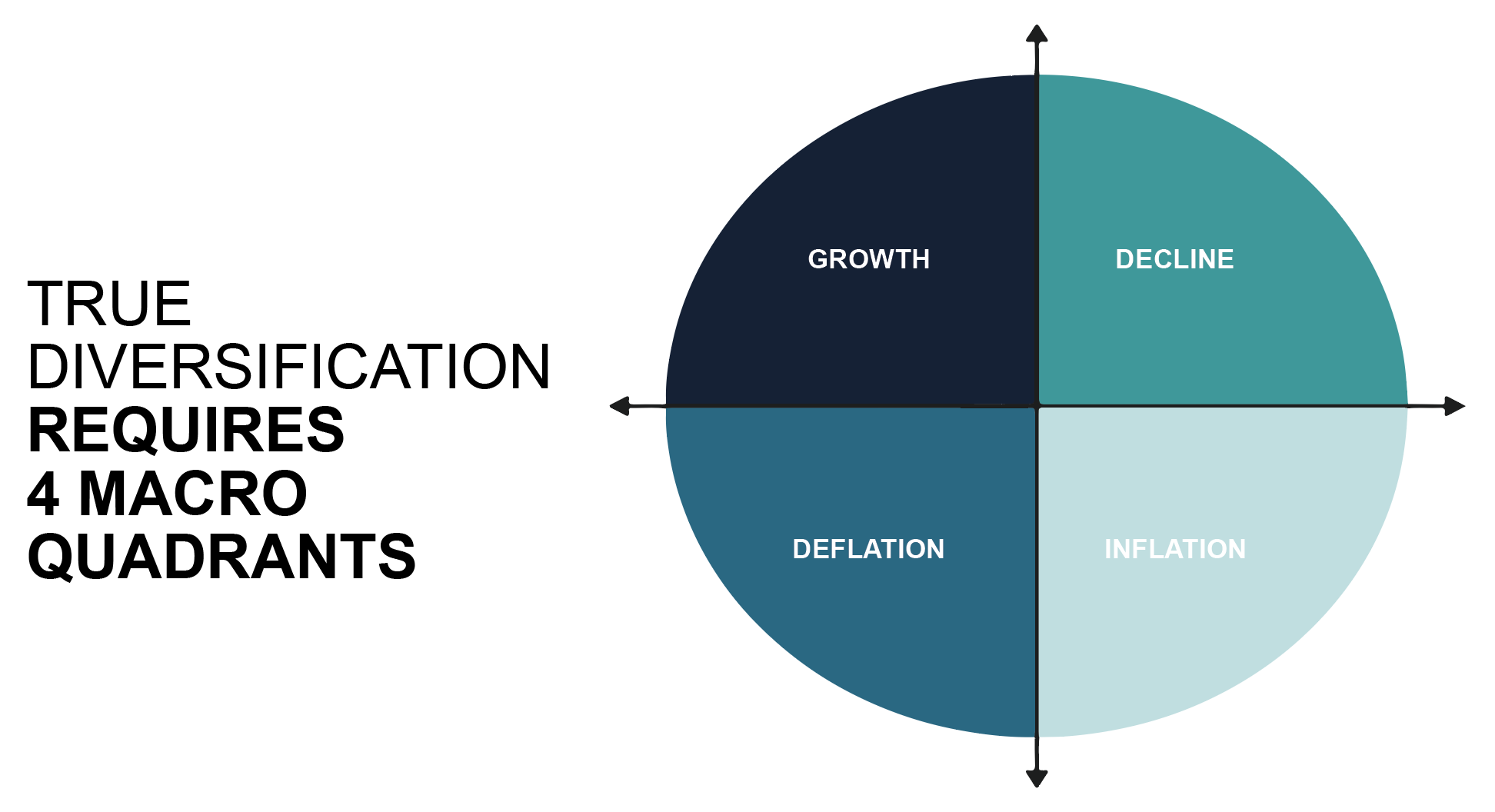

Browne had a different starting point that many other investors. Initially, he sought to define four different economic scenarios; growth, recession, inflation and deflation.

Chart 1: All Terrain Approaches Consider 4 Separate Macro Regimes

These four quadrants or regimes are appropriate because any period of recorded economic history can broadly be described by one of the four economic circumstances. We have found that more traditional approaches are very well suited to two of these environments, but do not necessarily cater for the other two.

The traditional 60/40 portfolio, which comprises 60% in equities and 40% in bonds, does well in growth environments, as the equities benefit, or slowing growth with low inflation or deflation. However, there’s good reason why much of the industry is dominated by this approach to portfolio construction. For long periods of history it has performed very well indeed – specifically 1980-1999 or 2010-2019 – and certainly outperformed most other approaches during those time periods. However, those periods did not necessarily require the more defensive qualities of the portfolio to perform, and were characteristed by either growth or disinflationary economic scenarios.

Unfortunately, until last year, many investors have yet to witness sustained deflationary or inflationary periods – two other quadrants that have dominated investing environments such as the lates 40’s and 70’s, but have been conspicuous by their absence in more recent times.

That’s where Harry Browne’s work comes into its own – it has an asset allocation that has historically stood up well in all regimes – all four quadrants – rather than just those where the going is good.

A question of perspective:

Harry Browne’s approach to portfolio construction was conceived with a very different historical perspective. Adjusting for inflation, the S&P peaked at 810 in November, 1968, fell 63% to 300 by 1982. In the UK, in the early 1970’s, the FTSE 100 fell by 67% over two year and four months. Bonds did not provide the ballast that portfolios would have hoped for, they fared poorly in an inflationary environment.

Therefore, considering the tools at his disposal, and the need to build a portfolio that could address all four economic outcomes, he sought to add two ‘defensive’ assets to the traditional mix. His portfolio was equal weighted, and positioned for all four macroeconomic regimes:

The ‘growth’ component includes:

25% in equities which perform well in growth environments;

25% in bonds which perform well in deflationary environments;

However, he also allocated to more ‘defensive’ assets to his mind:

25% in Cash which does well in a recession;

25% in Gold which fares well in inflationary periods;

In doing so, Browne’s approach meant significant outperformance of the more well know 60/40 equity / bond mix. He called it the Permanent Portfolio – permanent being a reference to its design for perpetuity, whether the investment horizon be for 10 years or 100. It is not an attempt to forecast future economic developments, rather one to be ready for whatever comes.

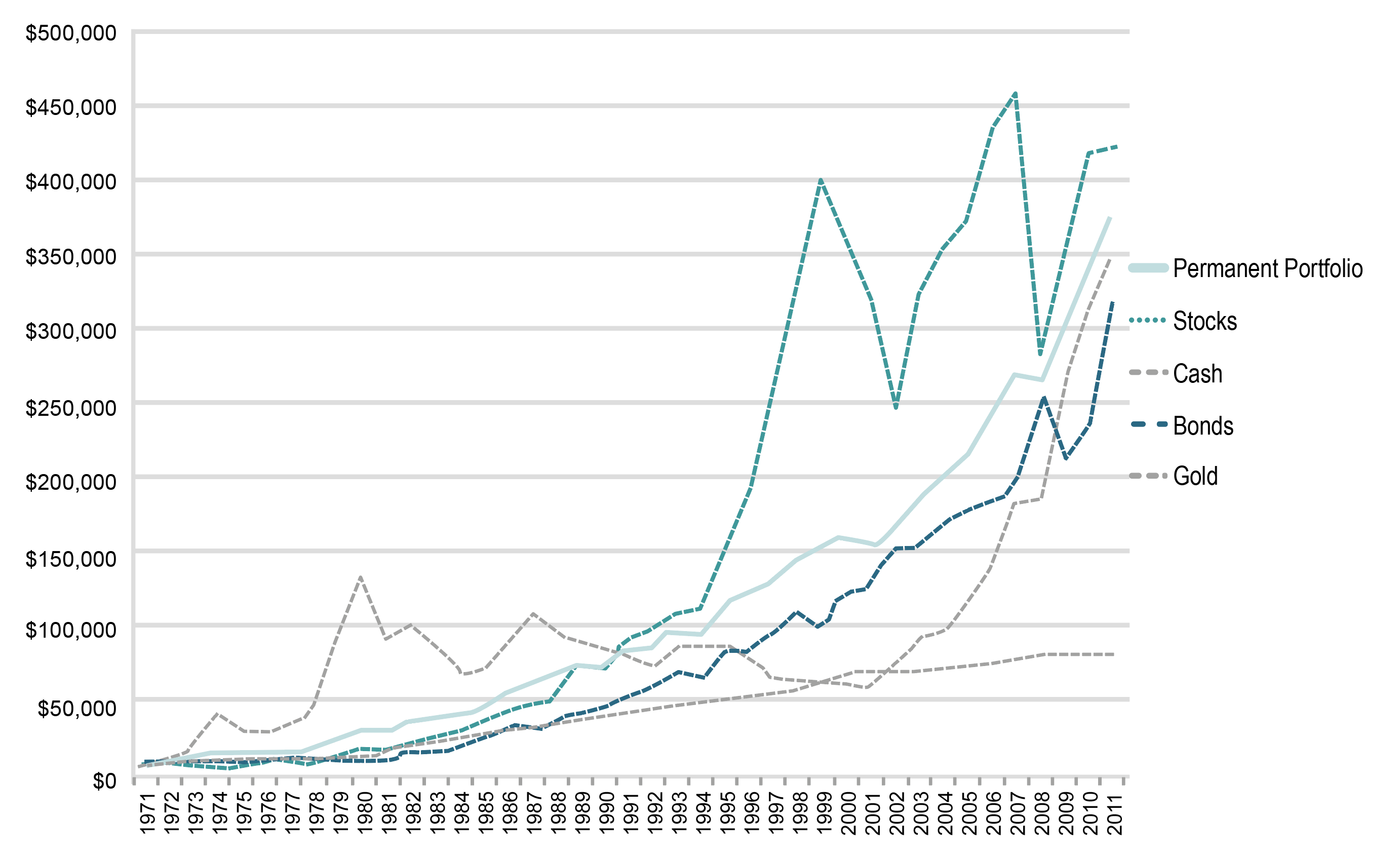

In our own studies, we have found that from 1970 to 2022, an equally weighted portfolio to international equities, bonds, gold and cash returned circa 9% per annum, (on a gross basis), with a maximum peak to trough fall of xx %. And just as importantly, 93% of all rolling 12 monthly returns delivered positive nominal returns.

Though the returns do not match those of a portfolio of exclusively equities, which returned xx% annualised over the same period, the maximum drawdown was nearly two thirds less (18% versus 66%). It is also worth of note that this review period includes 1980 to 1999, the best two decade period for stock market returns in the last century.

Therefore, we certainly consider that Harry Browne’s work was a step in the right direction – that where the ultimate objective is to delivery robust, reliable returns over a longer term horizon. During any 40 year period, markets will experience all four conditions – recession, growth, inflation and deflation.

Chart 2: Permanent Portfolio Approach Stands the Test of Time

As the chart above shows, compared to any single investment, the growth curve is comfortingly smooth, suggesting that we would be well set to address any of the unexpected events that life throws at us.

A Portfolio with Brakes

Diversification is supposedly the one ‘free lunch’ in investing. The premise being that by combining individual asset classes that in themselves are inherently volatile, when held alongside each other, reduce the volatility of the combined portfolio. To our mind then, diversification should be ‘effective’. One of the key takeaways from Harry Browne’s work is that by holding four assets that perform well in each possible economic scenario, and then rebalancing, we can create greater stability in rolling returns.

As the global economy cycles through different periods of stock market rises, geo political crises, recessions and black swans, each asset has their moment in the sun. As each asset has performed well, profits and then harvested and redistributed to the assets have underperformed, but now can be anticipated to have a period of more promising returns.

Harry Browne pioneered an approach that has been able to evidence defensive characteristics – both in recessionary periods and times of inflationary shocks.

However, that’s not to say time has stood still since the 1970’s. Had Harry undertaken his work today, he may well have looked to benefit from some of the tools that would have been at his disposal forty plus years later.

The Perpetual Portfolio: Harry Browne’s work updated

The quadrant or regime approach to investing has been gaining popularity with the investment industry as famed investors have taken on the approach and delivered robust returns. Ray Dalio and Bridgewater Associates run such an approach and consequently the largest hedge fund in the world. Meb Faber followed a similar path and included additional assets/strategies (such as momentum and value factors), within each of the four asset class exposures.

Artemis Capital developed the Dragon Portfolio, drawing on data that went back to the 1920’s and determined the asset allocation that had been the only one that survived every decade of the last century. (The Depression and Great Wars took a terrible toll of bond markets).

The Navigator portfolios operate in a similar vein. Drawing on Harry Browne’s seminal work, we have sought to improve certain aspects of it. For example, historically leading into recessions, the Permanent Portfolio still has still suffered drawdowns. During the last 10 years or so, strategies which benefit from more volatile environments, (namely volatility related strategies), have become more widely available. So whilst having a healthy cash weighting dampens portfolio volatility during downturns, an allocation to volatility strategies can actually increase in value, offsetting losses elsewhere.

Perhaps more importantly, the value of those gains (when considered in monetary terms) are even more valuable when there can be harvested after significant falls in stock markets, because those gains can then be harvested and re allocated at very attractive prices.

The challenge of course is gaining access to those long volatility strategies. Whilst readily available to institutional investors, for retail clients gaining exposure to such insurance policies is not easy, although increasingly liquid retail funds and exchange traded funds permit just that. Investors can benefit from access to institutional quality volatility or insurance policies, which pay off when markets are under duress, whilst having the comfort of being invested into a highly liquid investor fund or ETF, which is UCITS 5 compliant which means the highest standard of retail client protections.

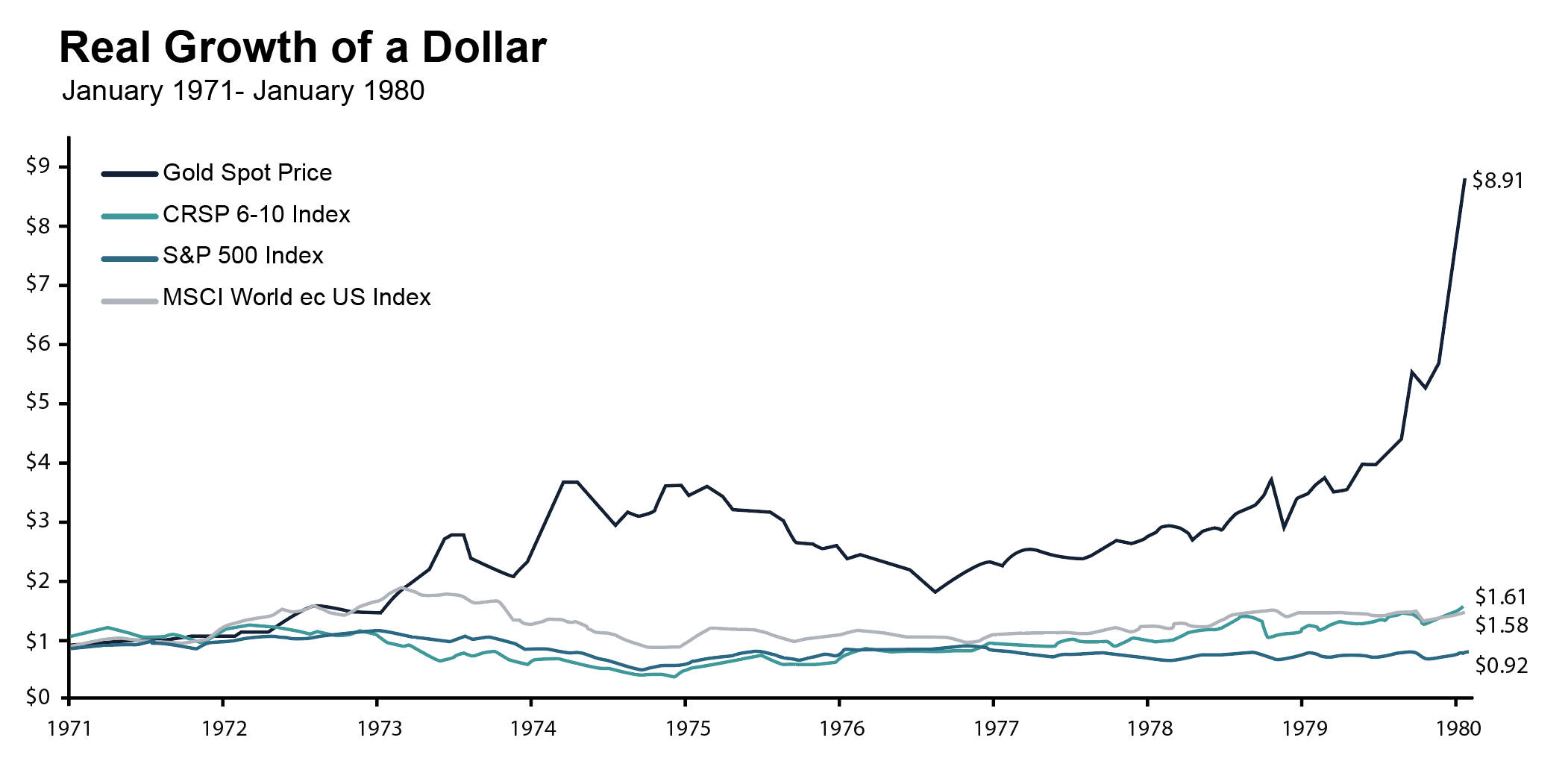

The second improvement we felt we could make related to the reliance on Gold to perform in both inflationary environments and extended recessionary periods. To our minds, and we believe Gold deserves a place in any portfolio (see ‘In Gold We Trust here), it is a chameleon asset. It often performs in reflationary environments, or at the onset of recession as it anticipates a fall in interest rates, but often underwhelms during periods of heightened sustained inflation or drawn out recession.

For example, the below charts show how Gold did well during the 1970’s but underperformed during the early 1970’s when equities markets struggled, yet gave up ground whilst markets saw something of a recovery during the middle of the decade.

In that sense, we have found by adding commodities as a basket – but specifically commodity trend strategies, could address both aspects. During inflationary periods it is often pricing pressures that are rooted in rising food prices, which by definition are a consequence of rising soft commodity prices – wheat, soybeans, sugar, cattle – all commodity exposure available to commodity trading strategies.

Secondly, by virtue of the directional positioning of commodity trend strategies (when commodities trend up such strategies are positioned for rising prices, and conversely revert to benefit from falling prices as they trend down), performance can be very strong during recessionary periods or extended bear market.

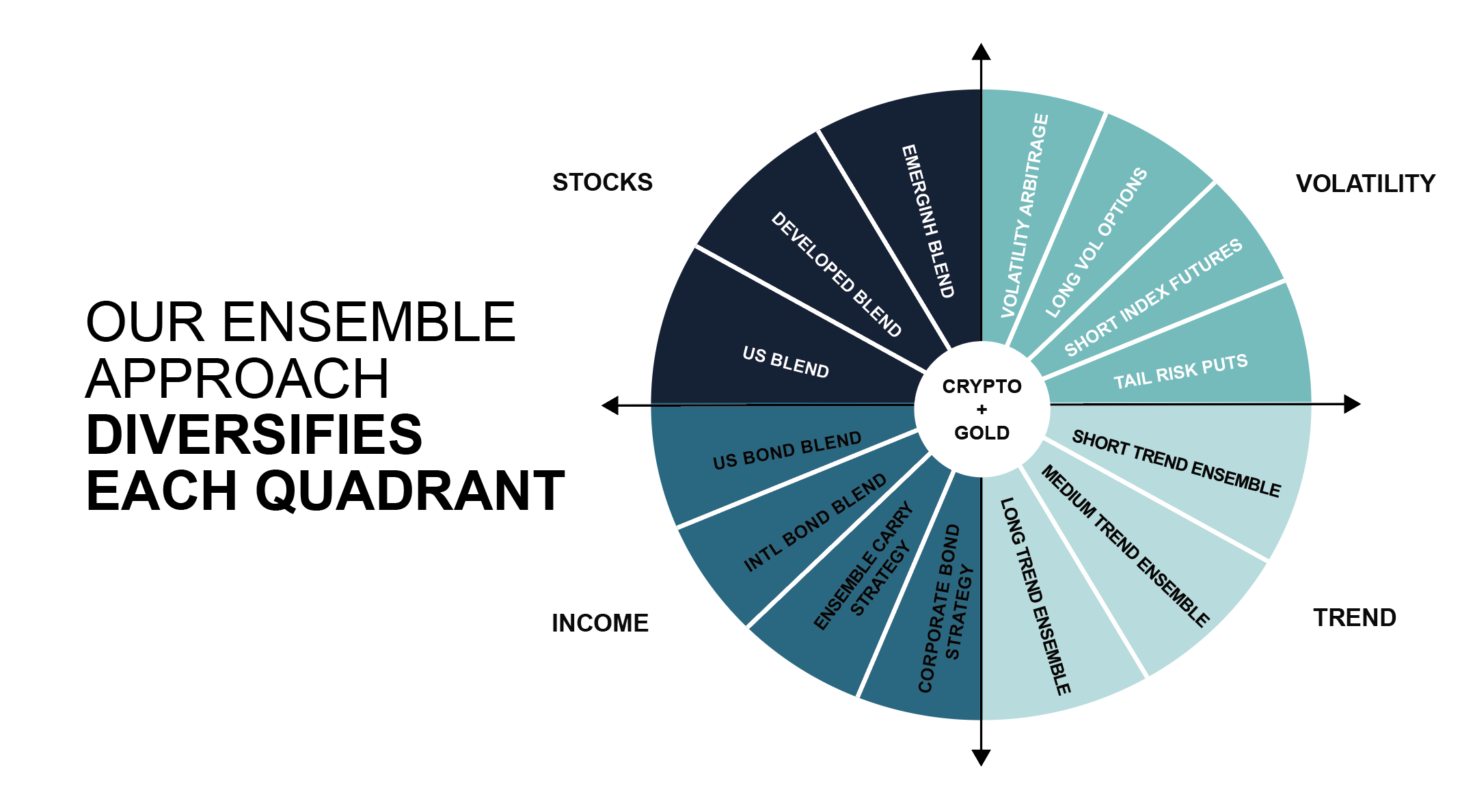

By including equities, bonds, three different trend strategies and three different volatility strategies, we diversify within each of the four macro regimes too – always looking to improve the risk return profile of the portfolio, i.e. minimise the volatility of returns for a given level of risk, or improve how robust the portfolio is.

Summary:

Therefore, the suite of Navigators portfolio seeks to we have sought to improve upon traditional asset allocations in three ways:

- Diversification by macro-economic regime, not just asset class;

- Layered diversification within each asset/quadrant – both asset classes and strategies

- Adding non correlated long volatility or insurance positions from trading strategies

Comparing the Perpetual Portfolio to the traditional asset allocation:

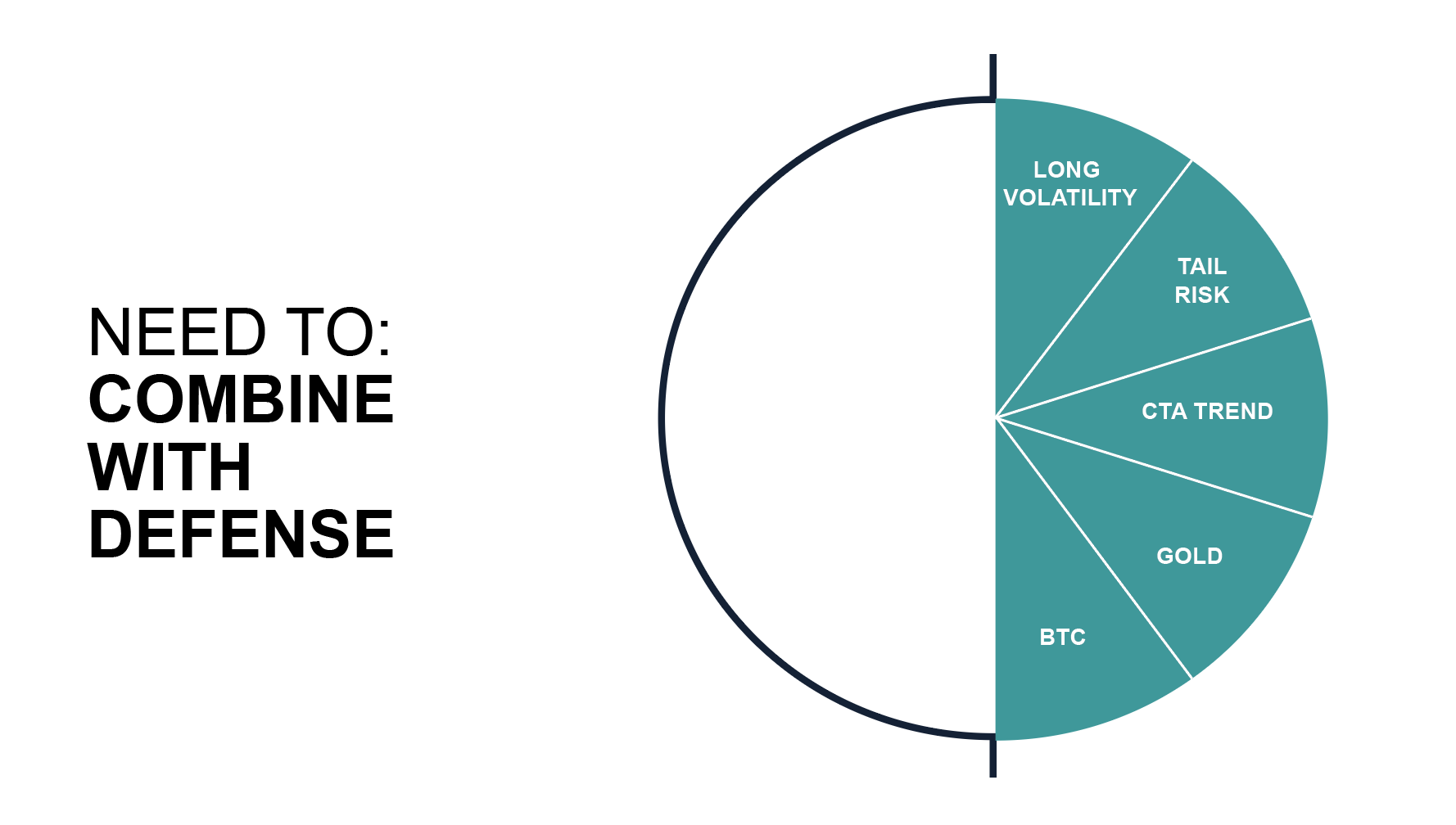

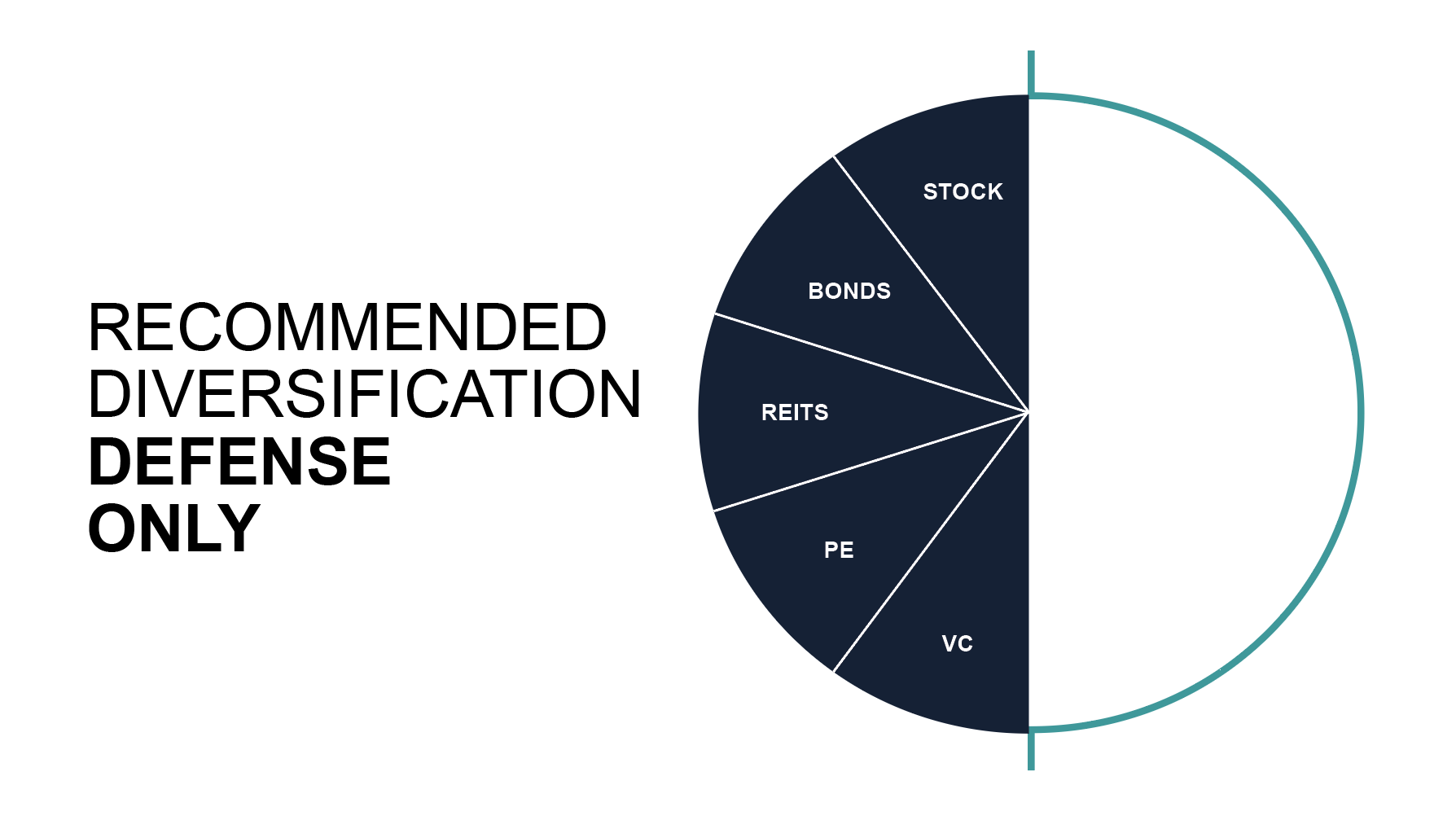

Harry Browne’s work ultimately alluded to the fact that traditional portfolios are perhaps over invested in growth assets – equities, bonds, commercial real estate, private equity, and insufficiently allocated to strategies that retain their defensive properties during times of market turmoil – that’s to say gold, commondity trend and volatility.

Traditional Diversification:

Perpetual Portfolio:

Returning to the four macro regimes, we can see how:

Equities perform in ‘growth’ environments:

Ultimately earnings are the long time drivers of stock market returns. As economies grow, so do the earnings of companies, which drive their stock prices higher.

Income performs during deflation:

As deflation conditions persist, typically asset values fall – be that shares, bonds or even property. Deflationary periods also bring lower interest rates, as the demand for credit or to borrow dries up, which means income streams are worth more. An bond that pays 7% is worth more when interest rates are 3%, than when interest rates are at 6%.

Volatility Shines during Recession:

Volatility moves inversely to asset prices. As stock markets fall, particularly when in a dramatic fashion, volatility and related strategies go up. Recessions often bring negative eranings surprises from companies, leading to stock market declines and increases in volatility related strategies.

Trend Strategies do well in inflationary periods: Inflation by definition is either driven by or contributed to increases in commodity prices. As the recent ‘cost of living’ crisis has shown all too well, rising energy prices have increased household utility bills, which is reflected in the consumer inflation numbers. Therefore, exposure to commodities and commodity trend strategies makes sense to guard against times of elevated prices.

Research Led Portfolios:

We have always sought exposure to ‘insurance policies’ for our portfolios, or brakes that can reduce volatility. This is because we fervently believe the key to outperformance over the long term, is to minimise the setbacks in portfolio values. Put simply, with a loss of 30%, an investor needs a gain of about 43% to recover. With a loss of 40%, investors need a gain of about 67% to recover. The Navigator portfolios are designed to stand up to all fall macro economic regimes, which means incorporating commodity trend strategies and importantly volatility exposure to mitigate sudden falls in asset prices.

There are no guarantees in investing, however, our longer term research suggests that we have transitioned into a macro-economic regime that is structurally different to that of the last 40 years. Globalisation, huge advances in technology had pathed the way for falling inflationary pressures and therefore persistently low interest rates. In fact, as interest rates become negative we would argue that we have seen a generational low in them. These conditions are the most fruitful for ‘growth assets’ – equities and bonds. However, growing geo political unrest, re-shoring of supply chains and structurally higher inflationary pressures suggest a very different outlook for the coming decade or so. In that respect, having a portfolio is that is an allrounder’, and holds investments that can ride out all four quadrants, and potentially even benefit from the inflationary and recessionary macro periods, in we believe will be pivotal to strong risk adjusted returns going forwards.

Latest from Featured Strategies

Latest from Featured Strategies

ARIA CAPITAL MANAGEMENT

REGISTERED OFFICE:

Nu Bis Centre,

Triq il- Mosta Road,

Lija LJA 9012,

MALTA

ALL MATERIAL CONTAINED ON THIS WEBSITE IS PURELY FOR INFORMATION PURPOSES ONLY AND IS NOT INTENDED AS INVESTMENT ADVICE. INVESTORS SHOULD SEEK FINANCIAL ADVICE BEFORE MAKING ANY INVESTMENT DECISIONS. THE PRODUCTS AND SERVICES ARE MAY NOT BE AVAILABLE TO RESIDENTS OF ALL JURISDICTIONS. THE INFORMATION ON THIS WEBSITE DOES NOT CONSTITUTE AN OFFER FOR PRODUCTS OR SERVIES, OR A SOLICITATION OF AN OFFER TO ANY PRESONS OUTSIDE OF THE EUROPE WHO ARE PROHIBITED FROM RECEIVING SUCH INFORMATION UNDER THE LAWS APPLICABLE TO THEIR PLACE OF CITIZENSHIP, DOMICILE OR RESIDENCE. ARIA CAPITAL MANAGEMENT (EUROPE) LIMITED IS AUTHORISED AND REGULATED BY THE MALTESE FINANCE SERVICES AUTHORITY IN MALTA. THE PRODUCTS MANAGED BY ARIA CAPITAL MANAGEMENT (EUROPE) ARE TYPICALLY AVAILABLE VIA PROFESSIONAL ADVISERS, RATHER THAN INDIVIDUAL INVESTORS, WHO SHOULD NOT RELY ON THIS INFORMATION BUT CONTACT THEIR FINANCIAL ADVISER.

The investments underlying the Company and its sub-funds do not take into account the EU criteria for environmentally sustainable economic activities.

ARIA CAPITAL MANAGEMENT (EUROPE) LIMITED IS AUTHORISED AND REGULATED BY THE MALTA FINANCIAL SERVICES AUTHORITY (WWW.MFSA.MT), AUTHORISED ID: FEXS. MALTA COMPANY NUMBER: C 26673. REGISTERED OFFICE: Nu Bis Centre, Triq il- Mosta Road, Lija LJA 9012, Malta.

ARIA Capital Management (Europe) Limited Homepage Website terms of use

This website is not suitable for individual (retail) investors. If you are a retail investor, please contact your financial adviser.